Community banking

Community banking

-

The Houston bank negotiated the agreement with the National Community Reinvestment Coalition after closing its merger with BancorpSouth. That deal created a lender with $50 billion of assets and operations in nine states.

February 24 -

The state Department of Financial Protection and Innovation issued a cease-and-desist order against Nano Banc, saying the troubled bank violated an earlier consent agreement when it replaced five board members and appointed a new CEO without the regulator’s permission.

December 21 -

Borrowers expect the Federal Reserve to raise interest rates next year to contain soaring prices and are locking in favorable terms now, bankers say.

November 24 -

With its agreement to buy KS StateBank’s residential mortgage operation, Kansas-based Armed Forces is going all in on home lending.

November 5 -

The Indiana company told investors that it’s ready to complete its combination with First Midwest Bancorp but that it’s unclear whether a recently filed mortgage discrimination lawsuit will get in the way of Fed approval.

October 19 -

With its sale to Blue Ridge Bankshares set to close within months, FVC Bankcorp is moving to diversify by taking a 29% stake in Atlantic Coast Mortgage.

September 1 -

The bank saw a modest increase in net income from the first quarter, as lawsuit settlements tied to the company’s discontinued home lending business and fees regarding an anti-money laundering and securities class action suit continue to limit growth.

August 2 -

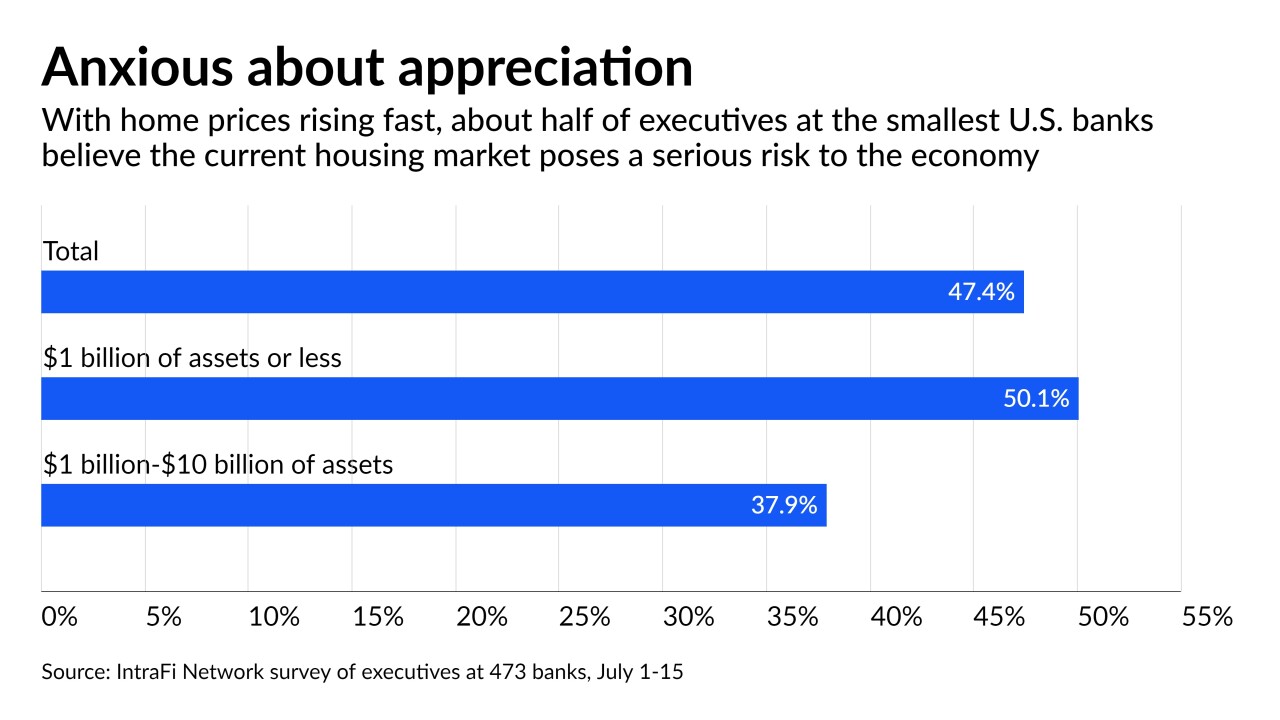

The very smallest banks, whose numbers shrank during the financial crisis, were most likely to express concern that the housing market will imperil the broader economy.

July 27 -

Even as lockdowns ease, the trend toward remote work poses challenges for building owners and the banks that lend to them.

June 30 -

The lender's founder and CEO says the acquisition of Roscoe State Bank will give it new products and referral sources.

June 14