Community banking

Community banking

-

Despite the reduction from last year, "there are some signs that that production is coming back" in mortgage, the bank's CEO said.

January 25 -

The same day Provident Financial Services announced it had agreed to buy Lakeland for $1.3 billion, the seller disclosed an ongoing fair-lending investigation by the Justice Department. Provident said it has "not heard anything" that would give it pause.

September 27 -

BayFirst Financial Corp. said it initiated the process of shuttering its out-of-state network of residential mortgage loan production offices.

September 22 -

The country's largest banks should deepen partnerships with minority depository institutions and community development financial institutions, and regulators should facilitate that process.

September 22 -

Bank lending activity grew at a strong clip in the second quarter and continues to expand. Yet rising interest rates and recession concerns could hamper future growth.

August 24 -

Farmers Bank plans to develop new revenue from home loans, despite seeing many bigger lenders flee the same market.

August 17 -

The fast-paced rise in rates should be good for banks — until it isn't. The higher interest earned on loan payments will at some point be offset by higher interest paid on deposits. The only questions are: When, and by how much?

July 5 -

The lawsuit filed by the Philadelphia company's CEO claims an opposing board faction lacks a quorum. Hill seeks to bar the group from reinstalling founder Harry Madonna.

May 18 -

The Office of the Comptroller of the Currency recently decided to put an official in charge of the rising number of small and midsize national banks that partner with fintechs or have nontraditional business plans. The agency’s goal is to establish a team that understands cutting-edge technologies and establishes consistent oversight policies in response.

April 17 -

As inflation increases, more companies are shifting to remote and hybrid work to get their costs under control. Landlords could face rising vacancies and tumbling revenue, leaving them behind on loan payments.

April 13 -

Banking executives and analysts worry that the Federal Reserve's aggressive plan to raise interest rates will be insufficient to tame inflation and overcome economic fallout from the war in Ukraine.

March 21 -

The Houston bank negotiated the agreement with the National Community Reinvestment Coalition after closing its merger with BancorpSouth. That deal created a lender with $50 billion of assets and operations in nine states.

February 24 -

The state Department of Financial Protection and Innovation issued a cease-and-desist order against Nano Banc, saying the troubled bank violated an earlier consent agreement when it replaced five board members and appointed a new CEO without the regulator’s permission.

December 21 -

Borrowers expect the Federal Reserve to raise interest rates next year to contain soaring prices and are locking in favorable terms now, bankers say.

November 24 -

With its agreement to buy KS StateBank’s residential mortgage operation, Kansas-based Armed Forces is going all in on home lending.

November 5 -

The Indiana company told investors that it’s ready to complete its combination with First Midwest Bancorp but that it’s unclear whether a recently filed mortgage discrimination lawsuit will get in the way of Fed approval.

October 19 -

With its sale to Blue Ridge Bankshares set to close within months, FVC Bankcorp is moving to diversify by taking a 29% stake in Atlantic Coast Mortgage.

September 1 -

The bank saw a modest increase in net income from the first quarter, as lawsuit settlements tied to the company’s discontinued home lending business and fees regarding an anti-money laundering and securities class action suit continue to limit growth.

August 2 -

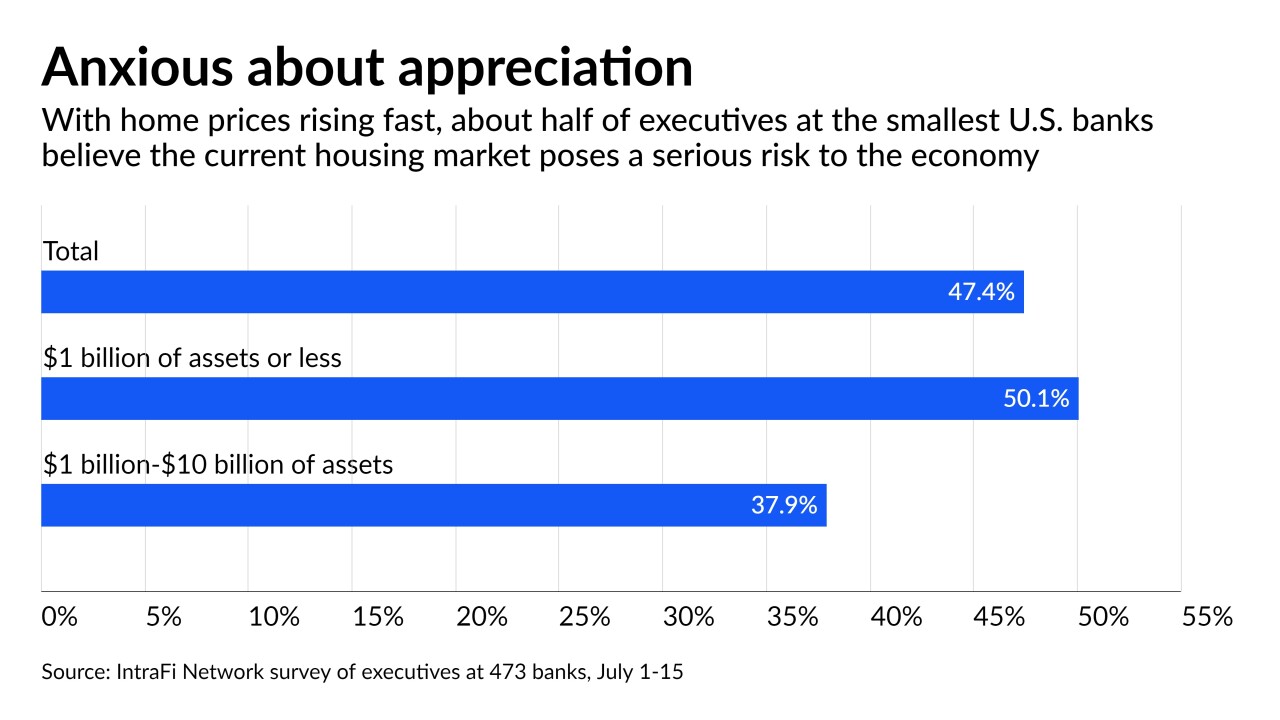

The very smallest banks, whose numbers shrank during the financial crisis, were most likely to express concern that the housing market will imperil the broader economy.

July 27 -

Even as lockdowns ease, the trend toward remote work poses challenges for building owners and the banks that lend to them.

June 30