-

The Federal Housing Finance Agency is revising the multifamily loan purchase caps for the mortgage giants Fannie Mae and Freddie Mac to increase affordable housing.

September 13 -

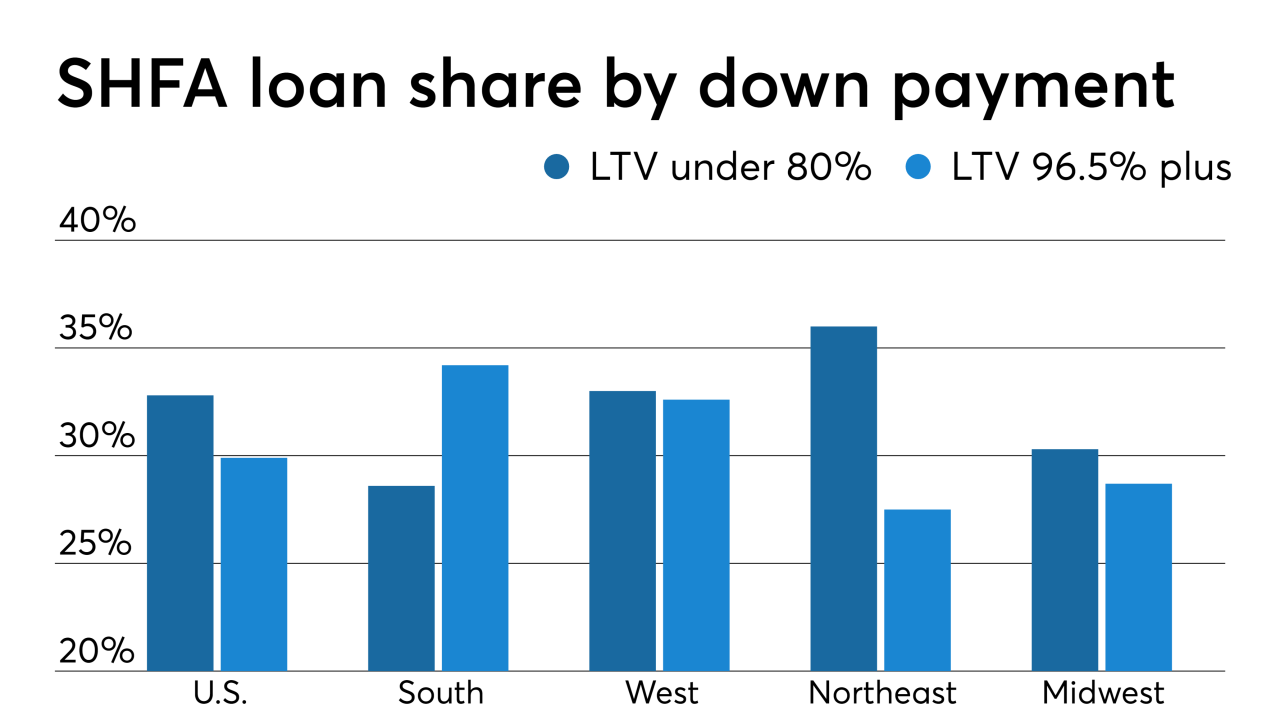

The use of state housing finance agency down payment assistance programs is part of the solution to address the growing affordable housing gap, a Fitch Ratings report said.

September 11 -

The legislation takes aim at third-party bank service vendors, the backlog of FHA appraisals, rural housing assistance and other issues where there is broad agreement.

September 11 -

By 2030, about 20% of the U.S. population will be over age 65, up from 15% in 2016, according to the Census Bureau.

September 10 -

The Trump administration raised the goal posts for ending the conservatorships of Fannie Mae and Freddie Mac, but how officials get there is still highly uncertain.

September 6 -

With its proposal to restrict disparate-impact claims, the Trump administration seems determined to solve a problem that does not exist.

September 6

-

The industry has taken some steps to lower barriers to affordable housing, but some observers say that more can be done.

September 5 -

The Trump administration is not backing down even after a federal court blocked guidance that would have limited the operations of national housing funds.

September 4 -

With officials putting finishing touches on presidentially directed reports on the future of the housing finance system, the Senate Banking Committee announced a hearing to examine the issue.

September 4 -

There is no legal basis to force Bank of America to make good on its commitment to provide $150 million in mortgages to beneficiaries of the Department of Hawaiian Home Lands, the state's Attorney General said.

September 3 -

About 80% of Opportunity Zones had median home prices below the national mark of $266,000 in the second quarter, with 47% of them below $150,000, according to Attom Data Solutions.

August 29 -

To boost its presence in affordable housing, Synovus Bank is devoting considerable resources to training its loan officers.

August 26 -

Builders in Oakland are on course to create more new housing units than San Francisco this year, a notable role reversal for a city that has long produced far less residential development than its wealthier and more bustling neighbor across the bay.

August 14 -

Banks currently can help their CRA performance with mortgages to anyone in a distressed neighborhood, but Joseph Otting said officials crafting a reform plan are considering limiting that to lower-income borrowers.

August 9 -

The head of the Senate Banking Committee invited the housing secretary to Idaho to discuss low-income housing shortages.

August 9 -

Seattle is poised to get a new $1 billion development steps from Amazon's sprawling urban campus as part of a major land sale by the city.

August 7 -

The Department of Housing and Urban Development approved a settlement in favor of the California Reinvestment Coalition against CIT Group's OneWest Bank, which Steven Mnuchin ran before he became Treasury secretary.

July 29 -

The. U.S. housing market is splitting along racial lines, with black homeownership dropping to the lowest level since at least 1970 — just two years after the Fair Housing Act was passed.

July 26 -

In an unwelcome turn for a city suffering from a homelessness crisis, federal housing officials said they have denied Los Angeles $80 million in funds, citing long-standing failures by local leaders to ensure that properties built with government money are accessible to those who use wheelchairs or have other disabilities.

July 24 -

The ruling deals a blow to efforts by the Department of Housing and Urban Development to restrict nonprofit housing funds from operating on a national scale.

July 17