-

Even as lockdowns ease, the trend toward remote work poses challenges for building owners and the banks that lend to them.

June 30 -

Democrats are pushing for a public-sector alternative to the three main credit bureaus, but Republicans argue that the government is ill-equipped to safely handle consumer data and produce accurate reports.

June 29 -

Fears of a permanent exodus from office life may have been premature, according to a study that finds a majority of businesses plan changes, but no significant downsizing of space.

June 28 -

The owner of former Sears stores is looking to sell as many as 50 properties as it tries to generate cash and focus on the development of other sites it owns.

June 25 -

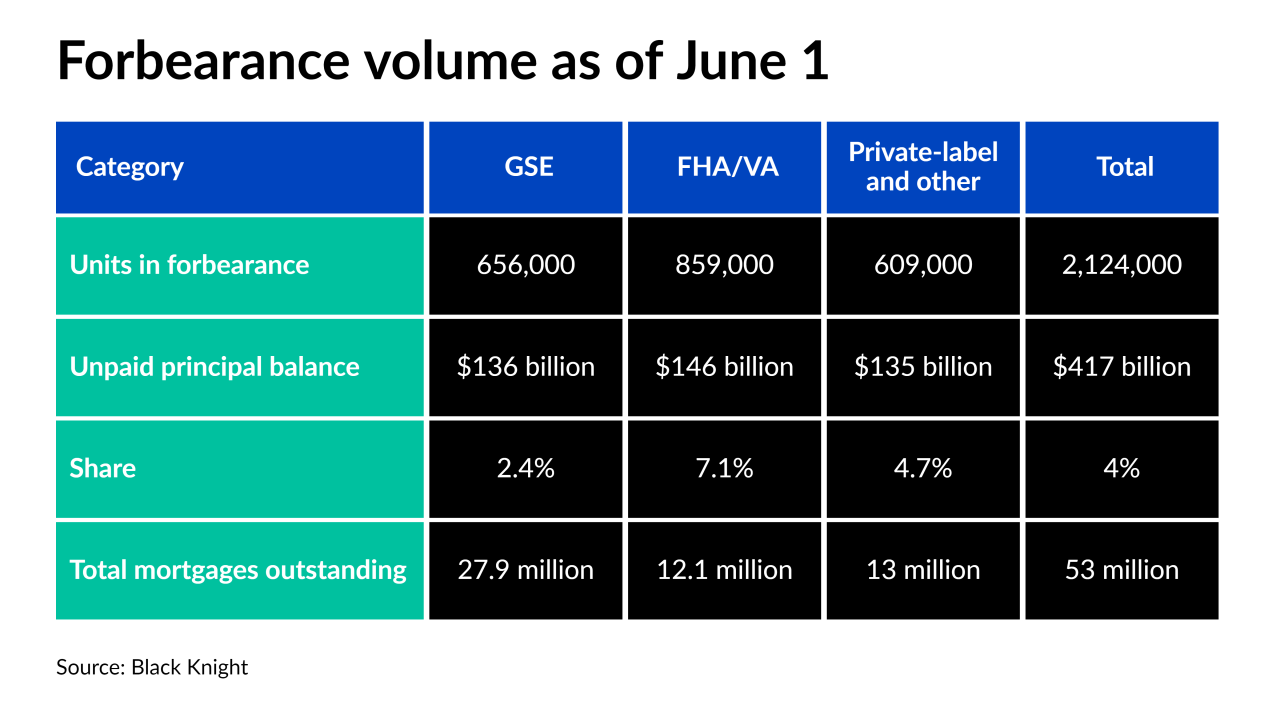

The numbers, which include payments suspended for pandemic-related hardships, could be a consideration in the possible further extension of moratoria federal regulators are close to making a call on.

June 23 -

Growing CRE mortgage volumes raised the bar for the coming year despite lingering concerns, according to the CRE Finance Council.

June 23 -

The strength of the housing market helped to increase forbearance exits while minimizing new requests, according to the Mortgage Bankers Association.

June 22 -

The new calculation of borrowers’ monthly obligations will allow for a higher debt load from tuition, potentially opening eligibility to more Black applicants, according to public officials.

June 18 -

About 20% of the pandemic-related delinquent borrowers are up for review by the end of June, which could lead to vast improvement or deeper financial strife, according to Black Knight.

June 18 -

The lender's founder and CEO says the acquisition of Roscoe State Bank will give it new products and referral sources.

June 14 -

Fears of widespread credit losses have largely subsided, but demand for new commercial real estate loans remains lackluster because many companies are sitting on so much cash they don’t need to borrow. Meanwhile, competition from private equity groups and other nonbank lenders is escalating.

June 14 -

Mortgage lenders should develop a comprehensive program to identify potential risks of noncompliance with consumer protection rules and take corrective actions before the Biden-era Consumer Financial Protection Bureau comes calling.

June 11Klaros Group -

Meanwhile, National MI has been increasing its new insurance written by slightly widening its credit standards.

June 11 -

But March's overall late payment rate was 1.3 percentage points higher than one year ago, while the 90-day-plus rate was 2.3 percentage points higher.

June 8 -

The sooner troubled loans can be put on a more proactive servicing path, the more likely the distressed homeowners will be able to avoid foreclosure, writes the vice president of market economics at Auction.com.

June 4 Auction.com

Auction.com -

The four-week high in forbearance exits also helped drive the considerable drop in plans, according to Black Knight.

June 4 -

Mortgage forbearances rose for only the second week in the past three months but big drops in numbers could be on the horizon, according to Black Knight.

May 21 -

For the first time since the pandemic began, the share of borrowers who are 30 days or more late on their payment is below 5%, Black Knight found.

May 20 -

Only 0.9% of mortgage borrowers are currently at least 90 days delinquent. That figure could rise as high as 3.8% once pandemic-related deferrals lapse — still well below the 6% mark reached after the Great Recession, according to research by the New York Fed.

May 19 -

Raising the capital gains tax and code changes could have more of an impact on the public debt market than rising interest rates, according to a panelist at the Urban Land Institute's Spring event.

May 13