-

The buyer said the all-stock deal to buy The First Bancshares would create a combined bank with $25 billion of assets.

July 29 -

In a new survey of bank executives from IntraFi, 90% of respondents said instances of check fraud have increased in recent years and half want law enforcement to make check fraud a bigger priority to stop criminals from stealing checks in the mail.

July 29 -

First Foundation in Dallas recently got a $228 million capital injection led by Fortress Investment Group. Now it's announced plans to pivot away from its heavy focus on multifamily loans, which lost value as interest rates rose.

July 26 -

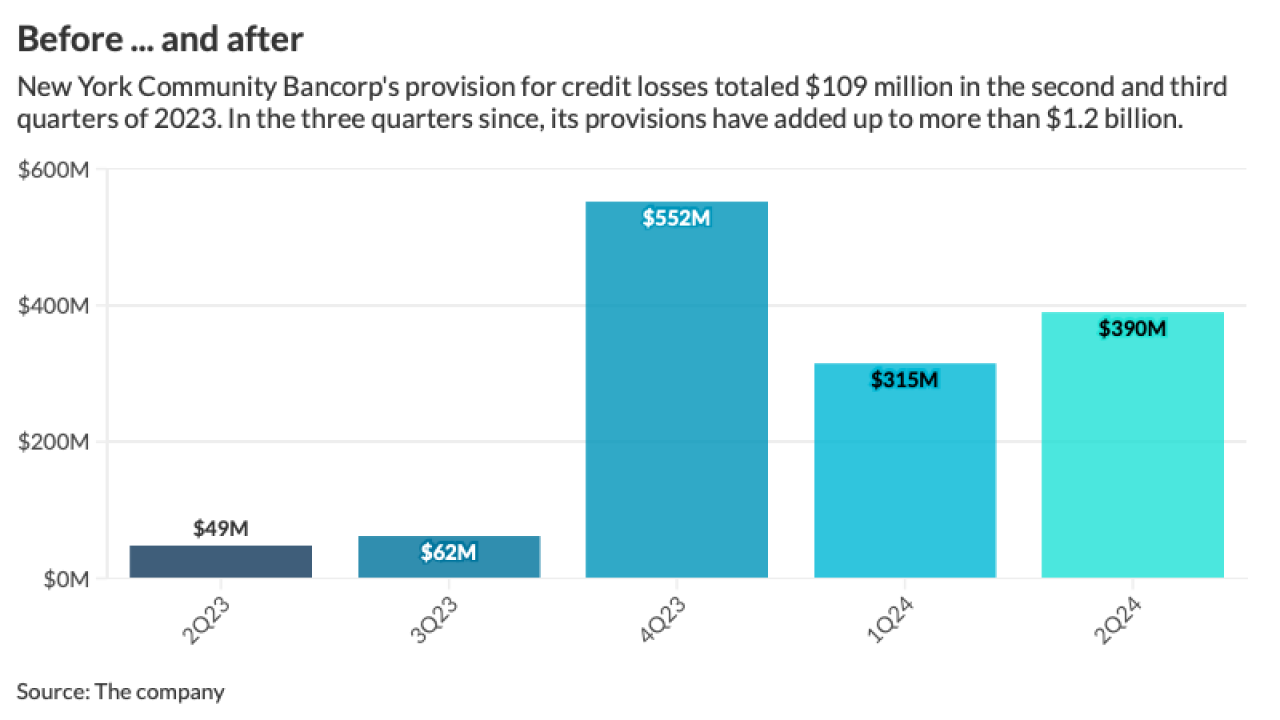

The parent company of Flagstar Bank reported a net loss of $323 million for the second quarter after boosting loan-loss provisions and recording a steep increase in net charge-offs. Still, it says it's making progress on a turnaround plan, including by agreeing to the sale of its mortgage servicing business.

July 25 -

The embattled Long Island-based bank announced the hiring of nine new senior executives. Most of them have ties to CEO Joseph Otting, who previously held the top job at the OCC and OneWest Bank.

July 24 -

Institutional investors have an opportunity to "do well while doing good" while advancing a flagship public/private partnership model writes the Chief Growth Officer of Rocktop.

July 23 Rocktop

Rocktop -

When the superregional bank sold its insurance business for $10.1 billion, it laid out three ways to use the proceeds: buybacks, a balance sheet repositioning and loan growth. The latter plan is so far proving to be elusive.

July 22 -

Bank OZK is the latest commercial real estate-heavy bank to announce plans to diversify its business. CEO George Gleason emphasized that he's confident in the bank's loan portfolio, but said he thinks misperceptions are dragging down the stock price.

July 22 -

The Dallas-based company, whose earnings per share fell short of consensus by 6 cents, lowered its revenue forecast and raised its expense outlook. Its stock price fell more than 8% on Thursday.

July 18 -

The Cleveland-based regional bank continues to benefit from strength in investment banking, though concerns about stalled loan growth emerged as CEO Chris Gorman described demand as tepid.

July 18 -

For at least the fifth consecutive quarter, the Providence, Rhode Island, company increased its allowance for credit losses on general office loans, which continue to be a problem area for banks.

July 17 -

The Charlotte, North Carolina-based bank saw profits and net interest income dip in the second quarter, but made up lost revenue through investment banking fees.

July 16 -

The Pittsburgh-based superregional bank reported a small quarter-over-quarter advance in net interest income, and it expects loan growth to pick up in the second half of the year. PNC, which announced job cuts last year, also said that it has identified an additional $25 million in cost savings.

July 16 -

The Consumer Financial Protection Bureau's proposal to eliminate medical debts from credit reports is under attack from debt collectors, which claim the rule will drive up litigation costs and drive doctors out of business.

July 15 -

Investment banking fees shot up at the nation's largest bank, thanks to rebounds in M&A and the equity capital markets segment. And despite higher credit costs in the company's card business, a top bank executive expressed confidence in the health of U.S. consumers.

July 12 -

The San Francisco bank's interest expenses continue to rise as depositors switch to higher-yielding options. At the same time, soft loan demand from business customers is putting a lid on how much interest Wells is collecting from borrowers.

July 12 -

A federal appeals court ruled that the Equal Credit Opportunity Act prohibits not just outright discrimination but also the discouragement of prospective applicants for credit.

July 11 -

Loan data spanning nearly a decade can be matched with other statistics from the influential government-related mortgage buyers to assess performance.

July 11 -

First Foundation will use the large investment to shrink its multifamily loan portfolio, which has weighed down its earnings since interest rates began rising.

July 2 -

Household borrowing from mortgages and other loans hit a record, outpacing inflation, a study shows.

July 1