-

About 80% of Opportunity Zones had median home prices below the national mark of $266,000 in the second quarter, with 47% of them below $150,000, according to Attom Data Solutions.

August 29 -

To boost its presence in affordable housing, Synovus Bank is devoting considerable resources to training its loan officers.

August 26 -

Builders in Oakland are on course to create more new housing units than San Francisco this year, a notable role reversal for a city that has long produced far less residential development than its wealthier and more bustling neighbor across the bay.

August 14 -

Banks currently can help their CRA performance with mortgages to anyone in a distressed neighborhood, but Joseph Otting said officials crafting a reform plan are considering limiting that to lower-income borrowers.

August 9 -

The head of the Senate Banking Committee invited the housing secretary to Idaho to discuss low-income housing shortages.

August 9 -

Seattle is poised to get a new $1 billion development steps from Amazon's sprawling urban campus as part of a major land sale by the city.

August 7 -

The Department of Housing and Urban Development approved a settlement in favor of the California Reinvestment Coalition against CIT Group's OneWest Bank, which Steven Mnuchin ran before he became Treasury secretary.

July 29 -

The. U.S. housing market is splitting along racial lines, with black homeownership dropping to the lowest level since at least 1970 — just two years after the Fair Housing Act was passed.

July 26 -

In an unwelcome turn for a city suffering from a homelessness crisis, federal housing officials said they have denied Los Angeles $80 million in funds, citing long-standing failures by local leaders to ensure that properties built with government money are accessible to those who use wheelchairs or have other disabilities.

July 24 -

The ruling deals a blow to efforts by the Department of Housing and Urban Development to restrict nonprofit housing funds from operating on a national scale.

July 17 -

The chamber passed a bill that would clarify how certain loans backed by the Department of Veterans Affairs are securitized, and legislation encouraging first-time homebuyers to participate in counseling programs.

July 10 -

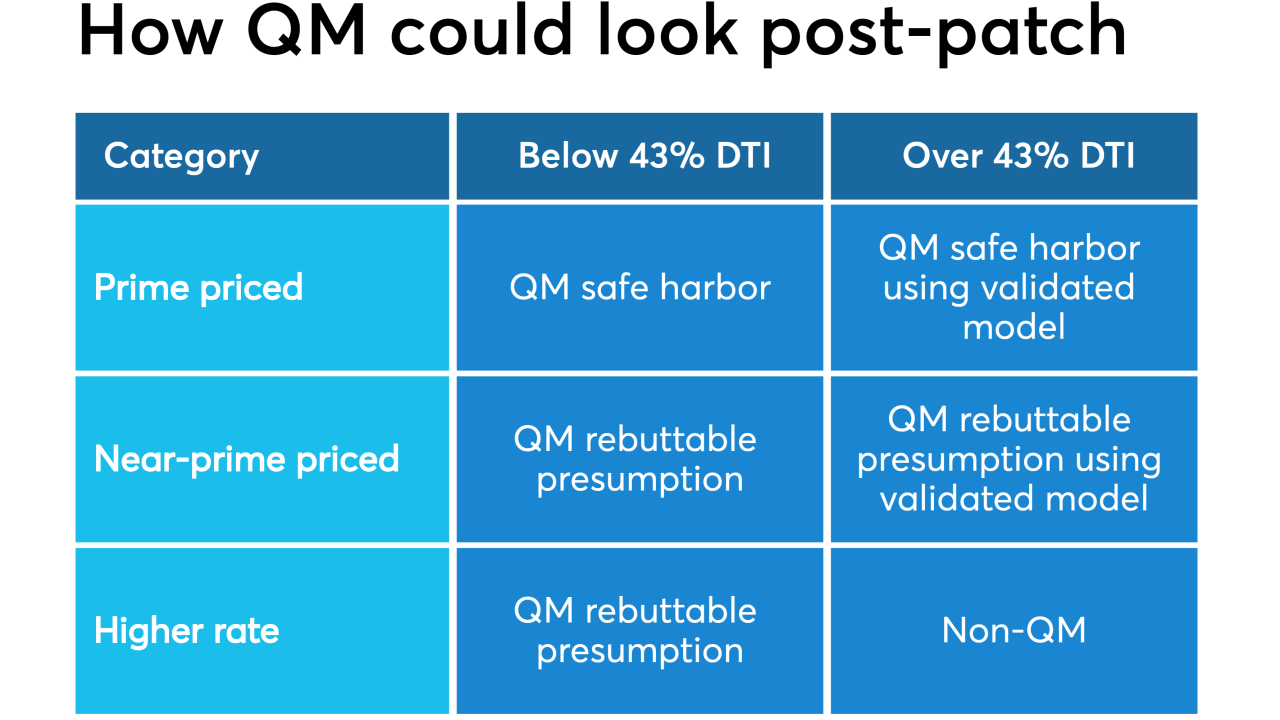

After the government-sponsored enterprise patch expires, "near prime" loans over the 43% debt-to-income ratio should be qualified mortgages if they have compensating factors, according to the Center for Responsible Lending.

July 9 -

Taking aim at the racial wealth gap in the U.S., Democratic presidential candidate Kamala Harris proposed a $100 billion program to help black families and individuals buy homes.

July 8 -

The Whitefish, Mont., Legacy Homes Program intended to create housing for those with moderate incomes officially went into effect on July 3.

July 8 -

The California Housing Finance Agency helped a record number of low- and moderate-income residents purchase their first homes with help from its down payment assistance program.

July 3 -

In a blow to a city struggling to build enough affordable housing, a controversial proposal to house formerly homeless people in buildings constructed from recycled shipping containers not far from San Jose's Willow Glen neighborhood has stalled.

July 3 -

As policymakers mull ways to update the 42-year-old Community Reinvestment Act, economists at the San Francisco Fed have put forth a novel proposal.

July 2 -

California cities and counties that don't plan for enough housing to be built within their borders could face big consequences -- up to $600,000 a month.

June 28 -

An Ohio county would invest an additional $65 million to spur construction of 2,050 affordable housing units over the next decade under recommendations included in a broader economic development plan.

June 27 -

Investors last year purchased a record share of Dallas-area homes and these for-profit homebuyers are expected to continue to gobble up thousands of houses in North Texas and nationwide.

June 27