-

Commercial real estate transaction volume rebounded in the second quarter from a poor first three months of 2019, although property price growth plateaued, according to Ten-X Commercial.

September 20 -

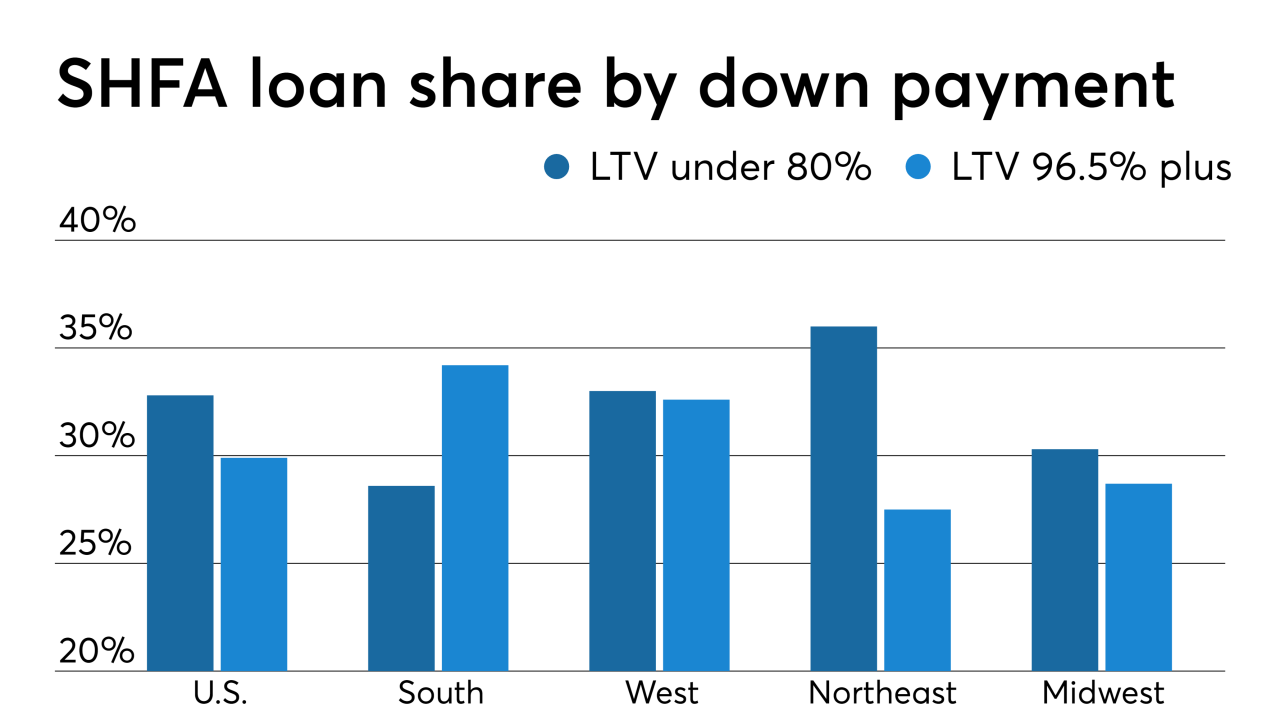

The use of state housing finance agency down payment assistance programs is part of the solution to address the growing affordable housing gap, a Fitch Ratings report said.

September 11 -

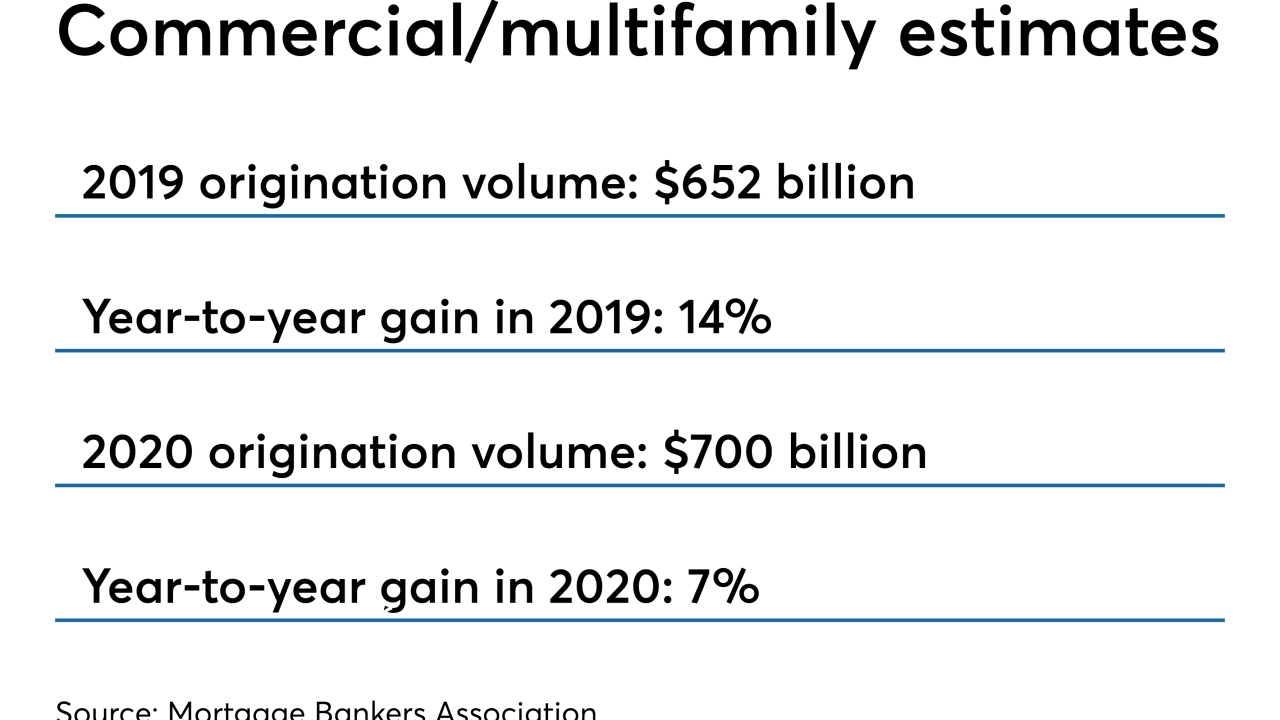

Lower interest rates are expected to drive financing secured by income-producing properties to new heights by year-end, according to the Mortgage Bankers Association.

September 10 -

The Federal Trade Commission wants to block the merger of Fidelity National Financial and Stewart Information Services stating the deal would reduce competition for title insurance, including for large commercial real estate transactions.

September 9 -

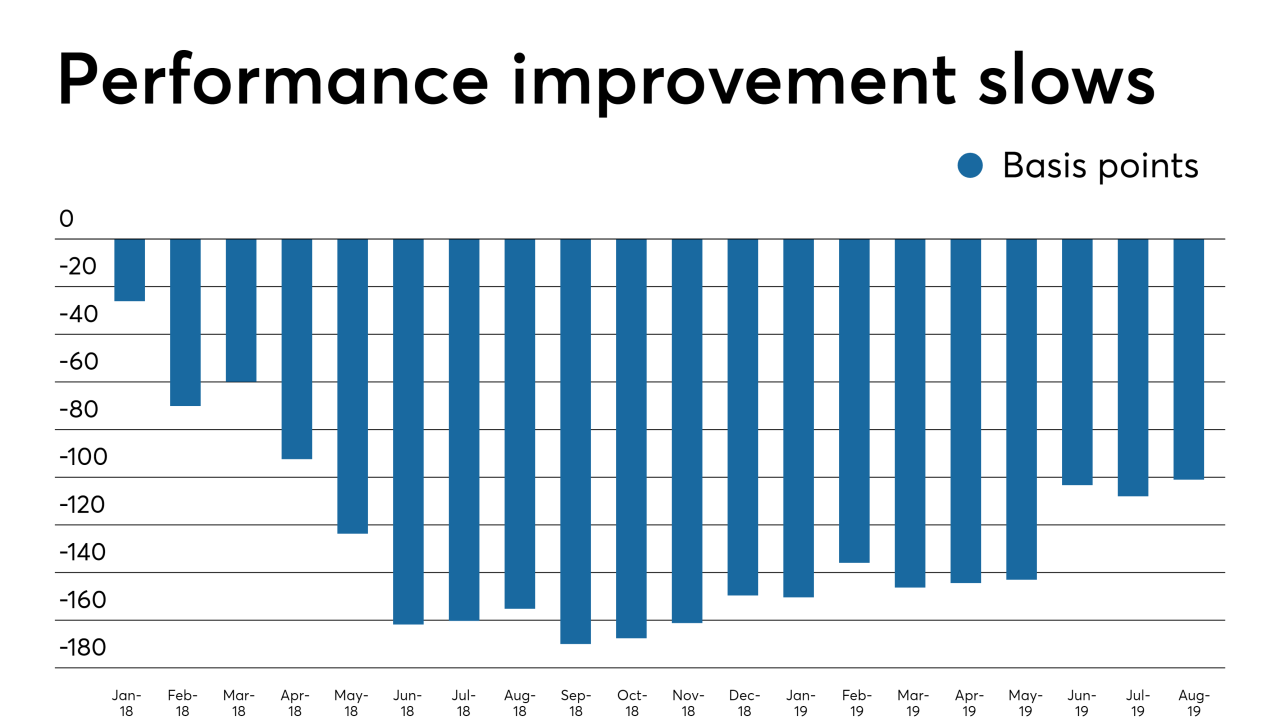

While delinquent loans in commercial mortgage-backed securities continued trending downward overall, there was an uptick in the rate for more recent originations, a Standard & Poor's report noted.

September 6 -

The Hamilton, Ohio City Council soon will consider whether to require owners to register their vacant industrial or commercial buildings.

September 3 -

Extell Development, facing an Aug. 30 maturity for a construction loan, signed an agreement for a new loan on the New York property, using the unsold units in the 815-apartment project as collateral.

August 30 -

Prospective buyers of the boarded-up East Hills Mall recently reached out to Bakersfield city officials with a new vision for demolishing and redeveloping the property into a village-like mixed-use center.

August 30 -

The second half of 2019 is a prudent time to examine the CRE market in the context of an inevitable slowdown, taking into account how the current landscape is impacting lending practices.

August 29 EDR Insight

EDR Insight -

The Delaware company, best known for issuing prepaid cards, has ramped up commercial real estate securitizations. The shift promises to deliver big fees, but it could also cause headaches if defaults spike.

July 30 -

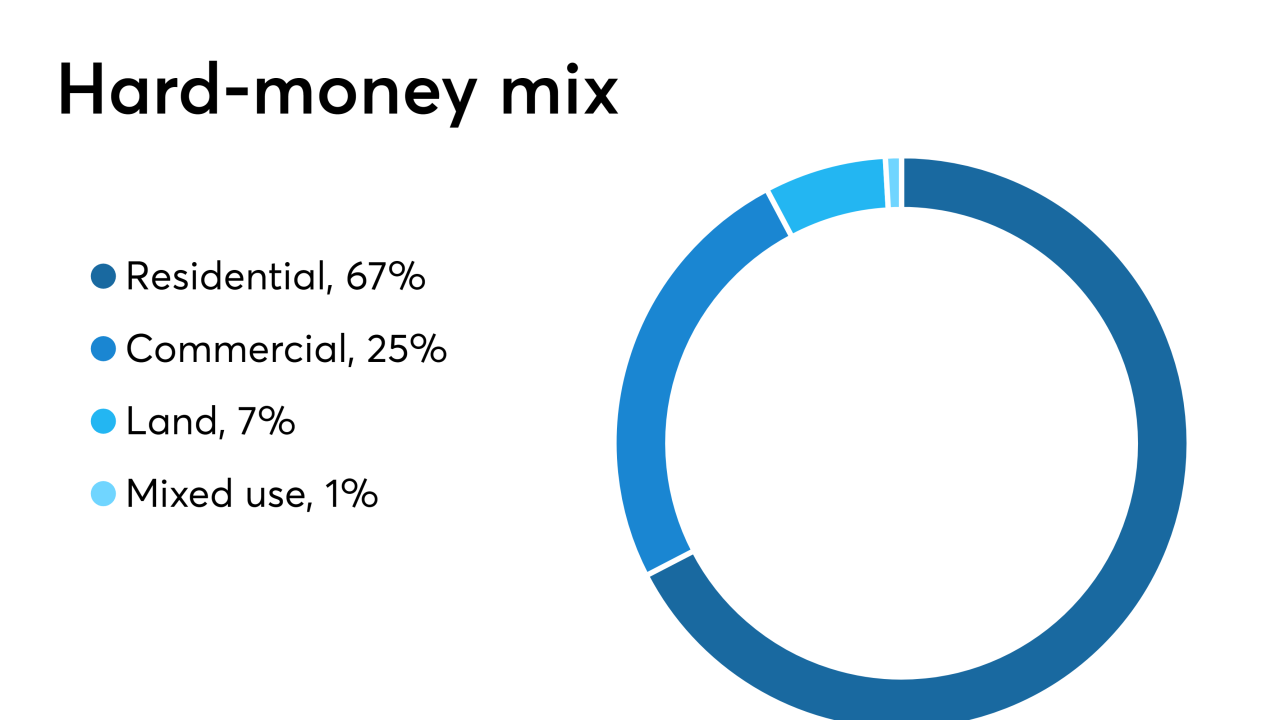

Sachem Capital Corp., a hard-money mortgage lender that makes short-term loans to investors, has raised $10 million in gross proceeds from a public offering of 2 million common shares.

July 29 -

The National Credit Union Administration caught flak after it approved raising the threshold for appraisals on commercial real estate loans to $1 million.

July 18 -

A developer behind projects in the Maine cities of Portland and Saco was sued by a business partner as properties there are scheduled to be sold at foreclosure auctions.

July 8 -

The value of construction projects started in the greater Houston area fell sharply across both the residential and nonresidential sectors in May, according to a new Dodge Data & Analytics report.

July 5 -

On sunny days, the Grand Venezia at Baywatch condominiums in Clearwater, Fla., offer a view of Old Tampa Bay that calms the mind.

June 28 -

EF Hutton admitted in a court filing that it has defaulted under the terms of its contract with a real estate company and that the company has rightfully accelerated the debt.

June 27 -

First National Bank of Pennsylvania has filed a commercial mortgage foreclosure action against Conneaut Lake Park Volunteer Fire Department to collect more than $400,000 in outstanding loan debt, interest and penalties.

June 25 -

Presidential candidate Sen. Elizabeth Warren, D-Mass., and another Democratic senator are asking whether Kushner Cos. "may have received special treatment" on a U.S.-government-backed loan of about $800 million.

June 13 -

Commercial and multifamily mortgage debt outstanding continued rising, aided by low mortgage rates and the steady incline of property values, according to the Mortgage Bankers Association.

June 12 -

The large number of overleveraged commercial mortgage-backed securities loans coming due in 2019 is likely to cause the payoff rate to drop an additional 9 percentage points by December, a Morningstar report said.

May 29