-

A gradual approach would help the market absorb loans affected by the government-sponsored enterprises' expiring qualified mortgage exemption, a Redwood Trust executive told analysts during a recent earnings call.

August 5 -

Many in the industry say releasing GSE-backed loans from stringent underwriting rules has helped the housing market recover, but a new level of regulatory burden could reverse those gains.

August 2 -

Fannie Mae's current tack could help it weather some of the new challenges confronting the government-sponsored enterprises, including the planned expiration of its qualified mortgage rule exemption and rate-driven earnings volatility.

August 1 -

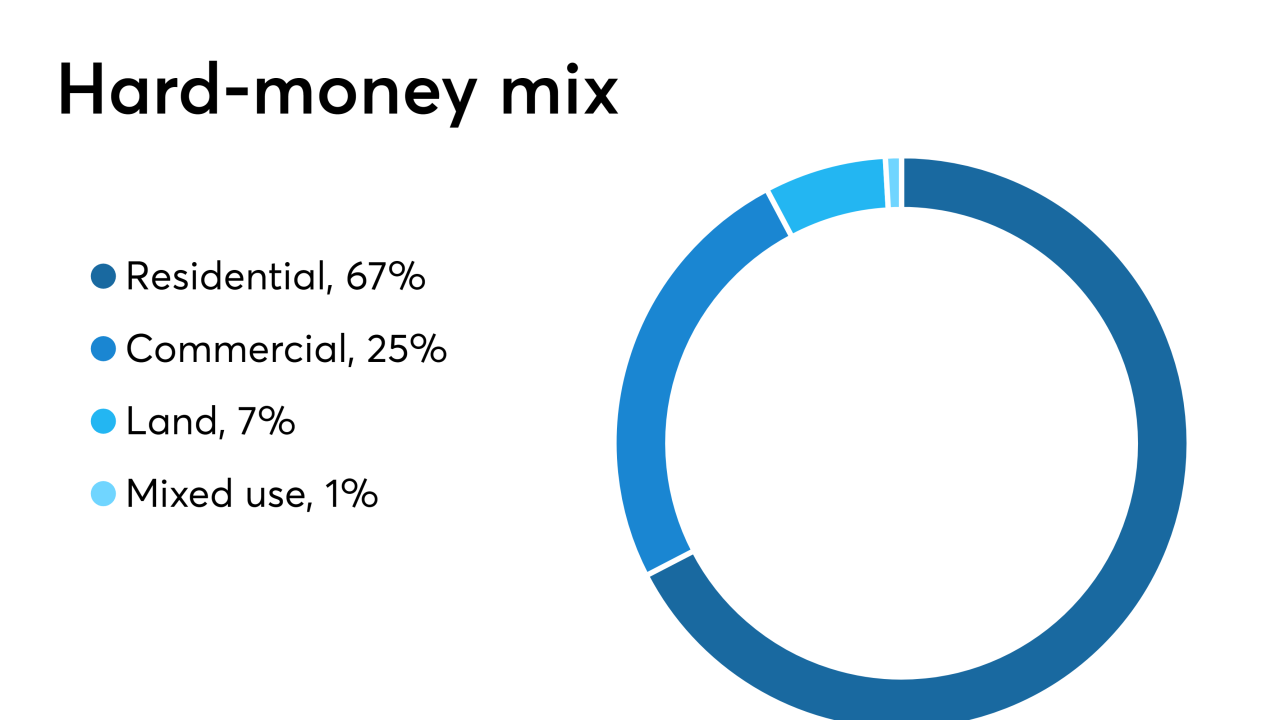

Sachem Capital Corp., a hard-money mortgage lender that makes short-term loans to investors, has raised $10 million in gross proceeds from a public offering of 2 million common shares.

July 29 -

The mortgage industry was caught off guard by regulators’ decision to cease special treatment for Fannie Mae and Freddie Mac in complying with underwriting rules. But how big of an impact will the new policy have?

July 28 -

Alternative investment manager Pretium plans to buy Deephaven, a residential mortgage-backed securities issuer that operates outside the qualified mortgage market, from Varde Partners.

June 18 -

The nonconforming market is ready to absorb most of the government-sponsored enterprise loans covered by the QM patch, but not all of them, according Redwood Trust.

May 31 -

Plaza Home Mortgage has improved its pricing for certain jumbo loans that Fannie Mae's automated underwriting system approves, but categorizes as ineligible due to loan size.

May 28 -

The market for non-qualified mortgages has been robust thus far in 2019, offering a pragmatic option for otherwise viable borrowers, as long as lenders stay vigilant about pushing the envelope too far.

May 17 -

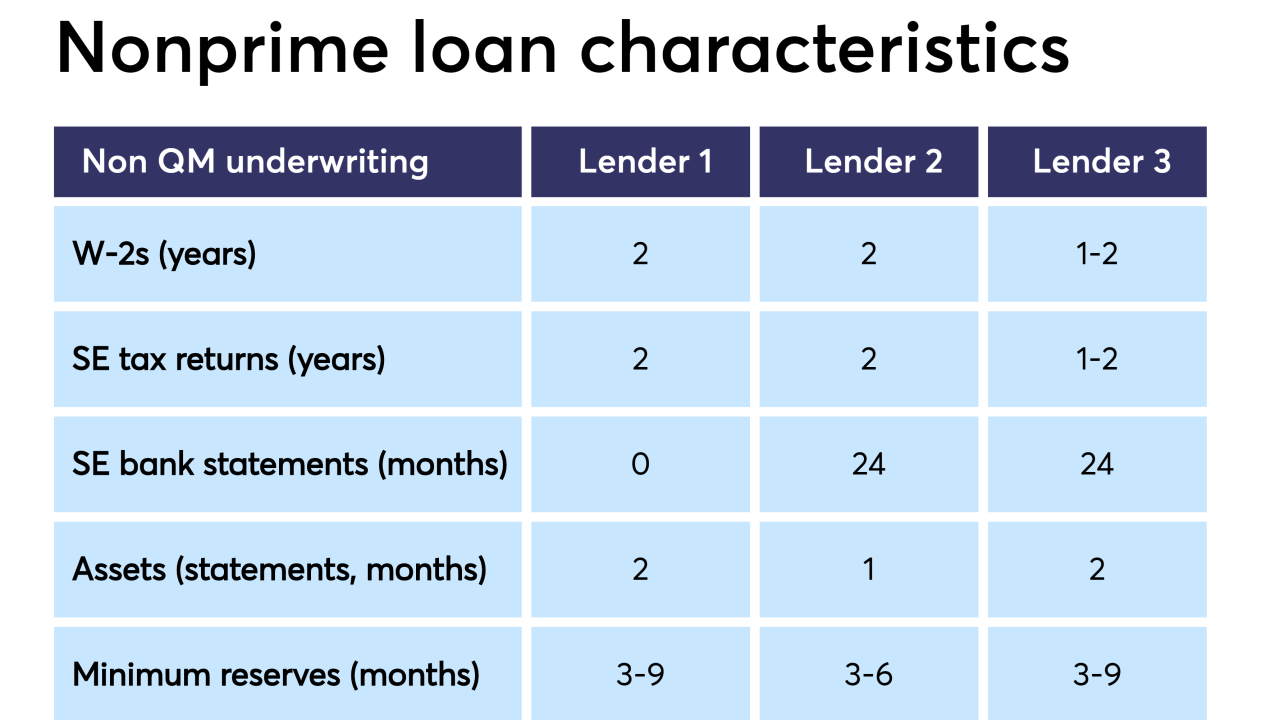

Securitized loans originated outside the Qualified-Mortgage rule's parameters have looser underwriting guidelines than mainstream loans do today, but are more tightly underwritten than past subprime or alternative-A products, according to DBRS.

May 6 -

As 30-year fixed-rate mortgages rose 30 basis points year-over-year, non-QM originations are estimated to grow 400% in 2019.

January 28 -

In a slow mortgage market, construction loans are considered the most likely source of growth for lenders, according to a new study.

January 22 -

As required by the Dodd-Frank Act, the bureau released long-awaited "look-back" reviews to assess the impact of mortgage underwriting and servicing rules on the industry and the credit markets.

January 10 -

Due diligence firm American Mortgage Consultants has purchased Meridian Asset Services as part of its continuing efforts to expand through acquisition or organic growth.

January 10 -

Although forecasts anticipate a continuing drop in overall originations, private-label residential mortgage-backed securitizations backed by newer loans are expected to keep increasing through next year, according to Bank of America.

November 5 -

Fund manager Varde Partners wants to grow its partnerships with lenders and servicers interested in selling off their excess mortgage servicing rights.

September 11 -

Angel Oak Companies' affiliates increased their production of loans made outside the boundaries of the Qualified Mortgage definition by 90% year-over-year during the second quarter, when most lenders' volume fell.

July 23 -

Commerce Home Mortgage and its parent company, The Capital Corps, are acquiring LoanStar Home Loans as a move to expand access to capital throughout the Northwest and Texas.

June 27 -

Angel Oak Commercial Lending has acquired a controlling interest in lender Cherrywood Mortgage in order to strengthen its focus on small-balance commercial lending.

June 5 -

The ability-to-repay standard is responsible for the reduction in loan application defects over the past four-plus years, according to First American Financial.

May 30