-

More consumers fell behind on their loans in the third quarter of 2018, even as average wages rose and the unemployment rate fell to a 50-year low.

January 8 -

The strong economic headwinds from last fall facilitated a declining loan delinquency rate across the country, though areas hit by natural disasters had increased defaults, according to CoreLogic.

January 8 -

Fannie Mae's overall single-family serious delinquency rate dropped another notch in November, according to its most recent report, but the current government shutdown raises questions about whether that trend will continue.

December 31 -

The cost of Wells Fargo's scandals continues to rise as regulators from all 50 states forced the institution to pay hundreds of millions in penalties for the creation of fake accounts, improper enrollment in life insurance, force-placed auto insurance policies and other activities.

December 28 -

The industry could see a boost in mortgage lending from regulatory changes, but other factors may slow growth.

December 26 -

The biggest question is whether new CFPB Director Kathy Kraninger will deviate from the pro-industry policies of her predecessor, or bring continuity.

December 25 -

Rep. Maxine Waters, D-Calif., will take the gavel on the Financial Services Committee next term.

December 24 -

Many servicers expect their Federal Housing Administration mortgage portfolios to grow in the next year or two, and that increase could coincide with an uptick in delinquencies, warns Altisource Portfolio Solutions.

December 21 -

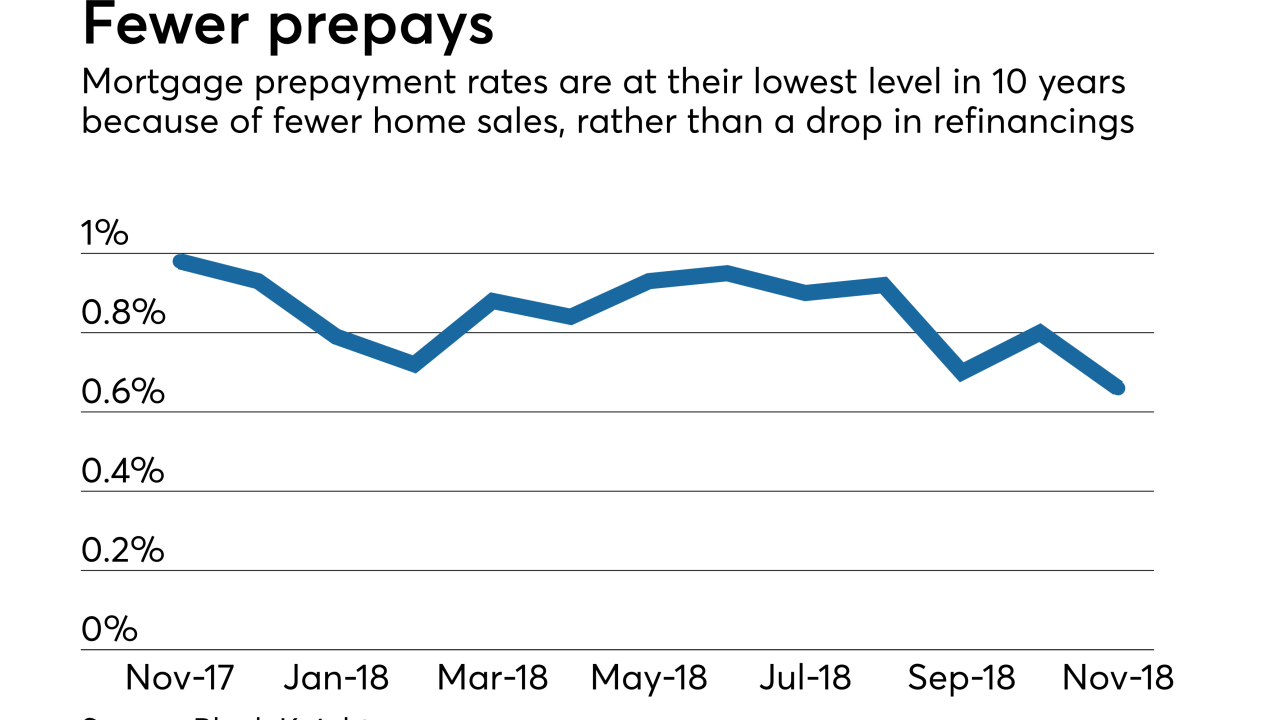

Mortgage prepayment speeds fell to their lowest level in 10 years in November as rising interest rates took a toll on origination activity, according to Black Knight.

December 20 -

Maria Vullo is stepping down as head of New York's banking and insurance regulator after three years in which she created a national model for cybersecurity regulations at banks and fought back against federal attempts to chip away at payday-lending rules.

December 19