Community banking

Community banking

-

The company will also gain its first branches in New Mexico after it buys Peoples Inc.

June 26 -

The Financial Choice Act contains many positive reforms for community banks, but a provision affording benefits for holding loans on balance sheet poses risk for small lenders.

June 21 -

Fed Chair Janet Yellen called the Treasury's report a "complicated document" that shared many of the central bank's objectives, including reducing regulatory burden without sacrificing safety and soundness.

June 14 -

Casey Crawford, head of the rapidly growing Movement Mortgage, recently recapitalized First State Bank in Danville, Va., with his own money.

June 14 -

The Treasury Department published its first report on regulatory reform, offering some familiar industry asks alongside some surprising positions.

June 12 -

There is a great opportunity this year to show the world that Congress can still pass bipartisan, common-sense legislation that helps lift the U.S. economy.

June 7 -

The accounting board has scheduled a meeting that bankers hope will produce eleventh-hour modifications to reserving requirements.

June 6 -

Financial regulators issued joint guidance on Wednesday highlighting the availability of cross-state appraiser licensing agreements.

May 31 -

First Savings Financial in Indiana and Dime Community in New York are keen on making more SBA loans as a way to diversify revenue and generate fees through loan sales.

May 19 -

The company also said it believes there are no regulatory obstacles that will derail its planned acquisition of Astoria Financial.

May 15 -

Construction lending could make a comeback if bankers persuade Congress to reform capital and other complicated rules on so-called high volatility CRE loans. But will regulators go for it?

May 12 -

The Federal Reserve is asking Sterling to address deficiencies tied to its collection, verification and reporting of CRA data from 2014 to 2016.

May 12 -

Stilwell Group, an activist investor, is alleging that HopFed chief John Peck bought two properties from the then-chairman of the Kentucky company's compensation committee and that the deals were a conflict of interest.

May 12 -

Brent Beardall, who recently took the helm at Washington Federal, discusses having excess capital, myriad potential fintech partners and why he would tweak — not repeal — Dodd-Frank.

May 11 -

Rebeca Romero Rainey, a third-generation community banker who rose to executive leadership in her early 20s, has been tasked to lead the Independent Community Bankers of America at a pivotal time.

May 2 -

Growth in commercial real estate loans is a big reason the New Jersey bank had a strong quarter.

April 26 -

President Trump’s proposed cuts to programs providing credit options for low-income and underserved communities would have a particularly negative effect in states that voted for him.

March 20 -

The president's budget calls for eliminating the Treasury's Community Development Financial Institution grant program, which often benefits poor and rural consumers in areas that Trump easily carried in the election.

March 16 -

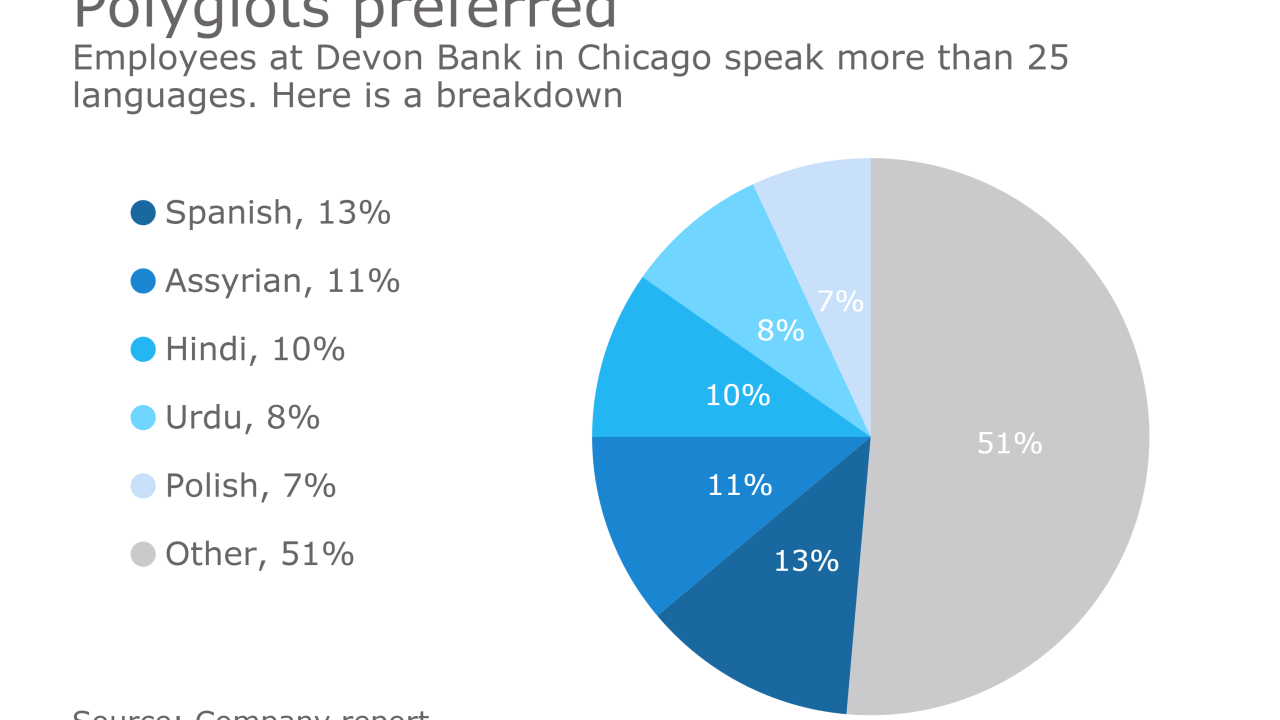

Devon Bank in Chicago has a long history serving immigrant groups in one of the nation's most diverse neighborhoods. Right now, its clients are worried about President Trump's actions on immigration and deportation.

March 16 -

Customer outreach is far from the actual core function of bank marketers: producing bottom-line results.

March 3