-

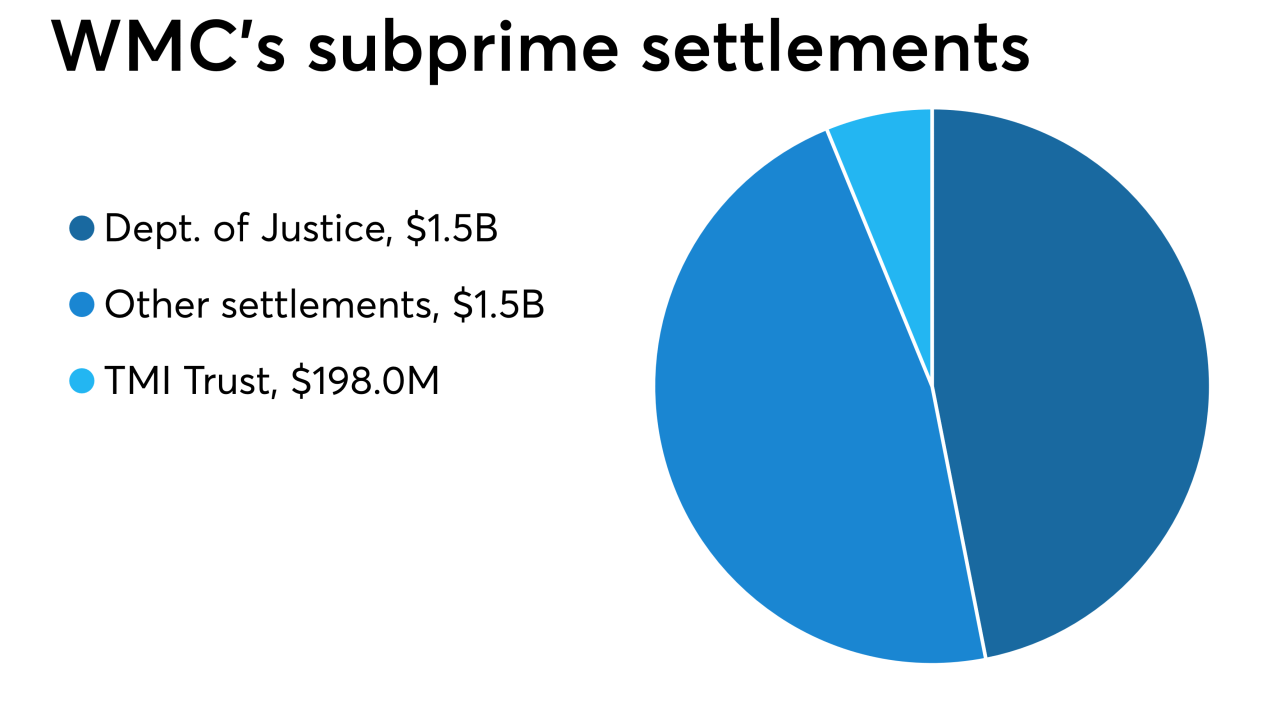

General Electric placed its WMC Mortgage unit into Chapter 11 bankruptcy protection as it has nearly $1.7 billion in legal settlements agreed to or pending.

April 24 -

Blue Lion Capital, which has been critical of the Seattle company in recent years, has nominated two individuals to become directors.

April 23 -

The bank is expecting to benefit from the discount airline's first flights to the Aloha State even as a white-hot local housing market starts to cool.

April 22 -

360 Mortgage is bringing back the no-income, no-asset loan, but says its $1 billion pilot's guidelines differ from those of the NINA loans that contributed to the financial crisis.

April 18 -

Marianne Lake, seen in recent months as a leading candidate to replace CEO Jamie Dimon, got the post she may have needed to round out her resume — consumer lending chief. And Jennifer Piepszak, another rising star at the company, will take over as CFO from Lake.

April 17 -

Mortgage rates continued to decline through the spring home buying season, driving up the share of refinance loans and overall closing rates, according to Ellie Mae.

April 17 -

In her first policy speech since being confirmed as the agency's director, Kathy Kraninger promised less focus on enforcement actions and more emphasis on consumer education.

April 17 -

The Minneapolis bank reported mid- to high-single-digit improvement in those categories, but total loan growth was curbed by declines in CRE and other credit types.

April 17 -

JPMorgan Chase's banner quarter didn't stop executives from warning that the pause in rate hikes could crimp profits, or from hinting that the bank might downsize its mammoth mortgage operation.

April 12 -

General Electric Co. finalized an agreement to pay $1.5 billion to settle a U.S. investigation into the manufacturer's defunct subprime mortgage business.

April 12 -

Freddie Mac's latest nonperforming mortgage auction will include one pool targeted to smaller investors like nonprofit organizations.

April 12 -

Gateway Mortgage Group’s dream of being a national, diversified financial services player will hinge on its effort to turn a community bank into an online-only platform.

April 9 -

The commercial mortgage-backed securities delinquency rate increased for the first time since October lead by a 31-basis-point rise in late payments for loans secured by retail properties, Fitch Ratings said.

April 8 -

The fate of U.S. office markets is intertwined with that of the biggest technology companies, Starwood Capital Group Chairman Barry Sternlicht said.

April 3 -

With interest rates down, purchase mortgages accounted for the vast majority of millennial homebuyers' loans in February, according to Ellie Mae.

April 3 -

Rep. Gregory Meeks of New York signaled which legislative provisions Democratic leaders would accept in a bipartisan housing finance package.

April 2 -

The company plans to sell its third-party origination channel to Renasant. It has also lined up a deal to sell its correspondent channel.

April 1 -

The Los Angeles bank will take a $1.4 million hit to earnings after the multifamily properties sold for less than their book value.

April 1 -

Tim Sloan couldn't hang on any longer. Here are insights about why he left now, what role policymakers played in the decision and will continue to have in the company's future, and who in the world would want to lead Wells Fargo.

March 28 -

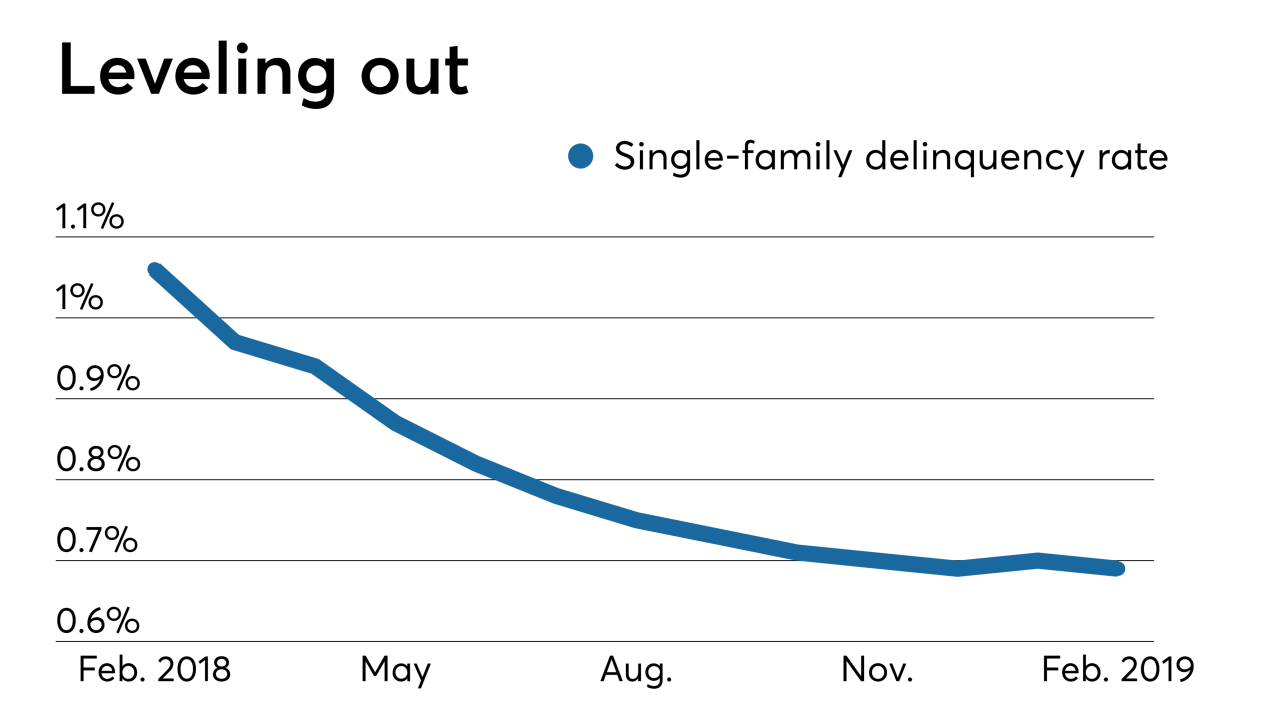

Late payments on single-family home mortgages changed direction and started falling again in Freddie Mac's latest monthly report.

March 26