-

Bain Capital and American Family Ventures were among the investors in this funding round for the company, which has more than doubled its staff in the past 12 months.

December 6 -

A group of 20 insurers and reinsurers provided coverage for the government-sponsored enterprise’s credit insurance risk transfer deal, which was the biggest in its category to date.

December 3 -

Acting Federal Housing Finance Agency Director Sandra Thompson and the Housing Policy Council say the new amounts are not good for affordable housing.

November 30 -

Due in part to pandemic-related forbearance, GSE portfolio loans with year-plus delinquencies hit the highest point seen since the Federal Housing Finance Agency started tracking them in 2015.

November 23 -

However, capacity issues, the suspension of the government-sponsored enterprise purchase caps and higher conforming limits all could affect activity, KBRA said.

November 22 -

The bulk package from an unnamed seller is associated with retail loans generally originated a little over a year ago and purchased by government-sponsored enterprises Fannie Mae and Freddie Mac.

November 18 -

Electronic signatures and remote online notarization can now be used for mortgages that previously were signed in person, subject to certain restrictions.

November 16 -

Amid its first post-IPO securitization of loans made outside a regulatory definition for standard products, the company has seen purchases accelerate, but it underperformed by some analysts’ estimates.

November 10 -

Nearly half of the company’s revenue comes from sources outside of the traditional home lending market, CEO Patricia Cook told analysts during the company’s earnings call.

November 10 -

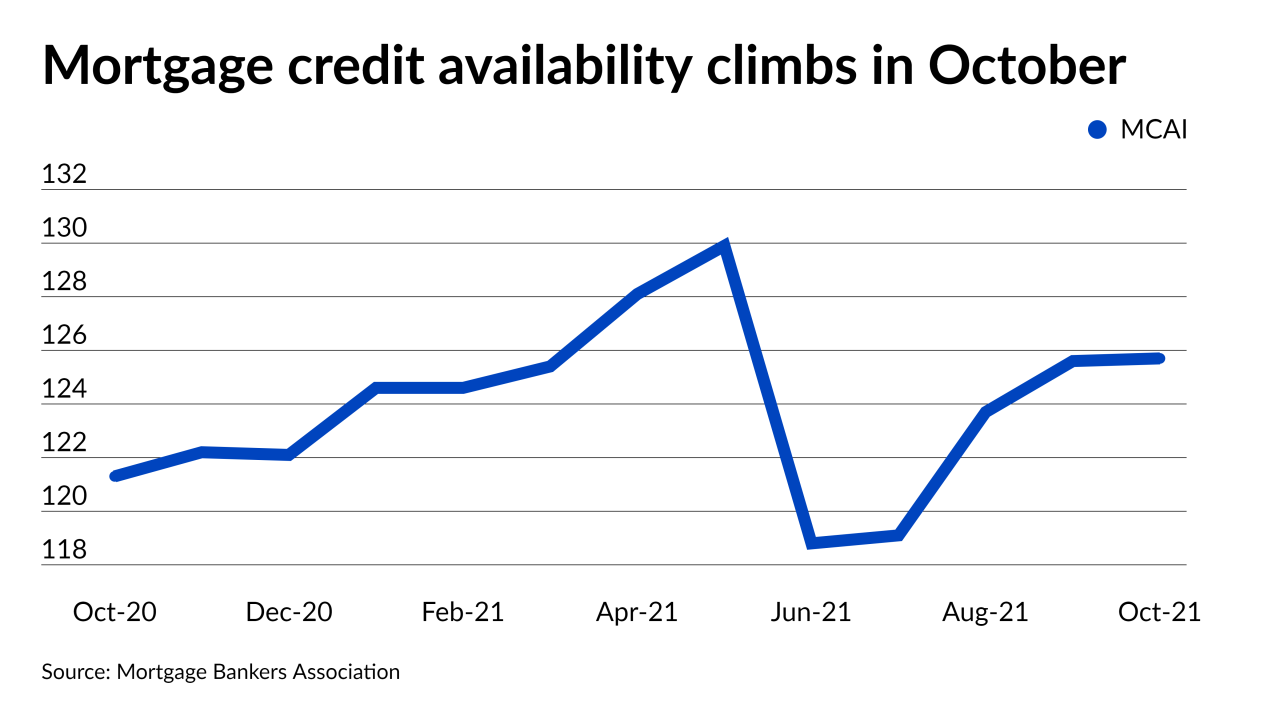

However, it remains 30% tighter than pre-pandemic levels, according to the Mortgage Bankers Association.

November 9 -

Acting FHFA Director Sandra Thompson's decision to act immediately rather than taking the time to examine the impact likely harmed private-label securitizations in the short term, but issuance is still on course for a record year.

November 9 -

More aggressive pursuit of government-related agencies’ affordable housing mission is expanding product availability, but government intervention can be a double-edged sword.

November 8 -

The seasoning clock for securitization eligibility restarts when a modification takes place, the government agency said.

November 4 -

The company is repositioning its secondary market sales of loans and servicing and implementing cost-cutting measures as the market normalizes.

November 4 -

The partnership with Esusu, which the athlete’s venture capital firm invested in earlier this year, could help renters build credit histories, broadening their housing options, improving loan performance and incentivizing originations.

November 3 -

The Fed said it would reduce Treasury purchases by $10 billion and mortgage-backed securities by $5 billion, marking the beginning of the end of the program aimed at shielding the economy from Covid-19.

November 3 -

When added to other staffing and acquisitions additions since year-end 2019, the mortgage services provider has more than tripled the company’s headcount.

November 1 -

The mortgage giant’s net worth of $42 billion at the end of the quarter was more than double what it was a year earlier. CEO Hugh Frater said that financial strength puts the company on better footing to support affordable housing goals outlined by the Federal Housing Finance Agency.

October 29 -

The move by the agency, which is an arm of the Department of Housing and Urban Development, will help further efforts to give servicers more leeway to modify mortgage terms.

October 29 -

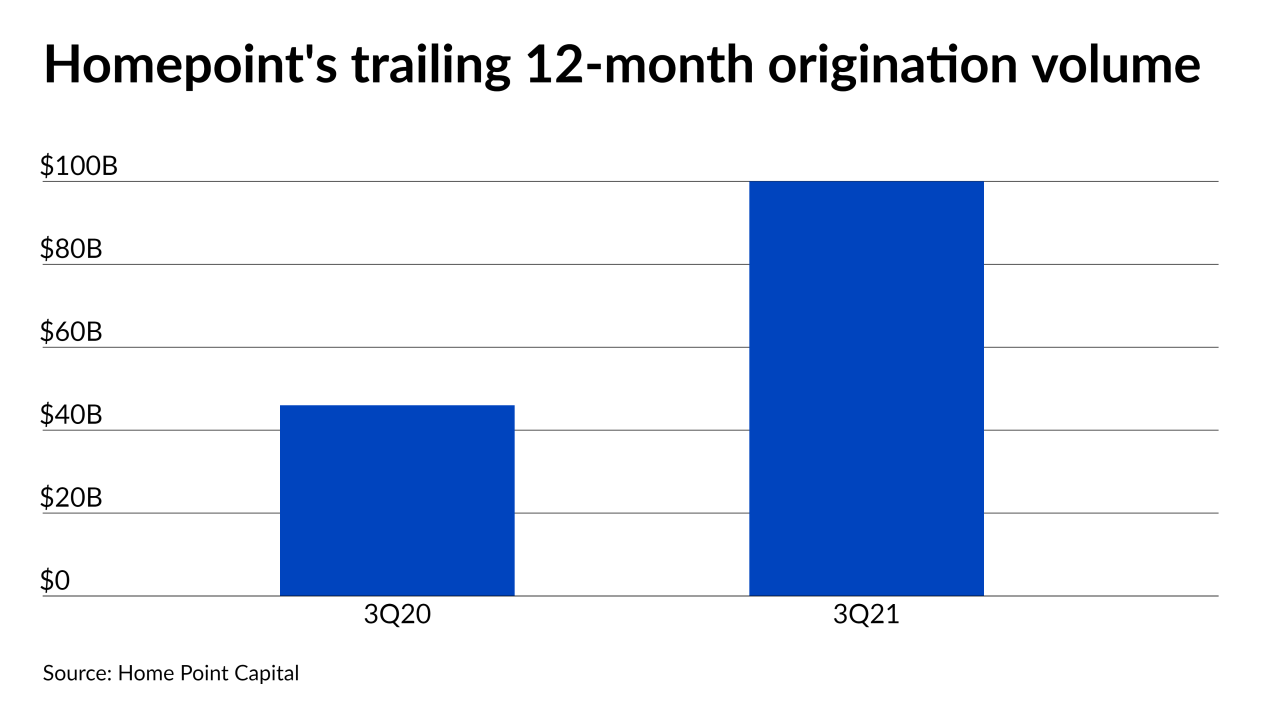

The combined refinance and purchase total was nearly double the average quarterly volume logged before the pandemic, the company said in its third-quarter earnings call.

October 29