-

For banks with assets between $10 billion and $100 billion, the average exposure is 165% of capital.

June 24 -

Starwood Capital Group missed two monthly payments on securitized debt tied to five shopping malls anchored by bankrupt department stores including Sears and J.C. Penney.

June 18 -

But deal sponsors are primarily restricting property assets to the lower risk multifamily and office buildings that lenders are more confident will weather the economic strains brought by the coronavirus pandemic.

June 12 -

Kalahari Resorts defaulted on a $347 million mortgage originated by JPMorgan Chase

May 27 -

The private equity firm's REIT arm is seeking to price a second CRE loan portfolio for May, this time led by an industrial portfolio of warehouses and logistics centers. No hotel or shopping mall loans are included.

May 20 -

Sellers are currently willing to concede discounts of around 5%, while bidders are hoping for about 20% off pre-pandemic prices. That estimated gap, which is likely wider in specific cases, has put a freeze on deals.

May 19 -

The global hospitality industry is facing the worst downturn in its history, and New York, the epicenter of the coronavirus outbreak in the U.S., is poised for a painful recovery.

May 15 -

Goldman Sachs and Morgan Stanley are backing the first commercial mortgage-backed securities activity in two months, through two deals that exclude hotel or department store retail assets that are most exposed to pandemic-related stresses.

May 6 -

More details have emerged about the damage the coronavirus pandemic is inflicting on the hospitality industry. One servicer alone has received 2,000 workout requests in the past month.

April 24 -

The Federal Reserve's $2.3 trillion loan stimulus includes plans for outstanding commercial mortgage-backed securities and newly issued collateralized loan obligations.

April 9 -

Fitch assumes a significant spike in defaults over the next few months, as well as declining new issuance volume during the second and third quarters of 2020, fewer maturing loans and fewer resolutions by special servicers.

April 9 -

Real estate crowdfunding company Sharestates launched a program Wednesday offering liquidity to private lenders and loan aggregators contending with margin calls as a result of market volatility related to the coronavirus outbreak.

April 1 -

Mortgage bankers are sounding alarms that the Federal Reserve's emergency purchases of bonds tied to home loans are unintentionally putting their industry at risk by triggering a flood of margin calls on hedges lenders have entered into to protect themselves from losses.

March 30 -

Real estate investor Tom Barrack said predicted a “domino effect” of catastrophic economic consequences if banks and government don’t take prompt action to keep commercial mortgage borrowers from defaulting.

March 23 -

The credit watch involves single-borrower securitizations of commercial mortgages for high-priced resorts in Florida and Hawaii.

March 19 -

Add continued growth in commercial and multifamily mortgage debt outstanding to the list of things that the economic fallout from the coronavirus might affect.

March 16 -

Any impact from the coronavirus outbreak on commercial and multifamily loan delinquencies won't be known for some time, the Mortgage Bankers Association said.

March 3 -

Most of the pool is made up of office-property loans, but also includes a sizeable exposure to hotel and retail properties.

February 27 -

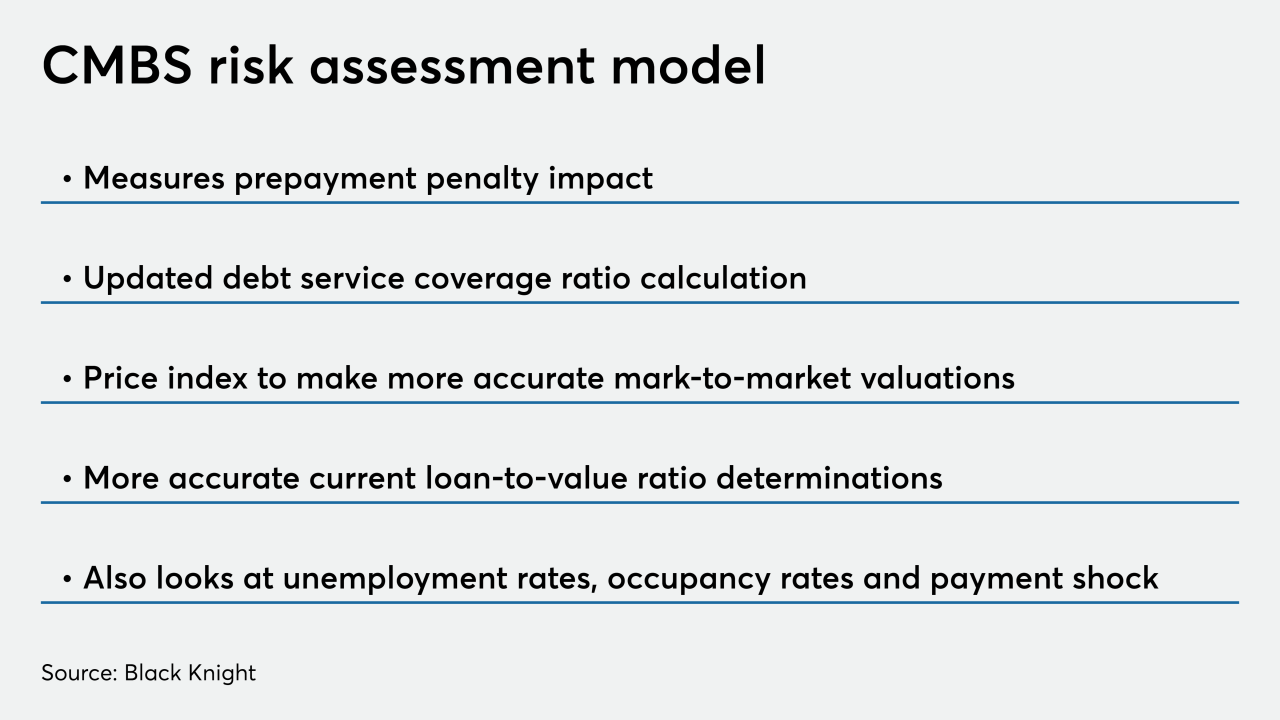

Black Knight introduced a model to gauge prepayment speeds and credit risk for investors that purchase commercial mortgage-backed securities.

February 24 -

Over 67% of the loan balances in Sabal Capital Partners' commercial mortgage MBS deal were for apartment buildings financed through the Irvine, Calif.-based firm.

February 19