-

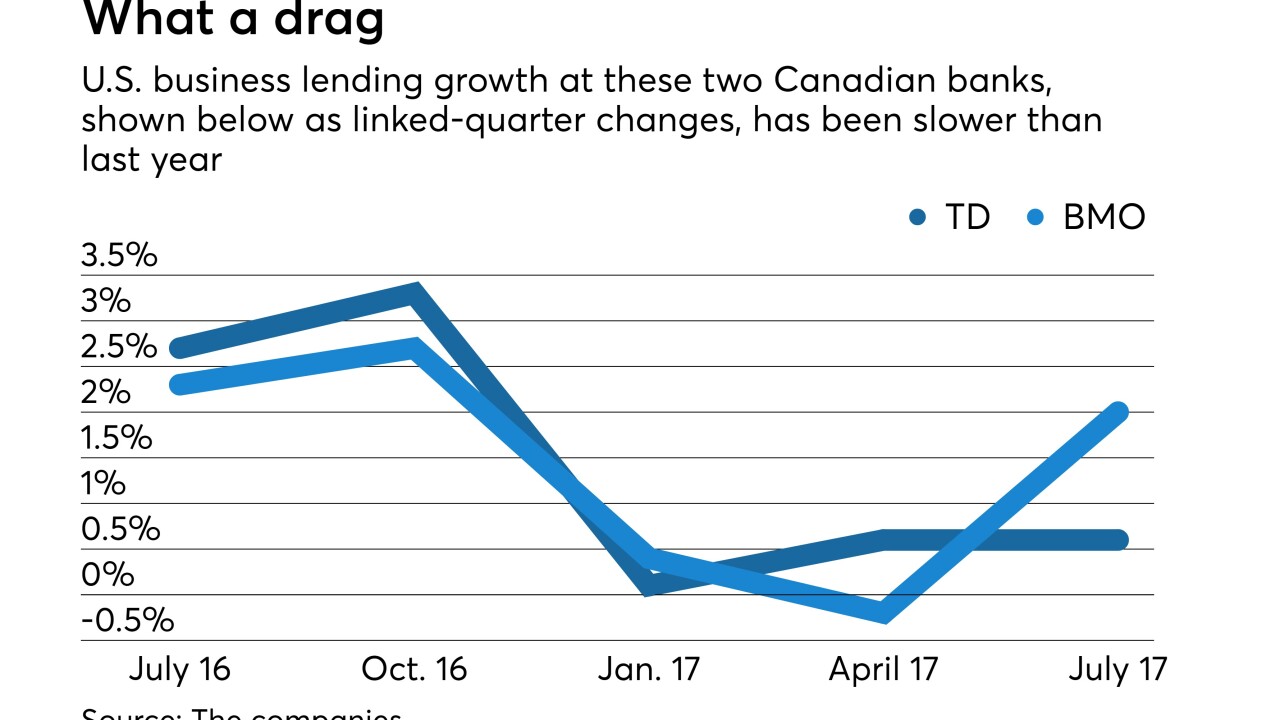

Pain stemming from slow U.S. commercial loan growth has spread north of the border, contradicting the yearslong narrative that Canadian banks are

relying on their U.S. operations to offset economic problems at home. However, TD and BMO executives said this week there is still upside in U.S. consumer banking.August 31 -

The Fed's order noted that Sterling had clarified errors in its Community Reinvestment Act data before receiving a "satisfactory" rating from the OCC.

-

The largest generation of Americans is set to inherit over $59 trillion in assets, but the federal financial regulators are behind in hiring millennials and focusing on issues of concern to them.

August 31 Pickard, Djinis and Pisarri LLP

Pickard, Djinis and Pisarri LLP -

A credit service provider agreed to exit the industry on Wednesday after a yearlong lawsuit with the Consumer Financial Protection Bureau.

August 31 -

Consumer Financial Protection Bureau Director Richard Cordray said his possible political ambitions did not affect the small-dollar rule, while declining to spell out if he was running for office.

August 30 -

As Republicans policymakers pursue efforts to revamp the Consumer Financial Protection Bureau and replace its leadership, state agencies are already preparing to fill any vacuum that might ensue if the CFPB steps back.

August 30 -

Millennial credit scores are lower than when Generation X consumers were coming of age, reflecting changes in credit consumption and other consumer behaviors.

August 30 -

House Financial Services Committee Chairman Jeb Hensarling, R-Texas, wrote a letter to CFPB Director Richard Cordray calling on him to clarify whether he is running for political office.

August 29 -

Their immediate effort is to ensure colleagues and clients are safe and that banking services are available to hurricane victims. The next big issue is preparing for the financial hit banks and customers will take from wind and water damage.

August 28 -

Republicans are already accusing CFPB Director Richard Cordray of misusing his job as a fundraising platform while many agency allies want him to stay.

August 25 -

Federal Reserve Chair Janet Yellen defended post-crisis reforms but allowed that further adjustments may be necessary to reduce adverse effects on small businesses and subprime borrowers.

August 25 -

Lenders will not have to report data on open-ended home equity lines of credit in 2018 or 2019 if they originated fewer than 500 HELOCs the preceding year, the bureau said.

August 24 -

It is the largest equity investment that Clearinghouse CDFI has received in its two-decade history.

August 22 -

The National Association of Federally-Insured Credit Unions defended the credit union tax exemption and called for other financial reforms during a meeting Tuesday with Treasury Secretary Steven Mnuchin.

August 22 -

The Trump administration says it has put a stop to Operation Choke Point, a controversial initiative aimed at discouraging financial institutions from servicing high-risk businesses.

August 18 -

Regulators reached a $183.5 million deal Thursday to get debt relief to 41,000 students of the bankrupt Corinthian Colleges.

August 17 -

A Fed committee studying Libor’s replacement has dwelled heavily on the potential impact to the derivatives market. Loans may become a bigger part of the conversation later this year, but the panel plans to leave a lot of the specifics up to lenders.

August 17 -

Auto, personal and credit card originations have fallen as delinquencies have risen, but researchers called the slowdown a temporary rebalancing by lenders.

August 16 -

Three years after guiding the Baltimore bank through bankruptcy, the group that recapitalized it found a similar institution eager to form a new partnership.

August 15 -

Payday lenders and arbitration supporters are claiming the CFPB has met more often with consumer groups than industry, laying the groundwork for likely lawsuits on key rules.

August 14