-

Royal Bank of Scotland Chief Executive Officer Ross McEwan said the likelihood is waning that the lender will settle a U.S. mortgage-bond probe before the end of the year as he'd hoped, though it's well-capitalized to handle a settlement.

December 8 -

The U.S. is taking steps to stamp out the practice of servicemembers and veterans being pressured into taking mortgages they don't need, a move that officials say will lower consumer costs and could lead to financial penalties for lenders.

December 7 -

Maxwell Financial Labs, a provider of a digital cloud-based platform used by the mortgage industry, is getting a new $3 million round of funding led by Anthemis Group's investment arm.

December 6 -

Testing of the common securitization platform is taking longer than expected, but the Federal Housing Finance Agency said it won't delay the 2019 launch of Fannie Mae and Freddie Mac's new single "uniform mortgage-backed security."

December 4 -

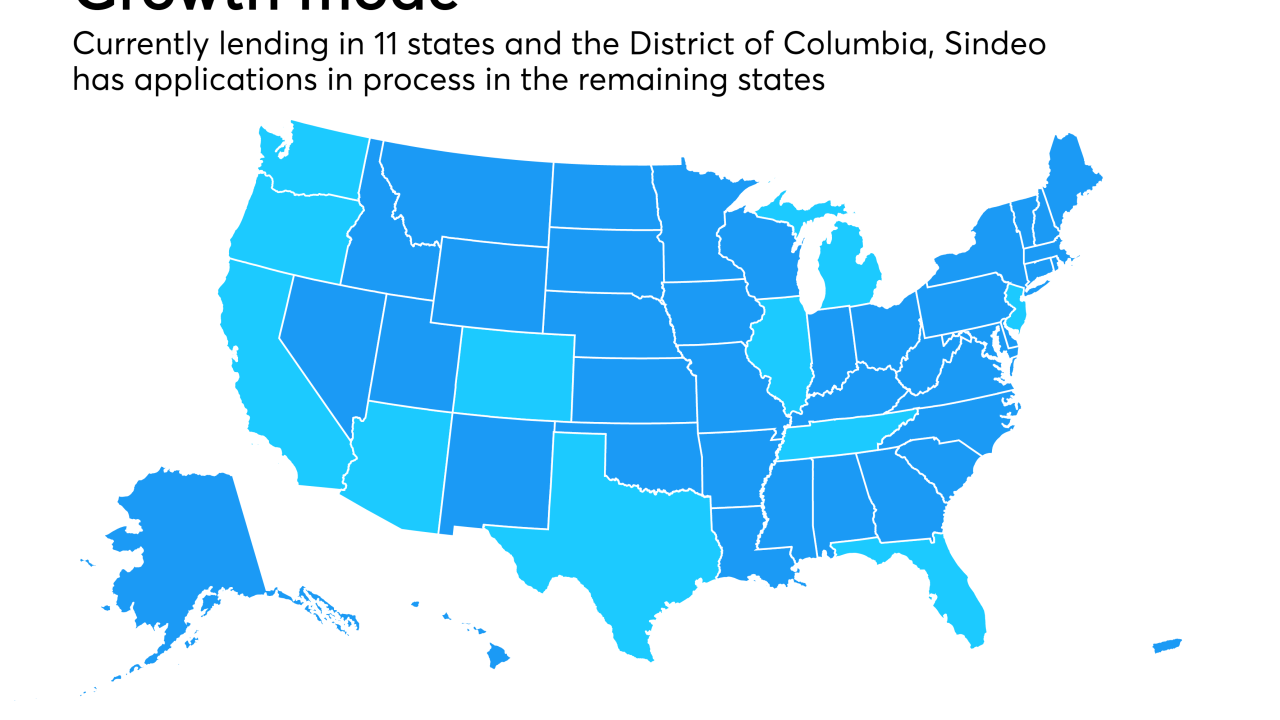

When a $40 million round of venture funding fell through at the last minute, digital mortgage broker Sindeo all but shut down this summer. Now recapitalized and rejuvenated, founder and CEO Nick Stamos explains why Sindeo is ready to grow again.

November 21 -

The senior tranche of Angel Oak 2017-3 benefits from 46.25% credit enhancement, up significantly from 37.75% for the sponsor’s July transaction, but in line with its April deal.

November 21 -

Fannie Mae servicers are facing pressure from the recent hurricanes, but so far are bearing up under the strain.

November 2 -

Credit Suisse's plan for consumer relief in a multibillion-dollar Department of Justice settlement related to residential mortgage-backed securities could reduce the costs involved, according to the settlement monitor's first report.

October 30 -

Called Structured Agency Credit Risk Securitized Participation Interests, the new securities are backed by mortgage loans, and are not general obligations of the government-sponsored enterprise.

October 18 -

Many of the prime jumbo loans backing the transaction, JP Morgan 2017-4, were contributed by originators with limited history in that product, according to DBRS.

October 18 -

Fintech and marketplace lender LendingHome is getting more than $450 million in investment and funding from different channels to help support mortgage production growth and technology improvements.

October 16 -

Entrepreneurs like LendingHome's Matt Humphrey are upending mortgage finance with tactics borrowed from fintech, marketplace lending and the traditional mortgage playbook.

October 16 -

The Treasury Department is expanding its calls for overhauling regulation of the financial services sector, this time focusing on changes to the most significant rules surrounding securitization and derivatives.

October 6 -

With a debt deadline looming and regulators again delaying approval of its takeover by China Ocwenwide, Genworth Financial is weighing how to protect its private mortgage insurance unit from its troubled life insurance business.

October 2 -

Fed economists are suggesting a new mortgage product that would allow home buyers to build equity faster and give banks incentive to profitably hold the loans in portfolio.

September 13 -

Lima One Capital is expanding its single-family investor financing business by acquiring the residential debt business of the marketplace lender RealtyShares.

September 12 -

Former Ginnie Mae President Ted Tozer will join securitization pioneer Lewis Ranieri at a new housing policy team at the Milken Institute.

September 7 -

As head of Fannie Mae's single-family mortgage business, Andrew Bon Salle wants to ease the burden of loan-level price adjustments, streamline condo loan approvals and expand rep and warrant relief. But even he admits there are limits to his power.

September 7 -

Zucker previously oversaw debt issuance at the New York State Homes and Community Renewal’s Office of Finance and Development.

September 5 -

The government-sponsored enterprise is still looking for the right balance between offering a product that's attractive to investors and a cost-effective way to reduce risk.

August 3