-

A bank, a drug store, another bank: Odds are, a stroll down a random Manhattan avenue devolves quickly into a retail snoozefest.

January 24 -

FICO plans to release a new suite of scores that could reduce defaults on newly originated mortgages by 17%, but home lenders may not use it unless the government-sponsored enterprises do.

January 23 -

Non-QM lending is expected to grow again in 2020, but it has some obstacles to navigate. Altisource CRO John Vella shares his insight into the sector and other hot topics.

January 23 -

Provident Bank in Amesbury, Mass., has entered warehouse lending after buying a business from People’s United Financial in Bridgeport, Conn.

January 22 -

People's United in Connecticut is letting the loans run off its books as it invests in higher-yielding commercial loans.

January 17 -

With most U.S. households spending more and paying their bills on time, their creditors are feeling more confident than ever.

January 17 -

Under terms of the settlement approved by a Georgia court Monday, Equifax may also have to pay an additional $125 million if the initial amount doesn't cover all the claims.

January 16 -

In another sign of state officials trying to outdo the Consumer Financial Protection Bureau, governors in California and New York want greater authority to license and oversee the debt collection industry.

January 16 -

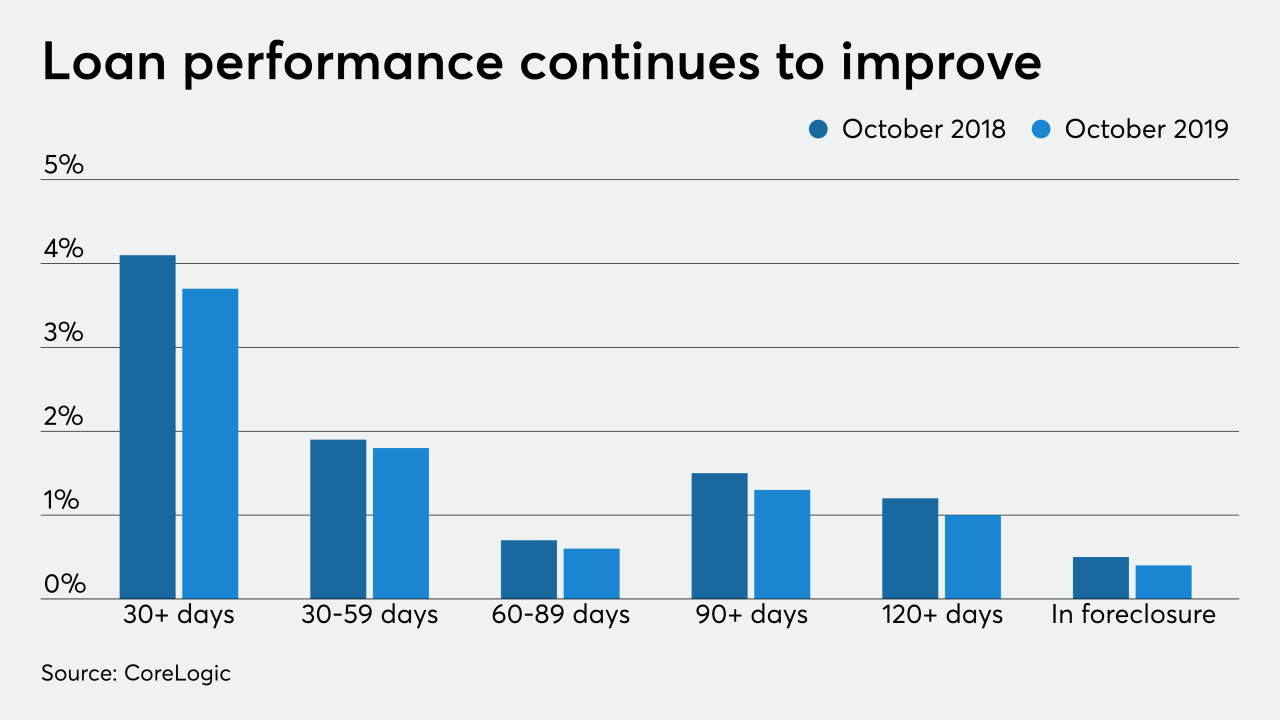

The nationwide mortgage delinquency rate had its best October in at least two decades, while the foreclosure rate remained at a 20-year for the twelfth straight month, according to CoreLogic.

January 14 -

A lender that provided more than $388 million to finance one of Plano's biggest real estate developments has filed to foreclose on the project.

January 14 -

Former CFPB Director Richard Cordray and consumer advocates have designed a proposed state consumer agency that would subject more financial firms and fintechs to state oversight.

January 10 -

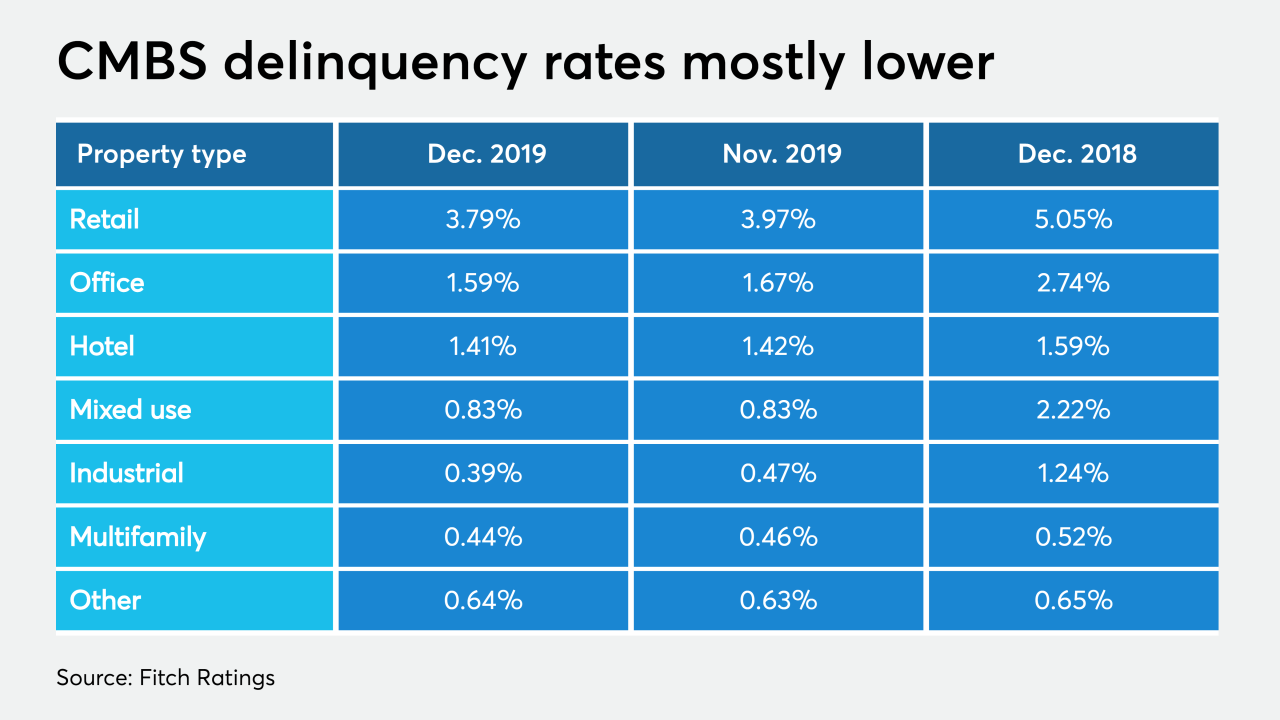

The delinquency rate for commercial mortgage-backed securities ended 2019 at its lowest point in nearly 11 years, aided by increased issuance and the resolution of legacy transactions, Fitch Ratings said.

January 10 -

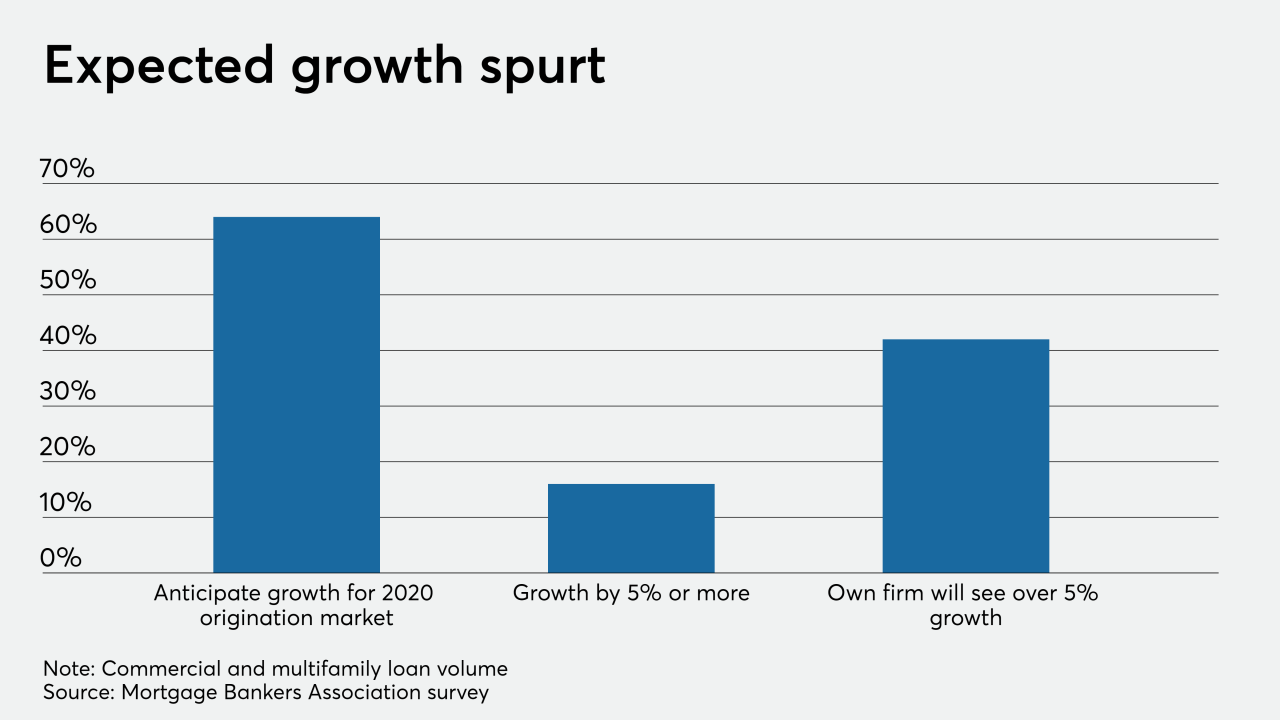

Bolstered by a high demand by both lenders and borrowers, 2020's commercial and multifamily loan volume is anticipated to shoot well past last year's record total but adapting to the LIBOR and CECL shifts will provide challenges, according to the Mortgage Bankers Association.

January 10 -

The developer of three adjacent lots said one of the reasons for the sale was her time was up with her mortgage holders.

January 10 -

In a case highlighting a fraud risk for mortgage companies and other financial institutions, two Garden State residents were sentenced for using fake money orders attempting to fraudulently discharge debts.

January 9 -

Goldman Sachs is sponsoring a $1.33 billion bond offering backed by commercial mortgages, in the first rated conduit deal of the year.

January 7 -

A Charlotte, N.C., developer detailed plans to build apartments and commercial space through a federal tax program that has faced scrutiny in recent months.

January 7 -

The foreclosed former home of Fireman's Fund Insurance in Novato, Calif., could become the site of a mixed-use development.

January 6 -

Freedom Credit Union has listed for sale the three downtown Springfield, Mass., office buildings it took back in November in a mortgage foreclosure.

January 2 -

Susan Riel succeeded Ronald Paul as CEO of the Maryland bank shortly before questions surfaced about credit quality and lending practices.

December 31