-

Join Jim McKelvey, co-founder of Square as he offers his insights into where the Fintech industry is headed next year. Will a Biden administration insist on greater regulation? What will happen in the cryptocurrency markets? What will be the big IPOs in the sector? Will GooglePlex make a big splash? What new technologies or applications should we be expecting?

-

Demand for home purchases and car loans would need to increase substantially to make up for what's expected to be a sharp drop in refinancing revenue.

December 22 -

The new bill ordering $600 stimulus checks and $25 billion in emergency rental assistance won't be enough to help millions of Americans struggling to make housing payments, according to industry watchers.

December 21 -

The agency's rule outlines steps collectors must take to inform consumers about an outstanding debt, and prohibits companies from pursuing lawsuits after a statute of limitations has ended.

December 18 -

Bank and credit union groups are pushing to include the industry’s front-line workers in the next priority group, but even as a recommendation is coming soon from a CDC advisory panel, the decision ultimately will be made state by state.

December 18 -

With infection rates rising and unemployment claims increasing since Thanksgiving, mortgages in coronavirus-related forbearance rose by 37,000 last week, according to Black Knight.

December 18 -

The boom continues, with refinances making up a 61% share of all mortgage loans issued that month, according to Ellie Mae.

December 17 -

Noninterest income has bolstered profits this year. But its growth is expected to slow over the next two years, making for a gloomy earnings outlook unless vaccine distributions and the economic recovery are relatively swift.

December 17 -

The percentage of seriously delinquent loans hit 5.8% in the third quarter, up from 1.5% a year earlier but down from 6.8% in the second quarter.

December 16 -

The largest concerns are with pandemic risk and defaults, along with business resilience and adaptability, according to a Wolters Kluwer survey.

December 14 -

The architects of two major loan deals featuring Black banks, one involving multiple lenders and a pro sports franchise and another backed by Citigroup, say more transactions like these are in the works.

December 13 -

While 12,000 mortgages exited forbearance, the most borrowers entered forbearance protection in a week since early September, according to Black Knight.

December 11 -

Borrowers who exit CARES Act-related forbearance in the spring and have stacks of other bills to attend to may be in search of liquidity via such products, the company predicts.

December 10 -

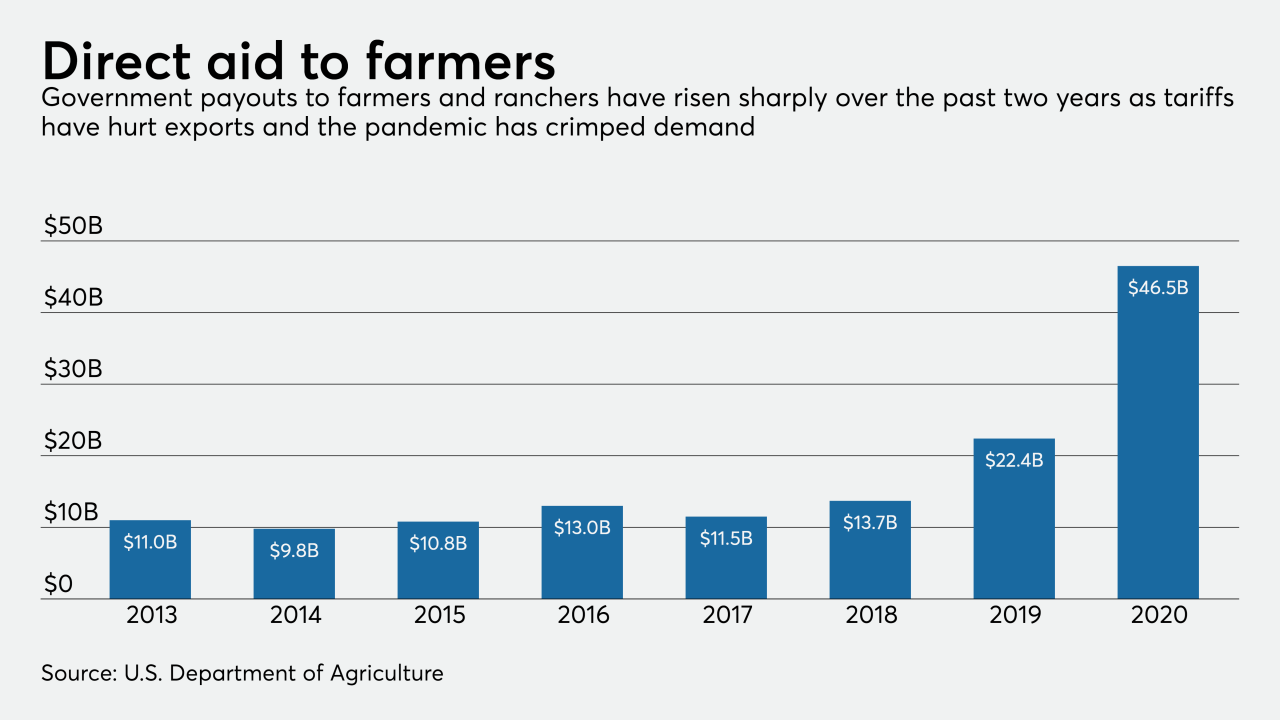

The Biden administration could curtail federal support for farmers, even with bankruptcies and requests for loan workouts on the rise. Banks are hoping that increases in crop prices and exports to China could help avert a credit crisis.

December 10 -

While distressed mortgage rates crept down overall, serious delinquencies still tripled year-ago rates in September, according to CoreLogic.

December 8 -

In November, more loan products were being offered both at the upper and lower ends of the market.

December 8 -

People with scores below 500 are often in communities that suffer the most from economic hardship and violence. Banks and regulators can do more to qualify them for financing, ultimately creating healthier local economies.

December 2 Operation HOPE Inc.

Operation HOPE Inc. -

Citigroup's realty arm is sponsoring a $1.06 billion RMBS of highly seasoned mortgage loans with troubled histories. All of the loans were acquired via a Fannie whole-loan auction.

November 25 -

Mortgage delinquencies dropped to the lowest level since March but, particularly at the seriously delinquent level, they're still much higher than pre-coronavirus rates, according to Black Knight.

November 23 -

The Term Asset-Backed Securities Loan Facility was brought back to inject $100 billion into the pandemic-battered economy, but only a fraction has been disbursed. Yet experts, pointing to its calming effects on markets, recommend that it be extended into next year.

November 17