-

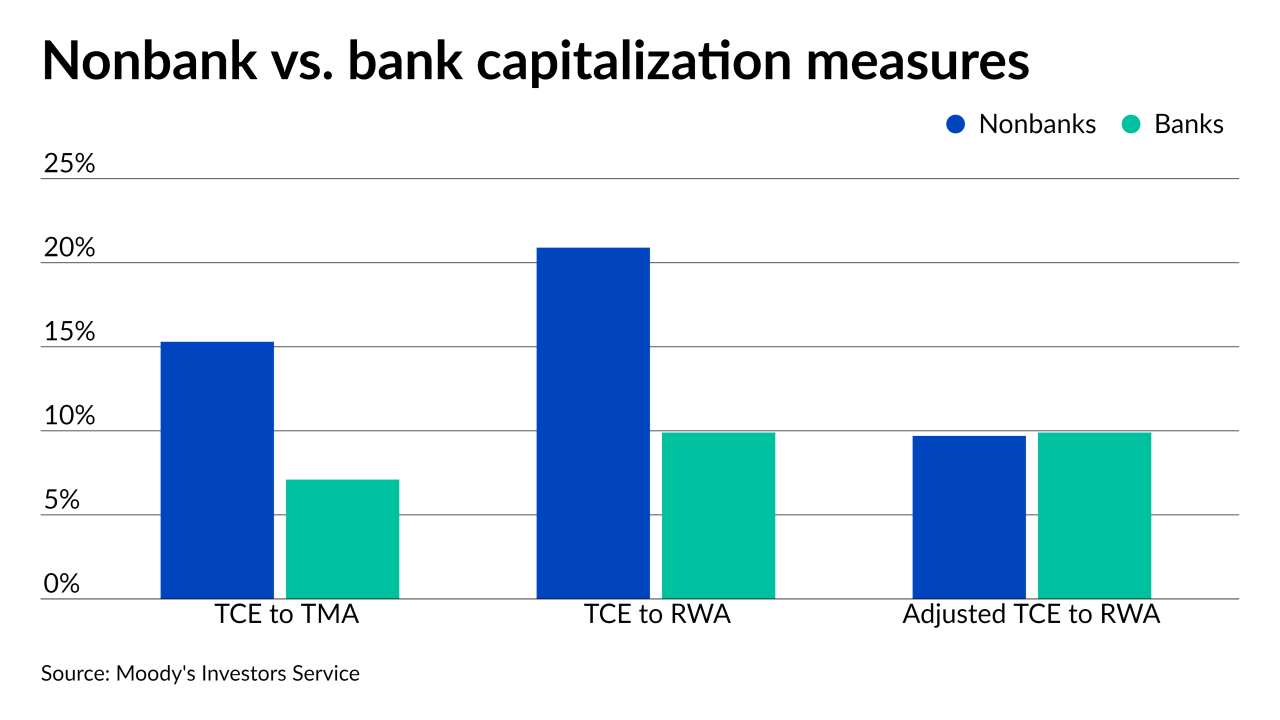

By some current measures, nonbank capitalization looks strong compared to banks, but the way a Ginnie Mae proposal aims to assess the value of mortgage servicing rights would change that, Moody’s Investors Service reported Tuesday.

August 31 -

Dave banking app originally created to do away with overdraft charges has taken the industry by storm. It's on a mission to advance financial opportunities for all Americans. Join Penny Crosman, Executive Editor of American Banker and Jason Wilk, CEO and Co-Founder of Dave as they talk about how this app is changing the way people manage their money and what’s in store for the future of one-stop-shops for finances.

-

The digital provider of commercial mortgage closing documentation hired a Guaranteed Rate executive and announced plans to add staff and integrate more loan operating systems.

August 24 -

Refinancing, high home prices, the concentration of pandemic-related hardships in the FHA market, and the lingering impact of last year’s market disruption all likely played a role in the intensified discrepancy.

August 20 -

The lending technology provider currently has 37,741 decisioning steps or pivot points on its platform.

August 18 -

The home purchase target for Fannie Mae and Freddie Mac would set a new 10% benchmark for qualified single-family lending in census tracts that meet certain demographic and income targets.

August 18 -

Originations of loans to the self-employed and other outside-the-box borrowers had better margins than mainstream mortgages in the second quarter, but rebuilding after the niche market’s temporary disruption last year generated significant expenses.

August 13 -

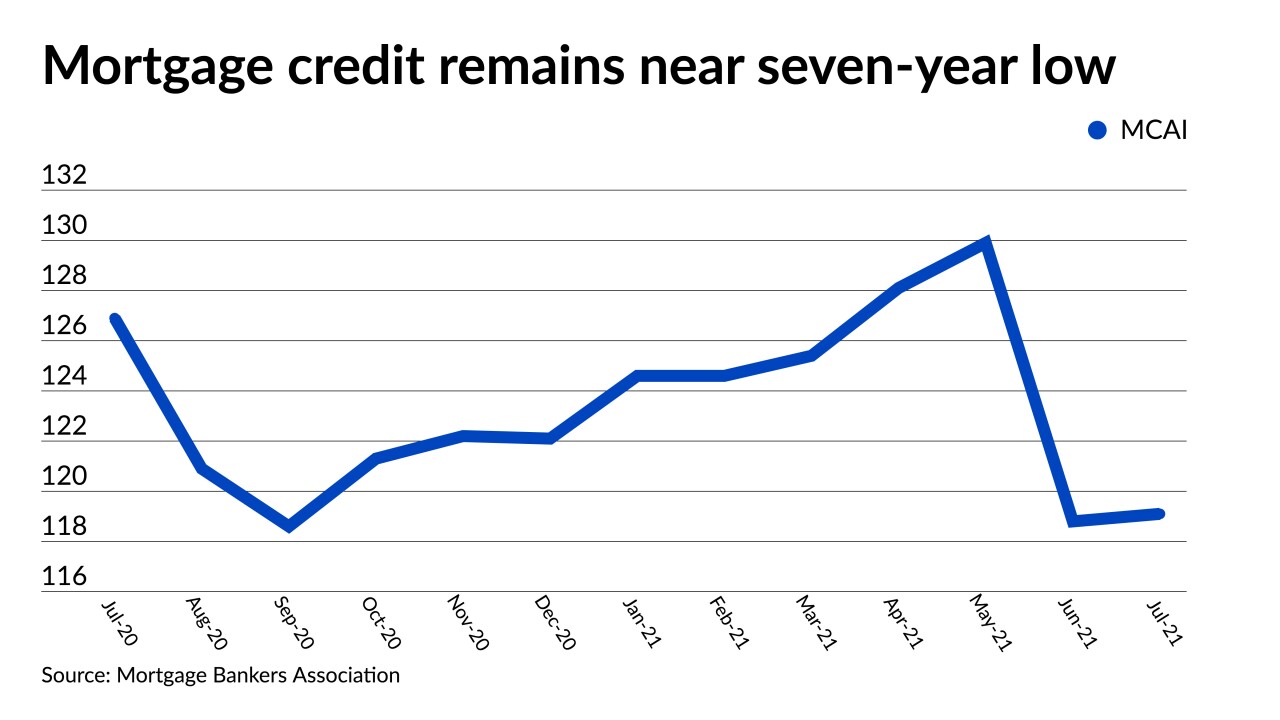

A jump in jumbo loan programs was countered by lenders dropping high loan-to-value conforming products.

August 12 -

Total investment property lending this year should be 31% above 2020's pandemic-affected activity.

August 10 -

The company has been making investments in correspondent originations and servicing and “reverse” loans used by borrowers age 62 and up to withdraw home equity.

August 5 -

While the hot market’s actual and forecast home price gains were key drivers of Fannie’s results, they also present a challenge to the affordable housing mission that it’s working to address.

August 3 -

The bank saw a modest increase in net income from the first quarter, as lawsuit settlements tied to the company’s discontinued home lending business and fees regarding an anti-money laundering and securities class action suit continue to limit growth.

August 2 -

The company’s results included some transitory revenue sources, including early buyouts of loans in forbearance from securitized pools, but executives plan to maintain growth over time through economies of scale.

July 29 -

The MISMO protocols are aimed at ensuring nothing is lost in translation when information about billing, late payments and related processing moves to a new system.

July 28 -

The acquirer will use the liquidation of a residential mortgage company’s assets to move several notches up in the rankings.

July 26 -

In 2011 Congress paid for payroll tax relief by raising secondary market guarantee fees for 10 years. The Mortgage Bankers Association, and others, don’t want to see that happen again.

July 23 -

Regulators should create a simple liquidity formula that allows the secondary market to function rather than using depository rules as a model, writes the head of Whalen Global Advisors.

July 21 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

While the unit saw a bigger increase in purchase volume compared to its competitors, net income, loan sales margins and total volume was lower compared with prior periods.

July 21 -

The Rhode Island bank endured a sharp decline in fee income from home loans, which had spiked earlier in the pandemic. But CEO Bruce Van Saun says the company is well positioned as the refinancing boom fades and the home purchase market becomes more important.

July 20 -

The new deal will remove manual bid taping and automate secondary loan sales directly on the Encompass platform.

July 15