-

Banks are increasingly tightening lending standards for commercial real estate loans and are likewise seeing a drop-off in demand, according to a report released Monday by the Federal Reserve Board.

May 8 -

The next single-asset CMBS to hit the market is backed by the land under an iconic Manhattan address known as the Lipstick Building.

May 5 -

First Financial in Ohio says financial health tools for its clients’ employees will build more lasting commercial banking relationships.

May 4 -

Rebeca Romero Rainey, a third-generation community banker who rose to executive leadership in her early 20s, has been tasked to lead the Independent Community Bankers of America at a pivotal time.

May 2 -

The U.S. Supreme Court issued a mixed decision on the reach of the main federal housing-discrimination law, telling a lower court to reconsider whether Miami can sue banks for lending practices the city said contributed to urban blight.

May 1 -

The Louisiana company also said that credit quality in its energy portfolio improved during the first quarter.

April 28 -

The Consumer Financial Protection Bureau sued four online tribal lenders on Thursday for illegally collecting debts in 17 states where they are prohibited by state usury or licensing laws.

April 27 -

The Trump administration's initial tax plan may be short on details, but a bipartisan bill offers some very specific relief for the commercial real estate industry.

April 27 -

Housing prices in the Near West Side, Logan Square and a handful of other popular areas north of downtown are now well above their pre-crash peaks, but most of the city and the suburbs are still clawing their way back from the depths of the devastating crash.

April 27 -

The Consumer Financial Protection Bureau ordered an auto loan servicer on Wednesday to pay $2.4 million for failing to live up to the terms of a 2015 consent order.

April 26 -

Growth in commercial real estate loans is a big reason the New Jersey bank had a strong quarter.

April 26 -

From a few employees at Hutchinson Credit Union who spent part of their day focusing on better servicing of local home mortgages, Member Mortgage Services has grown in just 13 years into a separate company with 37 employees.

April 26 -

Chaos broke out periodically as investors and activists spoke out against the board, at times yelling or choking back emotion.

April 25 -

Congressional action is necessary to give financial regulators the tools they need to promote responsible innovation.

April 25 U.S. House of Representatives

U.S. House of Representatives -

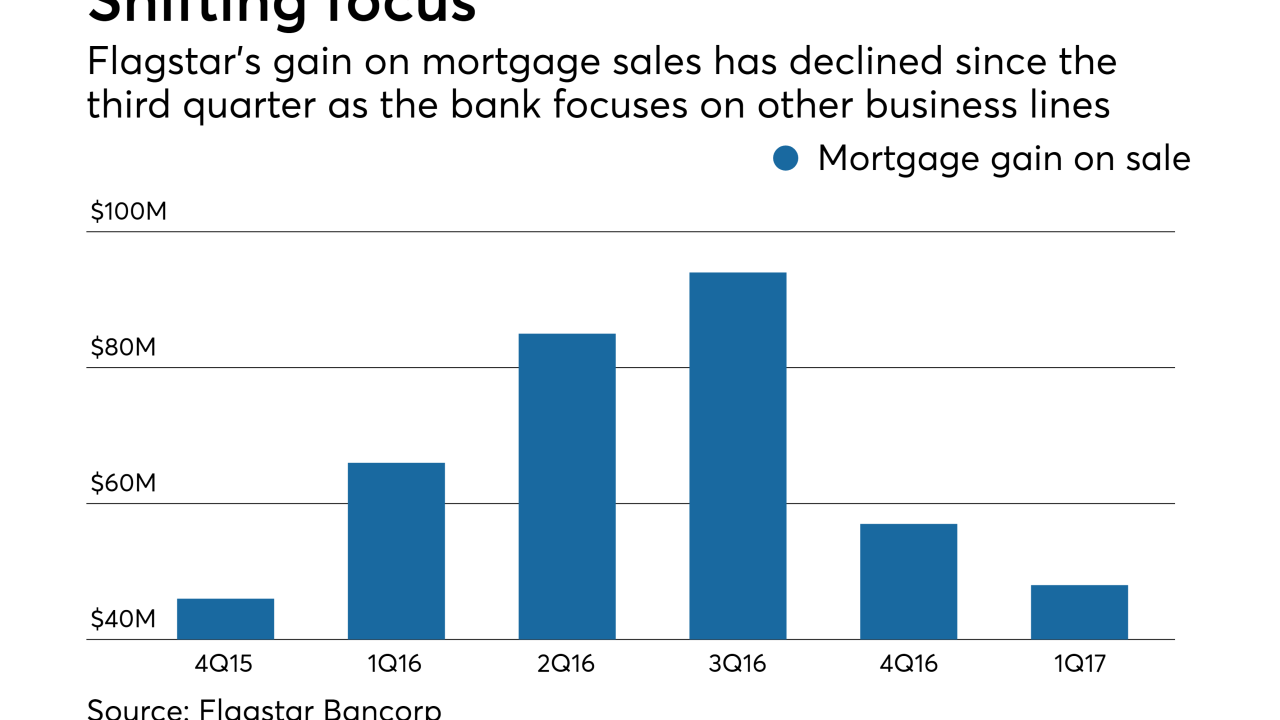

Growth outside of its residential mortgage business contributed to Flagstar Bank beating first-quarter earnings estimates, company executives said.

April 25 -

Shareholders voted to re-elect 12 board members and elect three more nominated by the company, but the slim margins sent a clear message.

April 25 -

Learn how some of the industry's most successful loan originators get it done with these tricks of the trade from the 2017 Top Producers rankings' top 20 loan officers of the South.

April 25 -

Caliber Home Loans' next nonprime mortgage securitization is nearly twice as large as its previous deal, completed in December.

April 24 -

The development of mobile mortgage solutions has to strike a delicate balance between self-service and making humans readily available for the stressful process.

April 21 -

Strong gains in low-cost health savings account balances helped fuel loan growth at the Waterbury, Conn., company.

April 21