-

January saw the lowest mortgage delinquency rate in over 20 years, according to CoreLogic.

April 14 -

New York's Real estate agents, home inspectors and residential appraisers are now considered "essential employees," according to the Empire State Development agency.

April 2 -

Finance of America Reverse agreed to pay $2.5 million to settle allegations that a company it acquired violated the False Claims Act for loans submitted for Federal Housing Administration insurance in 2010.

April 2 -

Consumer needs are in flux and Top Producers were looking at technology and risks associated with unexpected financial challenges as areas where they weren't yet meeting those needs. The coronavirus only intensified the urgency.

April 1 -

As social distancing related to the coronavirus complicates work for appraisers, real estate agents and construction lenders, professionals turn to technology and, in some cases, ask consumers to pitch in.

March 30 -

The percentage of mortgages underwater — when a mortgage exceeds value — has decreased dramatically in South Florida since the Great Recession, meaning the region may be better prepared to weather COVID-19 than the downturn a decade ago.

March 24 -

The Federal Housing Finance Agency authorized the government-sponsored enterprises to lend additional support to the mortgage-backed securities market and temporarily allow some flexibility in lending requirements to address coronavirus-related concerns.

March 23 -

Refinancing activity is surging, existing borrowers are inquiring about loan modifications, loan closings are being delayed by more complex credit checks — and banks are short on people to handle it all.

March 19 -

Mortgage industry technology providers are adjusting their processes to allow for originations to keep flowing through the system as the nation combats the coronavirus.

March 18 -

The Federal Housing Administration is making coronavirus adjustments while warning of possible delays as the industry anticipates a new wave of borrowing due to the Federal Reserve's latest short-term rate cut.

March 16 -

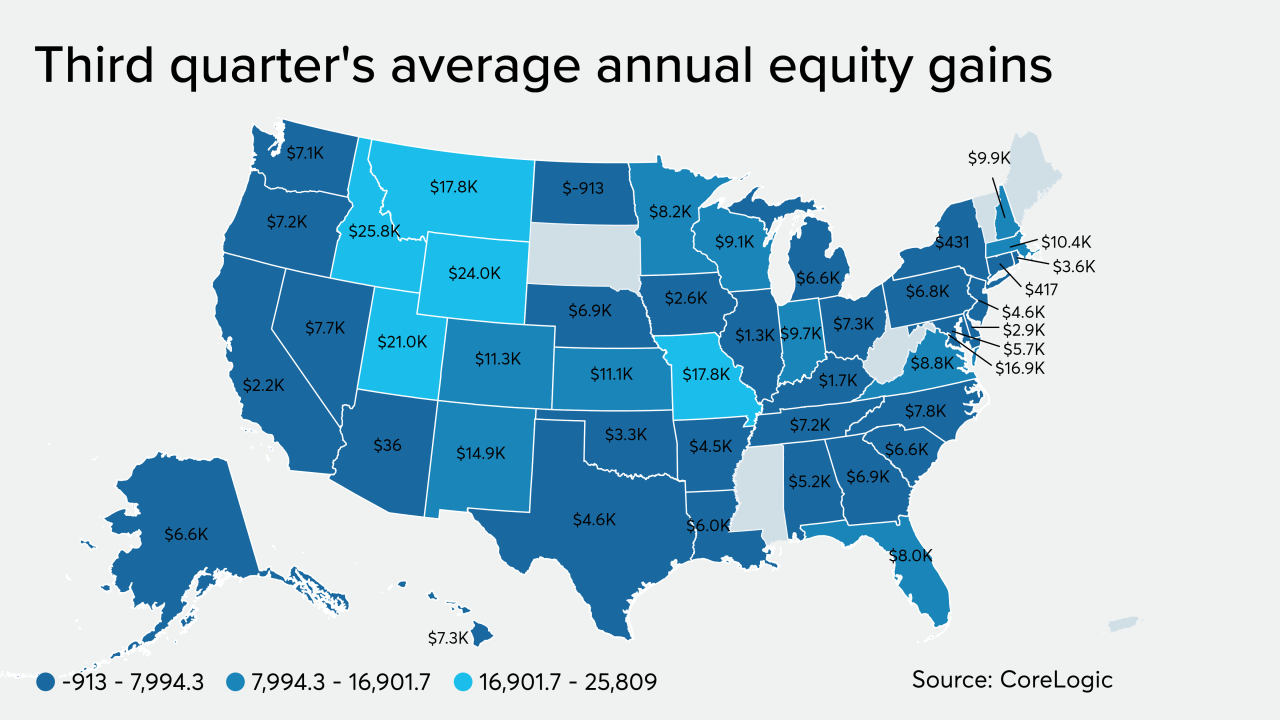

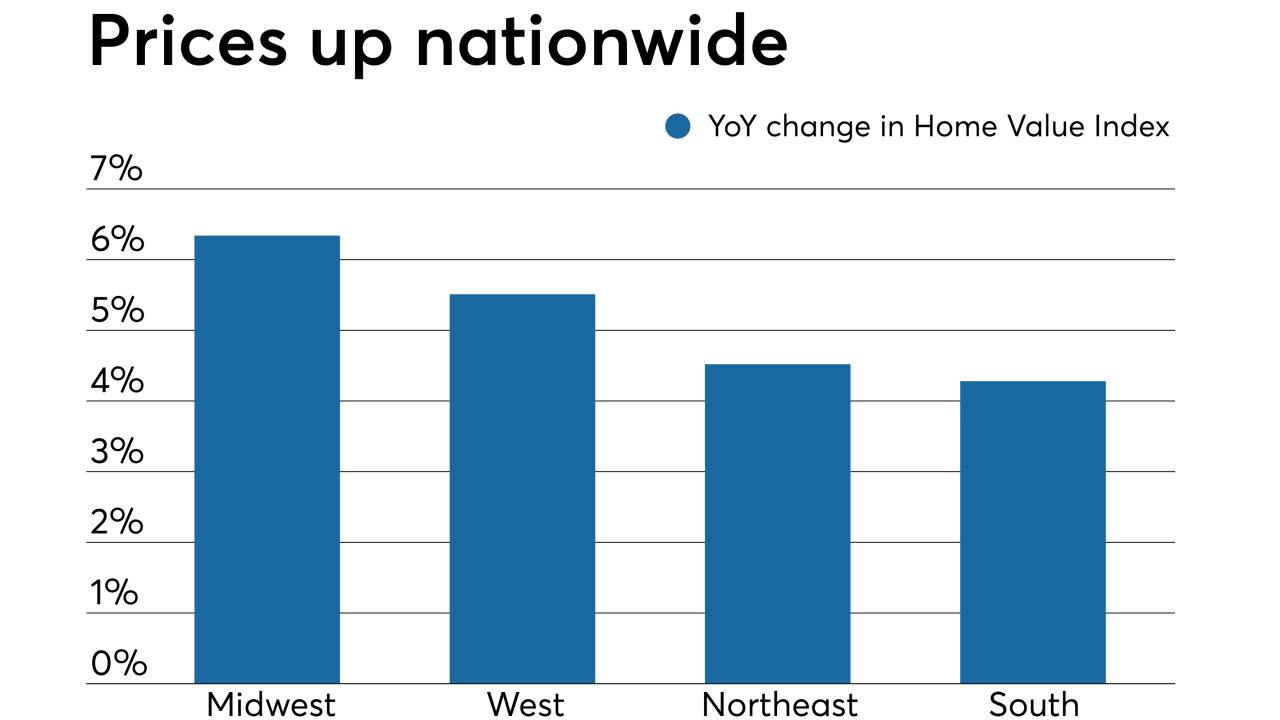

Home price gains continued during the fourth quarter and pushed the share of upside-down mortgages to the lowest level since the housing crisis, according to CoreLogic.

March 13 -

-

After maintaining a $250,000 exemption threshold for real estate appraisals for nearly 20 years, the National Credit Union Administration is set to raise that limit to $400,000.

January 31 -

As home value appreciation keeps churning, the share of those upside down on their mortgage grows smaller than ever, according to CoreLogic's Home Equity Report.

December 13 -

The housing market has changed dramatically since 2002 but the current appraisal limit has not. It's time for NCUA to catch up.

November 25

-

A new National Credit Union Administration proposal would raise the threshold for residential mortgages that require appraisals. However, the final rule is by no means a done deal.

November 21 -

Home values posted the largest month-over-month spike in over five years due to continued buyer demand, according to Quicken Loans.

October 10 -

In the decade ending in June, close to $9 trillion in additional owner-occupied real estate wealth was gained by U.S. households. Pacific states, led by California, grabbed 37% of this gain.

October 1 -

The three federal banking agencies moved to raise the threshold for residential transactions that require an appraisal from $250,000 to $400,000.

September 27 -

Still overvalued — that's the latest assessment of the Dallas housing market by one of Wall Street's big ratings firms.

September 20