-

Growth in commercial real estate loans is a big reason the New Jersey bank had a strong quarter.

April 26 -

From a few employees at Hutchinson Credit Union who spent part of their day focusing on better servicing of local home mortgages, Member Mortgage Services has grown in just 13 years into a separate company with 37 employees.

April 26 -

Chaos broke out periodically as investors and activists spoke out against the board, at times yelling or choking back emotion.

April 25 -

Congressional action is necessary to give financial regulators the tools they need to promote responsible innovation.

April 25 U.S. House of Representatives

U.S. House of Representatives -

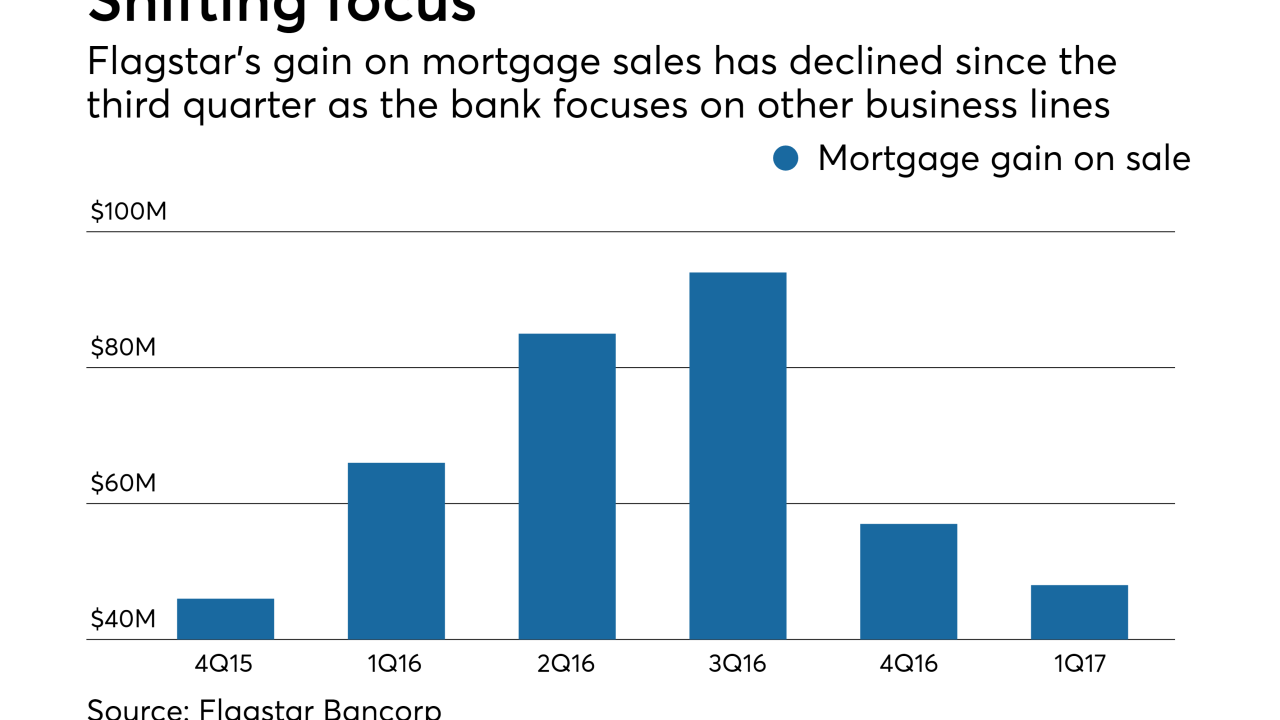

Growth outside of its residential mortgage business contributed to Flagstar Bank beating first-quarter earnings estimates, company executives said.

April 25 -

Shareholders voted to re-elect 12 board members and elect three more nominated by the company, but the slim margins sent a clear message.

April 25 -

Learn how some of the industry's most successful loan originators get it done with these tricks of the trade from the 2017 Top Producers rankings' top 20 loan officers of the South.

April 25 -

Caliber Home Loans' next nonprime mortgage securitization is nearly twice as large as its previous deal, completed in December.

April 24 -

The development of mobile mortgage solutions has to strike a delicate balance between self-service and making humans readily available for the stressful process.

April 21 -

Strong gains in low-cost health savings account balances helped fuel loan growth at the Waterbury, Conn., company.

April 21 -

The Atlanta company's profits rose on stronger net interest income and investment banking income as well as a tax maneuver.

April 21 -

The Wisconsin regional's profits rose 35% in the first quarter on healthy loan growth, wider margins and an improved efficiency ratio, and it said its "satisfactory" CRA rating had been restored.

April 20 -

Executives at BB&T, KeyCorp and Citizens are milking commercial lending niches and balancing cost control with new investments while waiting for more rate hikes to fatten margins.

April 20 -

Earnings per share fell a nickel short of estimates due in part to lower-than-expected revenue from the origination and sale of mortgages.

April 20 -

The New York bank has rapidly expanded its commercial real estate lending over the last several years, but now it is ready to slow down a bit and add more commercial and industrial loans to the mix.

April 19 -

Texas Capital Bancshares sharply reduced the size of its loan-loss provision as credit quality improved in its energy loan book. That helped the Dallas bank post a 77% rise in first-quarter profit.

April 19 -

The Mississippi company's first-quarter earnings rose 60% from a year earlier. Its results from last year were weighed down by a settlement with regulators.

April 19 -

Learn how the some of the industry's most successful loan originators get it done with these tricks of the trade from the 2017 Top Producers rankings' top 20 loan officers of the Midwest.

April 19 -

Lawmakers from both political parties are increasingly interested in forcing lenders that offer loans to upgrade home heating and cooling systems to issue better disclosures, a prospect that has some in the industry nervous.

April 18 -

The hand-wringing over business lending has overshadowed the fact that consumer lending — particularly for regional banks — has become a strong and steady engine of growth.

April 18