-

A new court filing suggests that Stephen Calk was named to a 13-member economic advisory team in 2016 in exchange for approving a $9.5 million loan to former campaign manager Paul Manafort.

July 6 -

The deal is designed to improve capital ratios and reduce risk at the Seattle company.

July 3 -

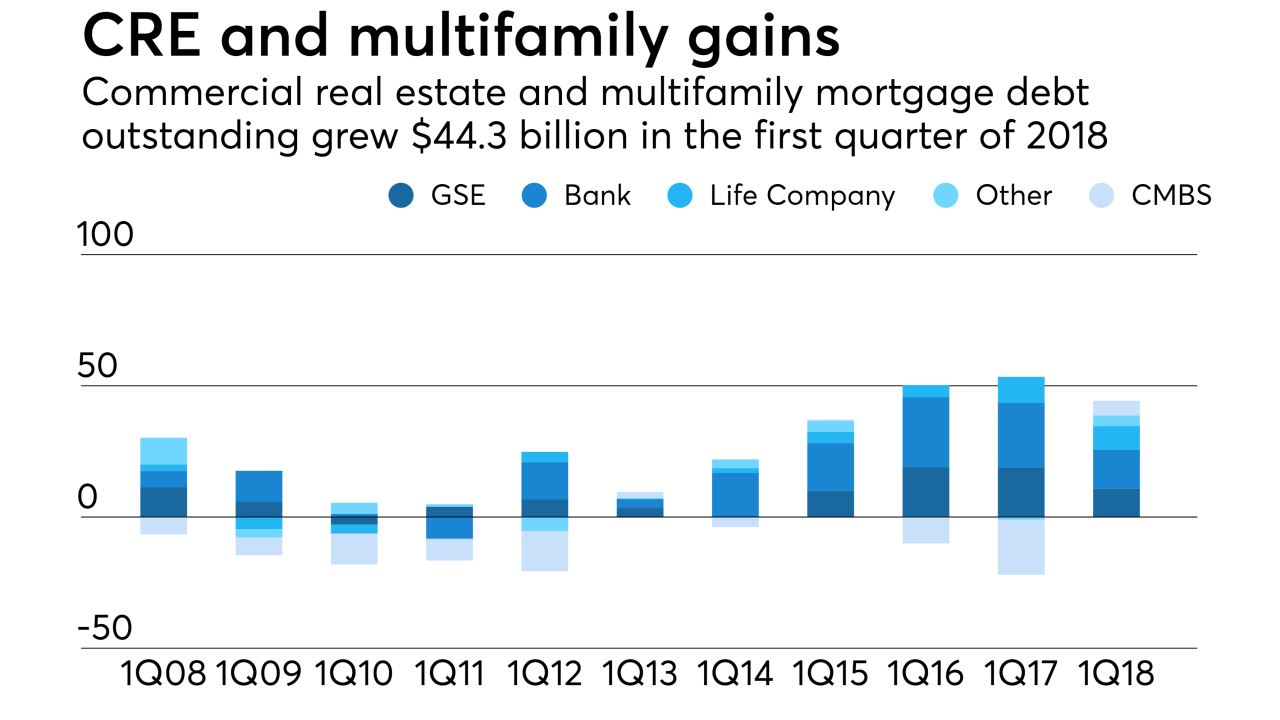

Commercial and multifamily mortgage debt outstanding grew $44.3 billion during the first three months of 2018, the largest first-quarter gain since before the Great Recession, according to the Mortgage Bankers Association.

July 2 -

Commercial real estate is their bread and butter, but many banks are scaling back in this vital loan category. Here’s why.

June 29 -

The measure, which has been compared to the EU’s new consumer privacy rules, grants Californians new rights over how companies collect and use their personal data.

June 29 -

The U.S. Supreme Court agreed to decide whether thousands of borrowers can invoke a federal debt-collection law when they are facing foreclosure.

June 28 -

Lauren Hedvat, Angel Oak's managing director of capital markets, said that the rising non-qualified mortgage volume in the market has expanded the number of third-party origination loan packages for purchase.

June 27 -

Credit reporting firms with significant operations in New York will face new cybersecurity and registration requirements to stave off concerns related to a breach of Equifax's systems last year.

June 25 -

Higher interest rates on home mortgages drove the share of loans used to purchase houses rather than refinance to new heights in May.

June 20 -

Paycheck information gleaned from bank accounts is emerging as an alternative to verifying a mortgage applicant's income and employment with a 4506-T tax transcript request to the IRS.

June 20 -

Ruoff Financial will make its first push into banking with the purchase of SBB Bancshares.

June 19 -

Blue Lion Capital, which has been a vocal critic of the Seattle company's strategy, also wants management to consider selling its MSR portfolio.

June 15 -

The Seattle company is firing 127 people, or a tenth of its mortgage staff, after enduring months of slow activity.

June 14 -

Angel Oak Commercial Lending has acquired a controlling interest in lender Cherrywood Mortgage in order to strengthen its focus on small-balance commercial lending.

June 5 -

Black Knight has acquired HeavyWater, a developer of artificial intelligence and machine learning technology for the mortgage industry, and plans to incorporate the startup's borrower data verification and other automation capabilities into its existing product suite.

June 4 -

Two South Korean financial firms have bought $100 million of debt on a New Jersey residential building that's part-owned by the family of Jared Kushner.

June 1 -

The value of commercial-property deals rose 6.7% in the first quarter from a year earlier, but higher interest rates and softer demand will weigh on the market, Ten-X Commercial said.

May 31 -

Promontory MortgagePath fills management roles for bank relations, technology and outsourced services opportunities.

May 31 -

The borrowers behind the $401.6 million COLT 2018-2 have weighted average liquid reserves of $426,633, or nearly twice the level of borrowers backing a deal completed in January.

May 29 -

Although mortgage default risk remains very low, it was the only category of consumer lending to experience increases both sequentially and year-to-year in VantageScore's latest update to its index.

May 29