Community banking

Community banking

-

Banking executives and analysts worry that the Federal Reserve's aggressive plan to raise interest rates will be insufficient to tame inflation and overcome economic fallout from the war in Ukraine.

March 21 -

The Houston bank negotiated the agreement with the National Community Reinvestment Coalition after closing its merger with BancorpSouth. That deal created a lender with $50 billion of assets and operations in nine states.

February 24 -

The state Department of Financial Protection and Innovation issued a cease-and-desist order against Nano Banc, saying the troubled bank violated an earlier consent agreement when it replaced five board members and appointed a new CEO without the regulator’s permission.

December 21 -

Borrowers expect the Federal Reserve to raise interest rates next year to contain soaring prices and are locking in favorable terms now, bankers say.

November 24 -

With its agreement to buy KS StateBank’s residential mortgage operation, Kansas-based Armed Forces is going all in on home lending.

November 5 -

The Indiana company told investors that it’s ready to complete its combination with First Midwest Bancorp but that it’s unclear whether a recently filed mortgage discrimination lawsuit will get in the way of Fed approval.

October 19 -

With its sale to Blue Ridge Bankshares set to close within months, FVC Bankcorp is moving to diversify by taking a 29% stake in Atlantic Coast Mortgage.

September 1 -

The bank saw a modest increase in net income from the first quarter, as lawsuit settlements tied to the company’s discontinued home lending business and fees regarding an anti-money laundering and securities class action suit continue to limit growth.

August 2 -

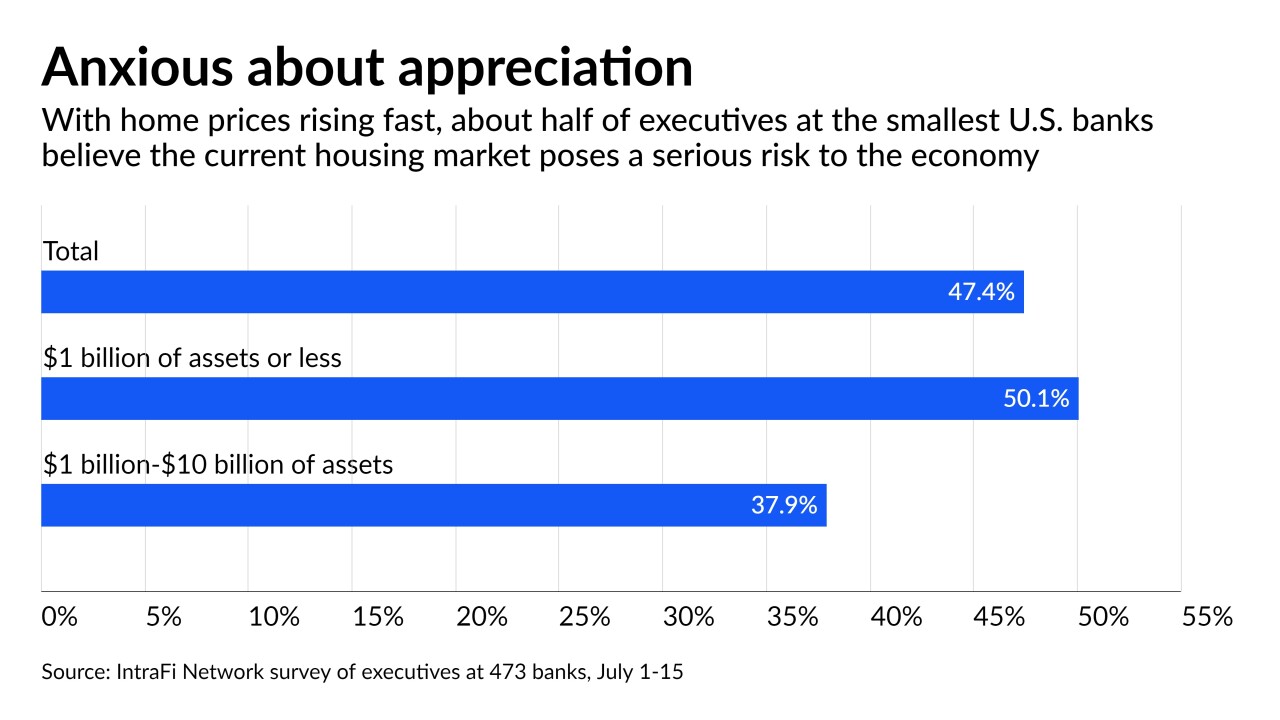

The very smallest banks, whose numbers shrank during the financial crisis, were most likely to express concern that the housing market will imperil the broader economy.

July 27 -

Even as lockdowns ease, the trend toward remote work poses challenges for building owners and the banks that lend to them.

June 30 -

The lender's founder and CEO says the acquisition of Roscoe State Bank will give it new products and referral sources.

June 14 -

Less than two years after shutting down its biggest business amid fraud allegations, the Michigan company has sold branches, settled a shareholder lawsuit and returned to profitability under turnaround specialist Thomas O’Brien.

May 7 -

The Dallas company will pay nearly $54 million for a 49% stake in a lender that operates in 10 states.

April 28 -

One year after its internal merger, the fintech and fulfillment services provider’s COO Debora Aydelotte discusses the company’s support for community banks and its placement in the ranking of Best Fintechs to Work For.

April 6 -

Like the fintechs SoFi and LendingClub, DLP Real Estate Capital is acquiring a community bank largely to lower the cost of funding loans.

March 18 -

First Foundation is relocating its corporate headquarters to Dallas, where the tax burden is lighter and it sees more opportunity to beef up lending, add wealth management clients and pursue acquisitions of community banks.

February 5 -

Community banks say Vizaline’s software, which converts property descriptions into images, helps them catch errors before they close real estate loans without resorting to expensive land surveys. But traditional surveyors say the results are of questionable value.

February 3 -

The architects of two major loan deals featuring Black banks, one involving multiple lenders and a pro sports franchise and another backed by Citigroup, say more transactions like these are in the works.

December 13 -

The Biden administration could curtail federal support for farmers, even with bankruptcies and requests for loan workouts on the rise. Banks are hoping that increases in crop prices and exports to China could help avert a credit crisis.

December 10 - LIBOR

The statement comes after multiple small and midsize institutions earlier this year warned the agencies that the secured overnight financing rate was ill-suited to them.

November 6