-

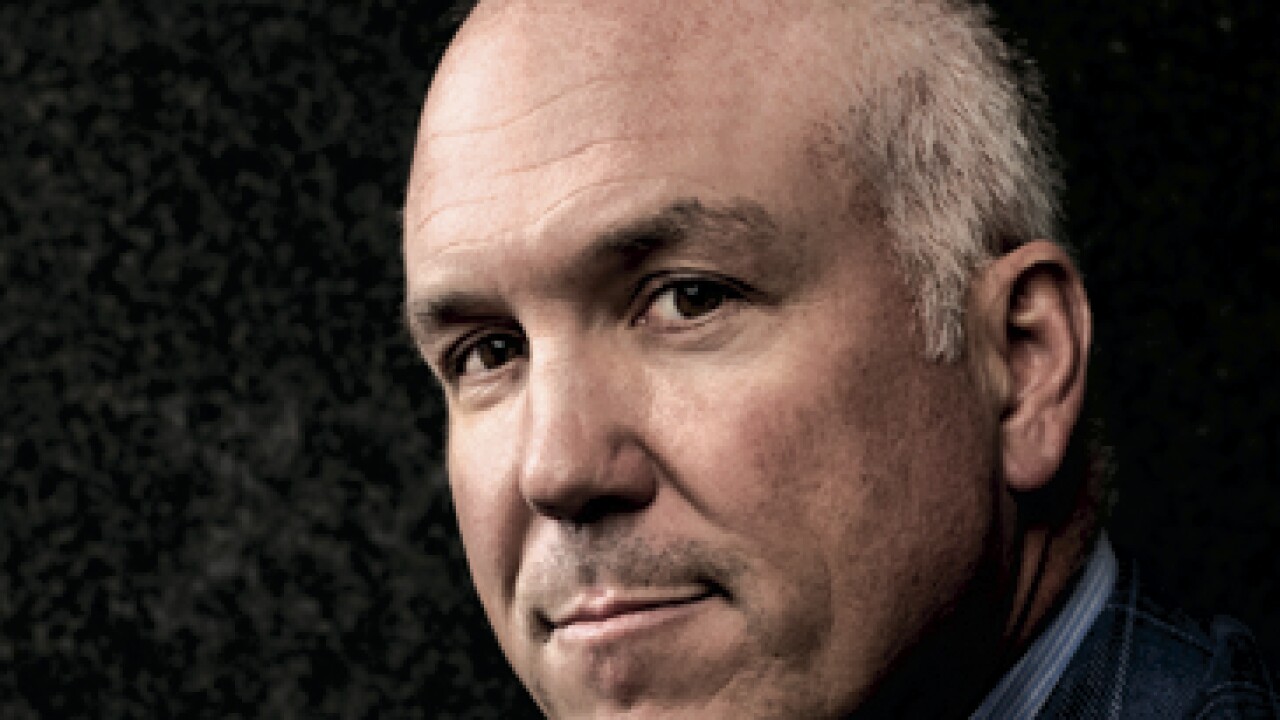

The Sarbanes-Oxley Act of 2002 is important, but it barely scratches the surface of former House Financial Services Committee Chairman Michael Oxley's impact on banking.

January 4 -

U.S. judge rejects Quicken Loans' effort to move FHA loan case to Detroit courtroom.

January 4 -

Rather than relying on a formal marketing services agreement to get business, loan officers now have to prove that they can provide realty agents and consumers the best mortgage experience.

January 4 -

The Dodd-Frank Act is a burden on community banks and credit unions but regulators are struggling to quantify the costs, according to a report released Wednesday by the Government Accountability Office.

December 31 -

From the rollercoaster ride toward the TILA-RESPA implementation deadline to concerns about other areas the Consumer Financial Protection Bureau would zero in on for scrutiny, these seven stories dominated National Mortgage News during 2015. Following are both the stories and an update on where the situation stands now.

December 30 -

"The allegations of discrimination and predatory practices raised by the reporting are obviously very concerning to the bureau," a CFPB official said Tuesday.

December 30 -

What mortgage companies pay LOs, and how compensation plans are determined and structured, can give regulatory agencies more information about a company's priorities than lenders might think.

December 28 STRATMOR Group

STRATMOR Group -

A proposal issued two weeks ago by the FHFA calls on the two government-sponsored enterprises to identify opportunities to increase their purchases of small multifamily properties in rural areas, sparking some concern among lenders.

December 28 -

After lenders and their technology providers spent much of 2015 implementing the TILA-RESPA integrated disclosures, forthcoming compliance audits and a government-sponsored enterprise plan to start collecting data from the new forms will tell if those efforts truly paid off.

December 28 -

The Federal Housing Finance Agency appears to be on course to decide next year whether Fannie Mae and Freddie Mac should update their credit scoring models.

December 22 -

The Federal Housing Finance Agency is giving private mortgage insurers some hope this holiday season that they might get a chance to offer deeper mortgage insurance on Fannie Mae and Freddie Mac single-family loans.

December 21 -

Some mortgage investors are refusing to buy home loans that are at risk of violations of new consumer-disclosure rules. The problem appears to be worst among nonagency jumbo loans purchased by private investors.

December 21 -

Rising rates could slow the runoff from refinancings and add stickier purchase loans to servicers' portfolios. That's the good news.

December 21 -

President Obama is expected to sign a bill passed by both the House and Senate that grants extensions on a number of tax benefits enjoyed by individuals and corporations, including a number of temporary provisions that the real estate industry sought.

December 18 -

Multifamily properties are getting pricy and new construction is putting upward pressure on vacancy rates, worrying banking regulators.

December 18 -

Sen. Bob Corker championed a provision he added to the budget bill that would temporarily prevent the Treasury Department from recapitalizing Fannie Mae and Freddie Mac and discussed other banking priorities in a sitdown interview.

December 18 -

All servicers that are part of the national mortgage settlement except Ocwen Financial passed metrics testing in the first half of the year, according to the settlement's monitor.

December 17 -

The Federal Open Markets Committee Wednesday voted to raise federal interest rates from nearly zero for the first time since 2008, meeting market expectations but ushering in a new and uncertain normal for the mortgage industry.

December 16 -

Affordable apartments have not been this hard to find in decades, and a new Mortgage Bankers Association study suggests there are ways existing public-private partnerships could do more to address the concern.

December 16 -

The agency released a plan Tuesday that would provide incentives for owners of manufactured housing communities to reform their practices if they want to tap financing by Fannie Mae and Freddie Mac.

December 15