-

The administration is prolonging a decision on a permanent director for the agency to keep the interim chief in place until year-end or longer.

May 8 -

Lorie Shannon, recruited from SunTrust, will oversee a strategy that features large, non-QM mortgages in key markets.

May 7 -

The public face of the Trump administration's revamp of the Consumer Financial Protection Bureau is by no means working alone.

May 7 -

The removal of costly appraisal requirements on tens of thousands of smaller commercial properties could help community banks better compete for loans they say they have been losing to nonbank lenders.

May 4 -

Preferred Bank's experience with an apartment developer is a reminder of how important strict underwriting terms will be as loan demand increases, rates rise and lenders try to outdo each other.

May 4 -

Costs rose at the global bank, profit in North America fell 16% and questions are mounting for new CEO John Flint ahead of the release of his strategic plan.

May 4 -

Leader Bank says it can land property managers as commercial clients by helping them handle tenant deposits — and possibly create opportunities to boost CRE lending.

May 3 -

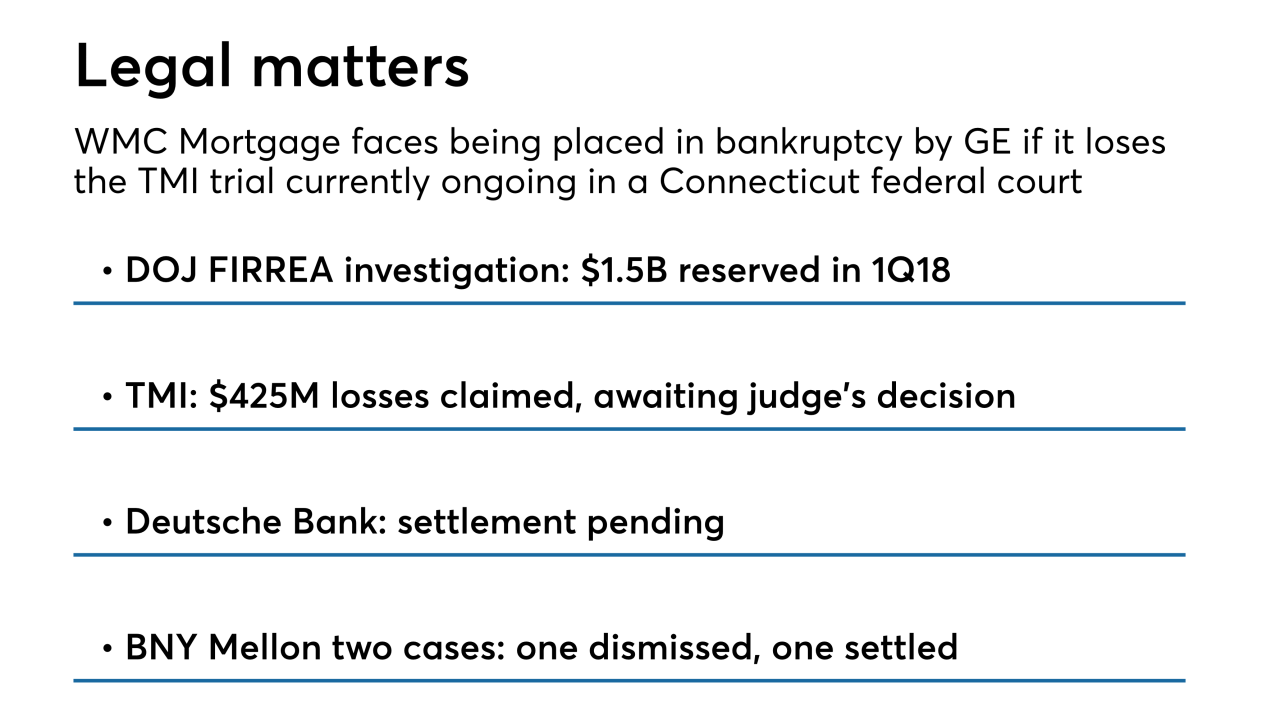

WMC Mortgage, a leading subprime originator during the boom era, could file for bankruptcy by parent company General Electric if it loses a legal proceeding regarding indemnifications on mortgage-backed securities.

May 3 -

As the mortgage industry makes more strides with technology, the time it took millennials to close loans for new-home purchases shrank to its fastest time yet.

May 2 -

The Federal Savings Bank has been under a spotlight since it was revealed that it provided $16 million in mortgages to onetime Trump campaign manager Paul Manafort.

May 1 -

The group says Mulvaney, who also runs OMB, was not totally forthcoming with the Senate Budget Committee about the foreclosure of a property he owns in South Carolina.

April 30 -

Since taking office in November of last year, acting Consumer Financial Protection Bureau Director Mick Mulvaney's actions have sparked outrage from his critics seemingly at every turn, including several times just last week.

April 29 -

Plans for a West Palm Beach, Fla. development with micro-condominiums, affordable apartments, offices, a grocery and a park, have collapsed over city commissioner concerns the developer couldn't make it happen.

April 27 -

Acting Consumer Financial Protection Bureau Director Mick Mulvaney announced a trio of significant changes to the CFPB.

April 24 -

The Seattle company has faced criticism from an investor over its commitment to the business, which lost money in the first quarter.

April 24 -

No individuals have been named in connection with the bank’s recent misdeeds, which resulted in a $1 billion fine, even as some senior leaders stand to gain from the government’s tax cut.

April 24 Public Citizen

Public Citizen -

The two credit unions have combined assets of more than $115 million and serve nearly 16,000 members.

April 24 -

The Cincinnati bank reported strong profits, but its efforts to lower credit risk curbed lending as expenses rose in the first quarter.

April 24 -

The legislation would prohibit the CFPB from penalizing institutions that rely in good faith on guidance from the bureau.

April 23 -

The Providence, R.I., company reported a double-digit increase in quarterly profits despite a year-over-year decline in fee-based revenue.

April 20