-

Per-loan profits for nonbank lenders increased over 13% in 2016 from the previous year, driven by higher loan balances and increased revenue.

April 13 -

Returns from funds investing primarily in government-related mortgage securities were stronger in the first quarter than they were in the fourth quarter of 2016, but aren't quite as strong as in the first quarter of 2016.

April 7 -

Freddie Mac has obtained two new insurance policies under its Agency Credit Insurance Structure program.

April 4 -

Fourteen institutional investors represented by the law firm Gibbs & Bruns are supporting the Lehman Brothers bankruptcy plan administrator's offer to settle certain securitized mortgage repurchase claims with securities' trustees.

April 3 -

Risk management concerns were responsible for a five-percentage-point reduction in bank non-qualified mortgage lending last year.

March 31 -

James Lockhart, former director of the FHFA, is replacing Wilbur Ross, who resigned when he became Commerce secretary, on the New Jersey company's board.

March 29 -

The industry expects to lean on technological efficiencies this year as higher rates and dwindling refinances test their businesses.

March 28 -

In a bitterly partisan Congress, two senators are making a rare push across party lines to solve a persistent riddle with huge implications for the U.S. housing market: What to do with Fannie Mae and Freddie Mac?

March 28 -

Fannie Mae has obtained reinsurance for $510 million of credit losses on $20.4 billion of single-family residential mortgages through a pair of credit insurance risk transfer transactions.

March 24 -

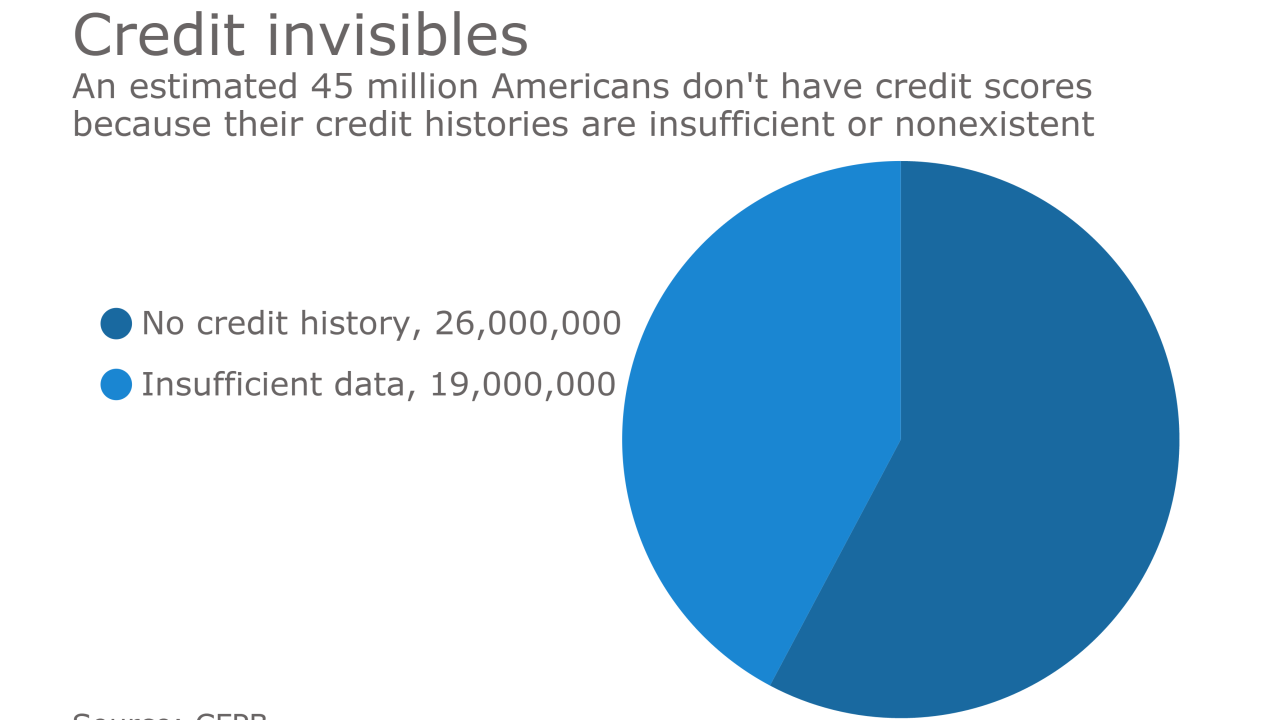

Freddie Mac will soon allow automated underwriting of borrowers who lack scores but have other financial records.

March 23 -

Servicers are able to borrow more against their Ginnie Mae mortgage servicing rights as financing providers become more comfortable with the collateral.

March 23 -

A $165 million cash settlement has been reached in a class-action lawsuit that alleged investors were misled about the safety of mortgage-backed securities comprised of loans originated by now-defunct subprime lender NovaStar Mortgage Inc.

March 15 -

Industry critics argue the Invitation Homes deal will create new risks for Fannie Mae and remove affordable inventory from homebuyers.

March 15 -

Freddie Mac is considering backing loans that finance single-family rental homes for the first time, mirroring a controversial transaction that Fannie Mae disclosed in January.

March 10 -

Freddie Mac is preparing a transaction that transfers credit risk on $640 million of super-conforming residential mortgages.

March 9 -

Mill City Holdings is returning to market with its fourth securitization of reperforming residential mortgages, this time with a sliver of home equity lines of credit added to the mix of collateral.

March 9 -

Altisource Portfolio Solutions has launched a new mortgage trading platform for mortgage bankers and loan investors.

March 6 -

The Mortgage Bankers Association has partnered with Altisource subsidiary Lenders One Cooperative, providing the organization's members with expanded benefits.

March 6 -

Deutsche Bank wants to finance hedge fund purchases of subprime loans in order to meet the terms of its $7.2 billion settlement with the U.S. government.

March 2