-

Fears of widespread credit losses have largely subsided, but demand for new commercial real estate loans remains lackluster because many companies are sitting on so much cash they don’t need to borrow. Meanwhile, competition from private equity groups and other nonbank lenders is escalating.

June 14 -

Mortgage lenders should develop a comprehensive program to identify potential risks of noncompliance with consumer protection rules and take corrective actions before the Biden-era Consumer Financial Protection Bureau comes calling.

June 11Klaros Group -

Meanwhile, National MI has been increasing its new insurance written by slightly widening its credit standards.

June 11 -

But March's overall late payment rate was 1.3 percentage points higher than one year ago, while the 90-day-plus rate was 2.3 percentage points higher.

June 8 -

The sooner troubled loans can be put on a more proactive servicing path, the more likely the distressed homeowners will be able to avoid foreclosure, writes the vice president of market economics at Auction.com.

June 4 Auction.com

Auction.com -

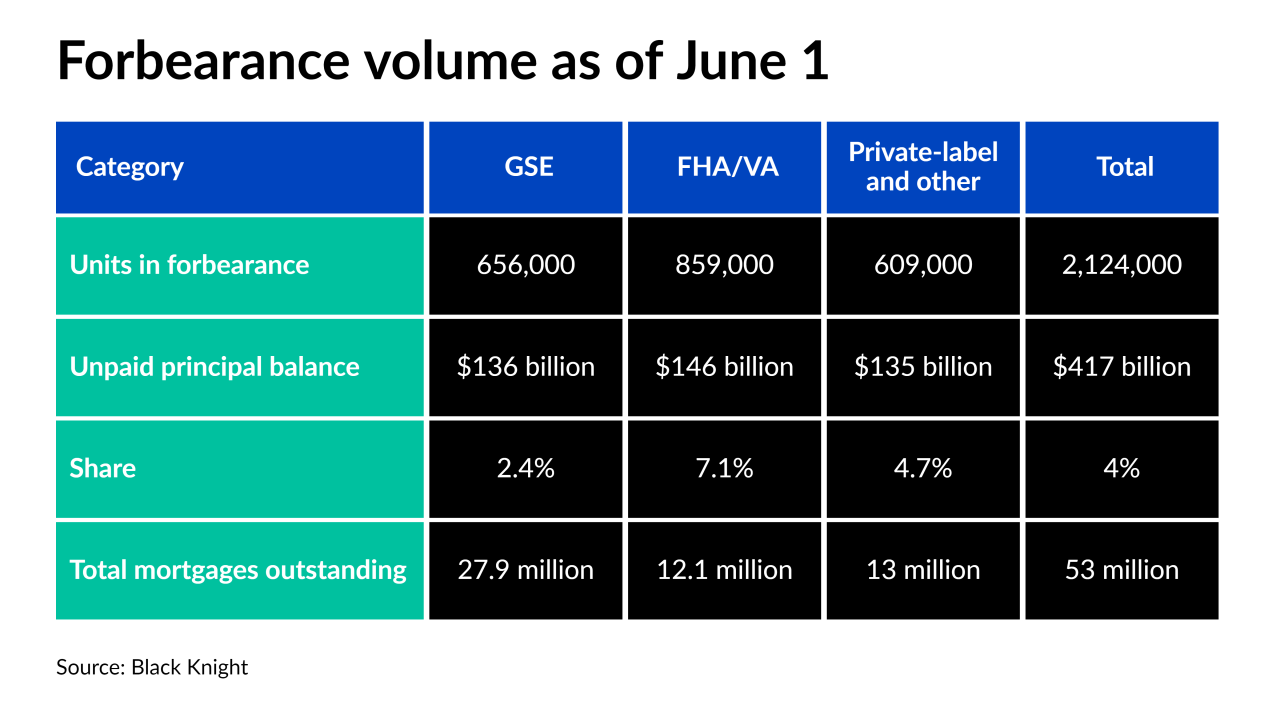

The four-week high in forbearance exits also helped drive the considerable drop in plans, according to Black Knight.

June 4 -

Mortgage forbearances rose for only the second week in the past three months but big drops in numbers could be on the horizon, according to Black Knight.

May 21 -

For the first time since the pandemic began, the share of borrowers who are 30 days or more late on their payment is below 5%, Black Knight found.

May 20 -

Only 0.9% of mortgage borrowers are currently at least 90 days delinquent. That figure could rise as high as 3.8% once pandemic-related deferrals lapse — still well below the 6% mark reached after the Great Recession, according to research by the New York Fed.

May 19 -

Raising the capital gains tax and code changes could have more of an impact on the public debt market than rising interest rates, according to a panelist at the Urban Land Institute's Spring event.

May 13 -

Collectors are mulling a procedural overhaul after a three-judge panel said the practice of using vendors to inform consumers about outstanding debts is illegal. The case may also complicate the CFPB's upcoming rule on electronic messaging.

May 11 -

The total number of loans in this category dropped 11 basis points from week to week according to the Mortgage Bankers Association. Meanwhile, the amount of unpaid balance in forbearance dropped almost 23% since the start of the year, a separate report from Black Knight found.

May 10 -

Less than two years after shutting down its biggest business amid fraud allegations, the Michigan company has sold branches, settled a shareholder lawsuit and returned to profitability under turnaround specialist Thomas O’Brien.

May 7 -

The agreement, which is extended for five years, also expands upon the delinquent mortgages services Altisource will provide to Ocwen.

May 6 -

The nation’s largest mortgage lender plans to use a new partnership with the financial technology company AutoFi to sell more cars to its home loan customers.

May 5 -

An economic rebound, stimulus payments and COVID-19 vaccinations contributed to new delinquencies dropping to an all-time monthly low with more recovery ahead, according to Black Knight.

May 3 -

Some say Equifax, Experian and TransUnion are too slow to investigate grievances, prompting more complaints to the Consumer Financial Protection Bureau. But the big three say other forces are at work.

April 30 -

The mortgage insurance business had adjusted operating income of $126 million in the first quarter, down from $148 million one year ago.

April 30 -

Kerry Killinger, former CEO of Washington Mutual, says the asset bubbles and increased consumer debt that contributed to his company's failure are reappearing.

April 30 -

While the government passed sweeping measures last year to prevent mass homelessness among renters, there was no targeted help for mom-and-pop property owners who provide much of America’s affordable housing.

April 29