-

Live Well Financial's creditors are seeking a court-supervised bankruptcy, but the mortgage lender is opposing the move, saying it can get more for certain assets if it sells them before filing.

June 19 -

Ditech Holding Corp. has entered into purchase agreements with New Residential Investment Corp. and Mortgage Assets Management, in which each would acquire certain assets in the company's Chapter 11 bankruptcy.

June 18 -

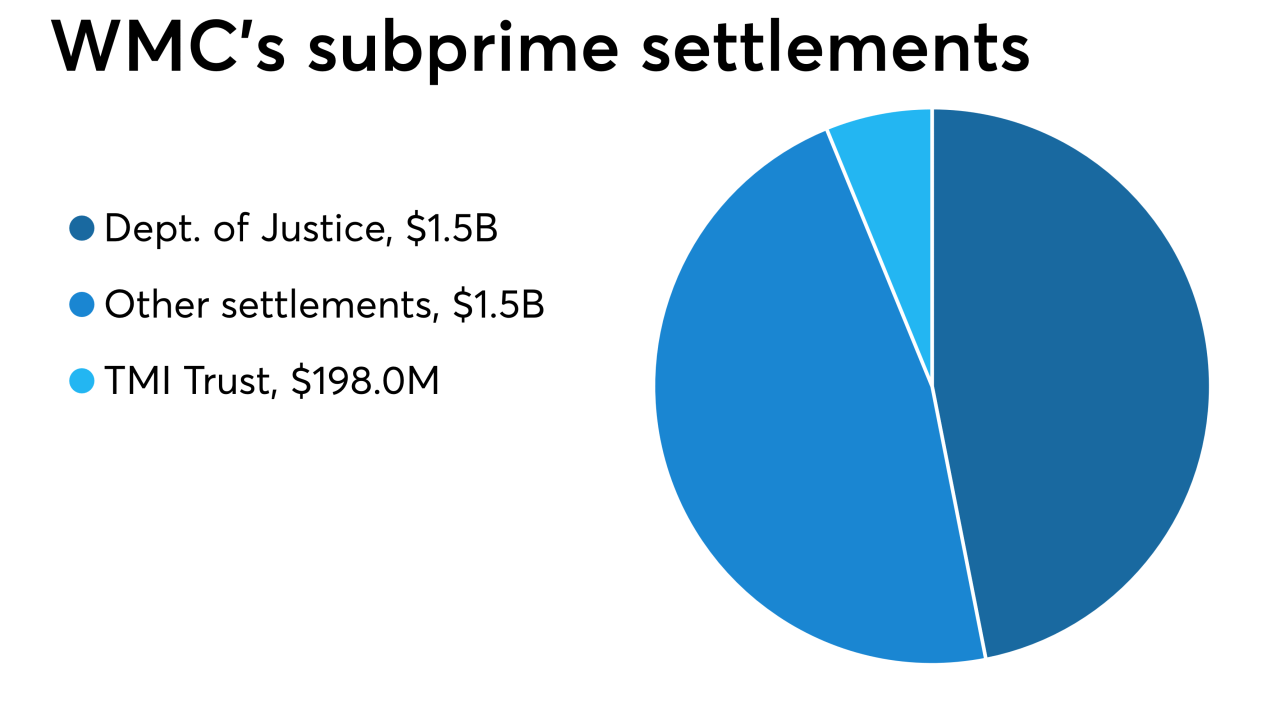

General Electric placed its WMC Mortgage unit into Chapter 11 bankruptcy protection as it has nearly $1.7 billion in legal settlements agreed to or pending.

April 24 -

Homeowners in Chicago cheated by a mortgage fraud scheme are seeking to form a committee to protect their interests in the bankruptcy of Ditech Holding Corp., the company that owns their loans.

April 23 -

Ditech Holding Corp. is refiling for bankruptcy almost a year after emerging from it in order to facilitate a restructuring agreement with lenders holding more than 75% of its term loans.

February 11 -

The Consumer Financial Protection Bureau finalized a rule on Thursday that gives mortgage servicers more latitude in sending periodic statements to borrowers in bankruptcy.

March 8 -

Ditech Holding Corp. promoted Jeffrey Baker to interim CEO of the company, replacing Anthony Renzi who left the company.

February 21 -

Walter Investment Management Corp. plans to emerge from Chapter 11 bankruptcy and start trading again under a new name in a matter of days.

February 8 -

Anthony Renzi, the former Freddie Mac executive brought in to try and right the ship at Walter Investment Management Corp., will be leaving the company once a replacement is found.

February 2 -

Walter Investment Management Corp. pushed back the date it would emerge from bankruptcy to no earlier than Feb. 2 from the originally planned Jan. 31.

January 31 -

The impending bankruptcy of Walter Investment Management Corp. should not affect its subsidiary Ditech Financial's capability to service securitized mortgages, Fitch Ratings said.

November 20 -

Walter Investment Management Corp. is looking to file for bankruptcy protection by Nov. 30, after lining up $1.9 billion of debtor-in-possession warehouse financing.

November 10 -

The U.S. Bankruptcy Court for the Southern District of Florida has approved a portal created by HLP to enhance communications during the mediation process.

October 30 -

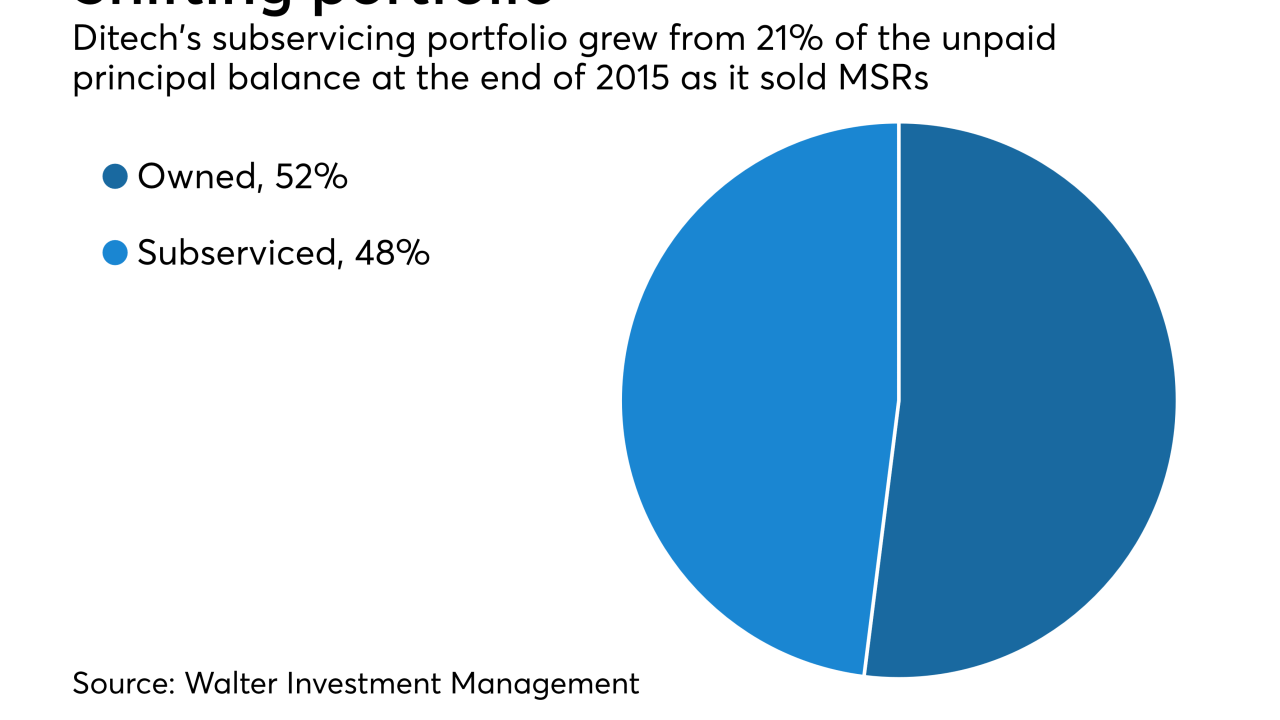

Walter Investment Management Corp. was supposed to prosper by snapping up mortgage cast-offs from big banks at fire-sale prices. Instead, Walter is belatedly joining the list of companies burned by the U.S. housing crisis.

October 25 -

Bank earnings could be hurt this year as big retailers close stores and file for bankruptcy. The situation has sparked a debate about how much CRE and C&I books will suffer just as lenders were putting other commercial woes behind them.

April 11