-

From insights about borrower payment preferences to new automation assisting with natural disaster recovery efforts, here's a roundup of news coming out of the Mortgage Bankers Association Servicing Conference.

February 7 -

QuestSoft is buying data verification and audit services firm Investors Mortgage Asset Recovery Co. at a time when lenders are more widely using technology to verify information.

February 1 -

Compliance is a significant cost center for mortgage lenders. But with bulk rates, technology and better process management, some lenders have found new ways to reduce the burden.

January 29 -

Optimal Blue, a mortgage technology provider owned by private equity firm GTCR, has acquired Comergence Compliance Monitoring.

May 31 -

All post-closing reviews of new Federal Housing Administration-insured mortgages must now use the defect taxonomy, effective immediately.

May 16 -

Accenture acquired BeesPath's ClosingBridge product to become part of its Mortgage Cadence loan origination software and help lenders with TILA-RESPA integrated disclosure compliance.

April 13 -

American Mortgage Consultants has acquired a business unit that handles due diligence and quality control for residential mortgages from Stewart Lender Services.

January 10 -

Initiatives aimed at a more inclusive credit box have long relied on costly approaches that are difficult to scale. Now, demographic shifts are intensifying industry demand for a more automated and efficient solution.

January 6 -

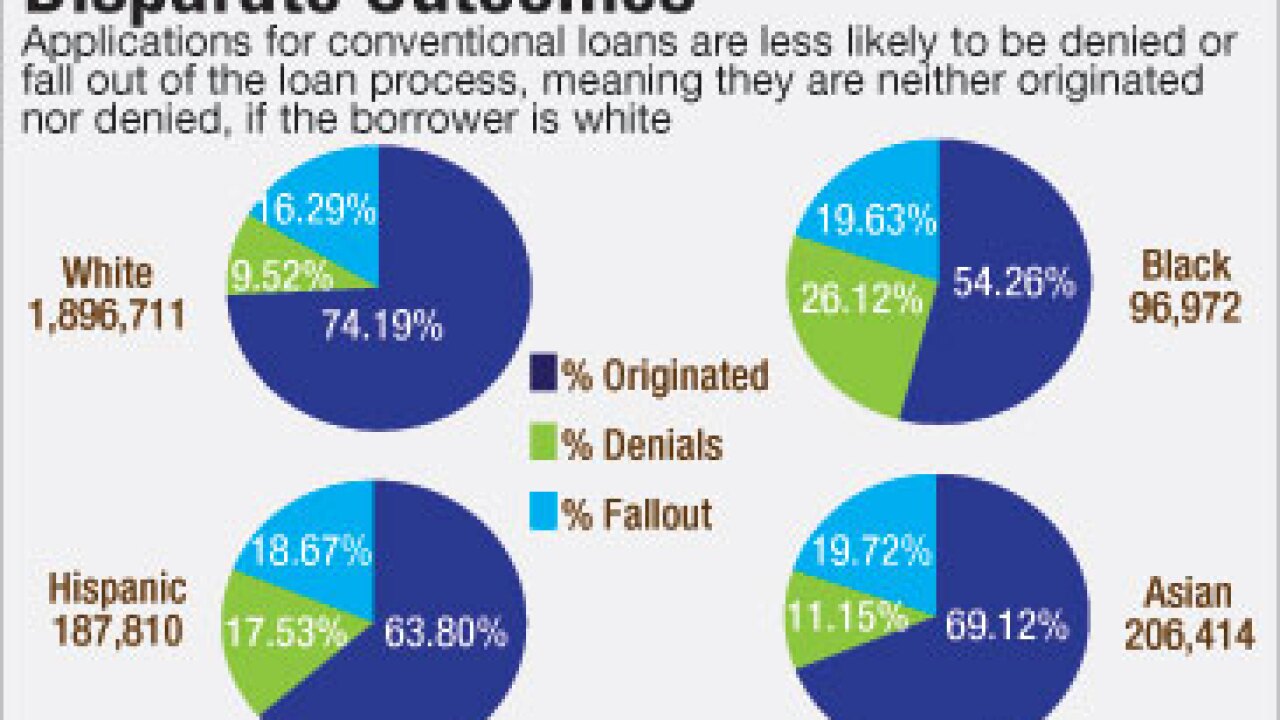

Demographics are shifting, creating more prospective minority homebuyers than ever before. But predominant underwriting processes and these would-be borrowers' financial backgrounds are holding them back.

January 5 -

Some of the most popular contributors to National Mortgage News' Voices community weigh in on what they see coming in the next year for origination, servicing, technology and regulation.

December 29 -

Moves by lenders to adapt their processes with the TILA-RESPA integrated disclosure rule in mind appear to have staunched the increase in loan application defects, according to ACES Risk Management.

December 9 -

The Federal Communications Commission has denied a request to exempt servicers from getting consent before robo-calling borrowers' mobile phones, rejecting arguments that the waiver would enable the mortgage industry to better help delinquent borrowers.

November 18 -

Banks have been waiting on Justice Department guidelines on how to make their websites compliant with the Americans with Disabilities Act, but many are being advised to take action now or face lawsuits from disabled customers.

November 10 -

Mortgage brokers were among the companies that received the regulator's warning letters, but brokers are not required to report HMDA data leading many to suspect mini-correspondents, which straddle the line between broker and lender, were the recipients.

October 28 -

-

The Consumer Financial Protection Bureau's proposed changes to new mortgage disclosure requirements do not go far enough, according to many in the industry.

October 21 -

In a move designed to help further calm lender fears about mortgage repurchase liability, Fannie Mae is preparing to offer immediate representation and warranty relief to lenders that use its suite of automated quality assurance technology.

October 20 -

The Internal Revenue Service's indefinite delay of a deadline for a new authentication procedure has headed off concerns about potential interruptions in mortgage production.

October 19 -

While compliance costs continue to increase for lenders, the rising age of company owners is what's prompting many independent mortgage bankers to sell their companies.

October 18 -

Servicers have long skimped on technology investment, leaving legacy systems that can't keep pace with compliance demands. But rising costs and a new round of regulations are compelling both servicers and vendors to finally address these deficiencies.

October 12