-

Subprime originations are climbing in multiple consumer loan categories, including mortgages, but the increase is much smaller in the home loan sector than it is in other markets, according to TransUnion.

November 19 -

The bank recently notified an upstate New York man that he was wrongly denied a mortgage modification, and enclosed a $25,000 check. But details of what went wrong have been hard to come by.

November 13 -

The mortgage delinquency rate dipped to a 12-year low, but overvalued housing markets and eventual reversal in the unemployment rate present risk for future delinquencies, according to CoreLogic.

November 13 -

Mortgage delinquencies inched up, in part from natural disasters hindering homeowner performance, but a stronger economy is still keeping defaults low, according to the Mortgage Bankers Association.

November 8 -

Despite recriminations about how the crisis and ensuing regulations have tightened loan access, an actual assessment of mortgage credit availability finds the situation is more complicated.

October 24 -

A new credit score that includes consumers' cash flow alongside their credit score is winning praise for its potential to help expand access to credit, but some worry it gives the credit bureaus even more data that could be compromised.

October 23 -

In a move designed to improve access to financial products for consumers with low credit scores and short credit histories, Experian, FICO and Finicity are developing an "UltraFICO" score that lets individuals share checking and savings account data and help lenders better assess risk.

October 22 -

The senior Democratic lawmaker said the CFPB chief and the Trump administration "are doing everything in their power to roll back consumer protections."

October 2 -

After a run-up in the latter half of last year, delinquencies on mortgages sold to Fannie Mae and Freddie Mac look fairly stable for the time being.

September 27 -

A new financial technology company called Scratch is planning to use a new web-based platform along with an alternative pricing model to compete with companies that service mortgages and other consumer loans.

September 20 -

Commercial mortgage-backed securities delinquency rates are likely to continue to decrease for the rest of the year, as new issuances outpace maturing loans and precrisis loans continued to get resolved by special servicers, Fitch Ratings said.

September 17 -

A decade after the credit crisis, investors are returning to where it all began. The mortgage sector, blamed in large part for the near-collapse of the global financial system, is now seen by many as a high-quality market forged by fire.

September 14 -

Caliber Home Loans’ next offering of subprime mortgage bonds includes a new product offered to borrowers with a stronger credit profile than its other programs – but also less equity in their homes.

September 10 -

The dollar volume of private-label residential mortgage-backed securities issuance this year is the highest it has been since the Great Recession, despite a decline in new originations.

September 6 -

Delinquencies for loans securing commercial mortgage-backed securities continued to decline, although they are still well above rates for other types of investors, according to the Mortgage Bankers Association.

September 4 -

The 30-day delinquency rate dropped to a low not seen in over a decade in July, but foreclosure starts also increased to a three-month high.

August 24 -

Several states pledged to compensate for a slowdown in enforcement at the Consumer Financial Protection Bureau under Mick Mulvaney, but their efforts have been complicated by tight budgets and doubts over whether such initiatives are necessary.

August 20 -

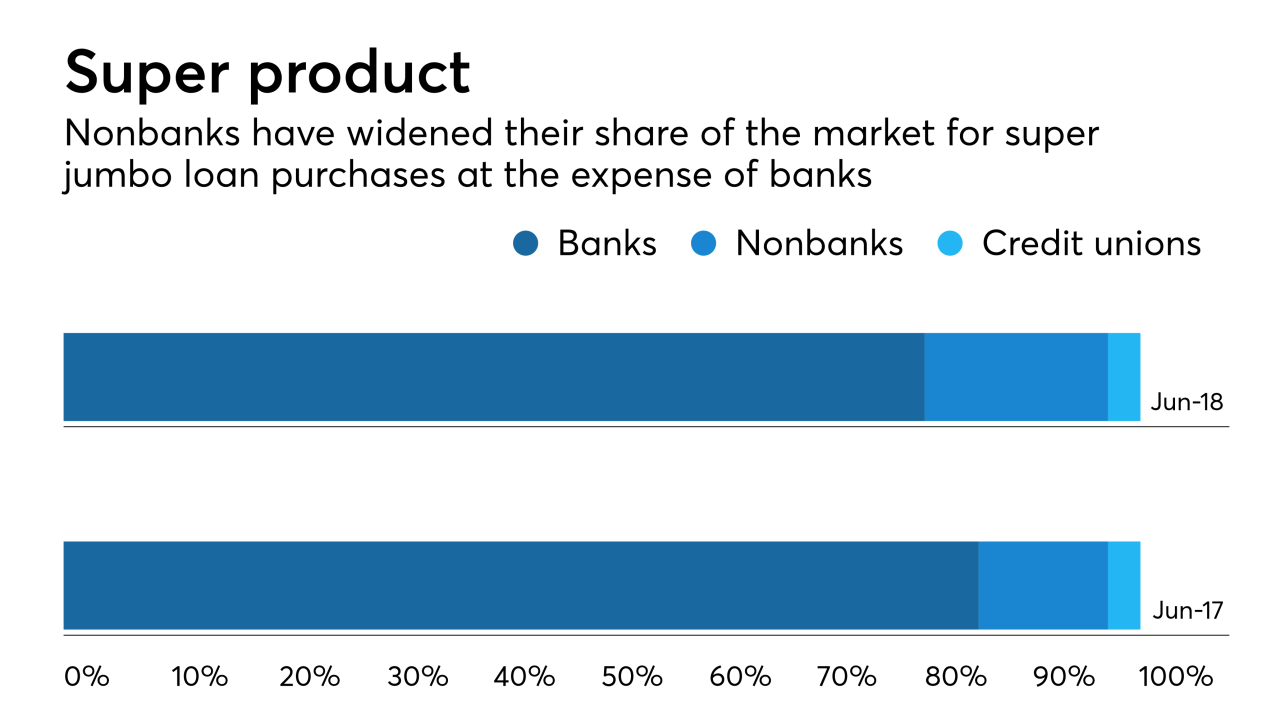

New investor appetite for mortgages over $1 million is motivating more nonbank lenders to offer super jumbo loans, often with weaker credit terms than traditional banks.

August 20 -

MountainView Financial Solutions is brokering a more than $3 billion package of Fannie Mae and government mortgage servicing rights originated primarily through third-party origination channels.

August 17 -

The investors initially won the right to sue as a group in 2015 before an appeals court reversed the ruling; the $13 billion lawsuit can now proceed as a class action.

August 15