-

The industry had tightened up last year in the face of COVID-19. But as the economic outlook improves, banks are now easing criteria amid heightened competition, according to the Federal Reserve’s survey of loan officers.

August 2 -

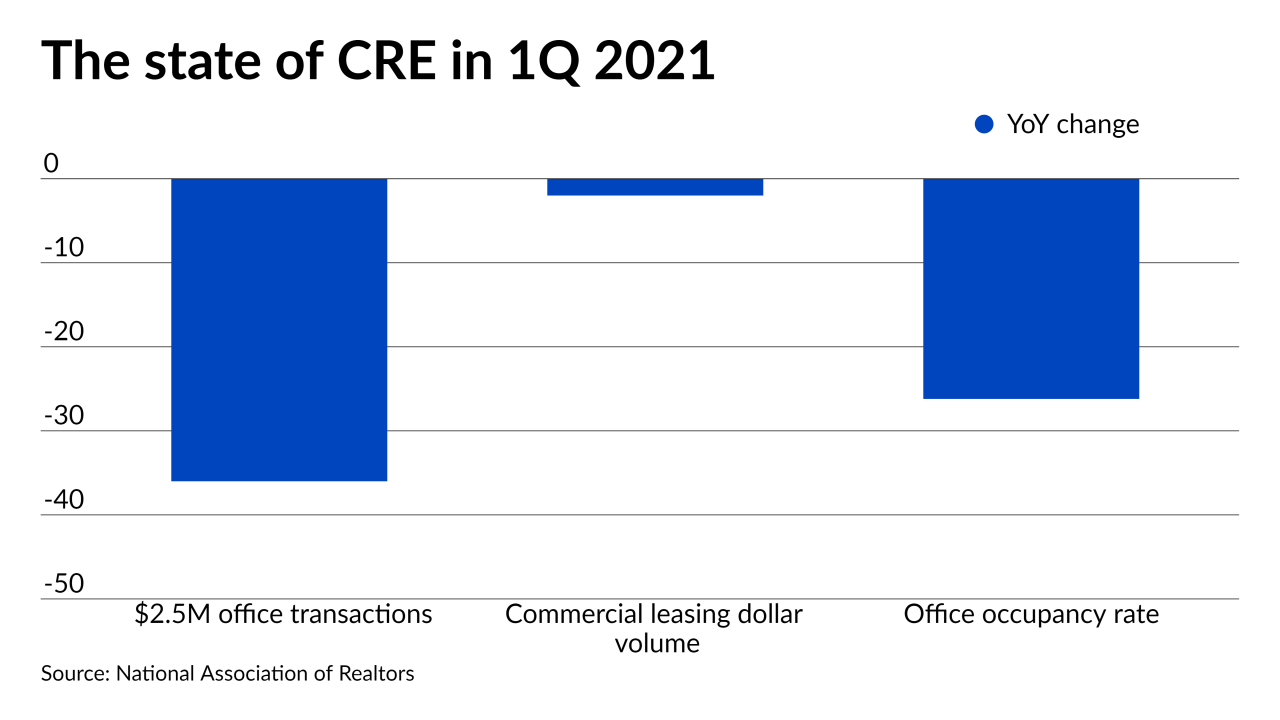

Even as lockdowns ease, the trend toward remote work poses challenges for building owners and the banks that lend to them.

June 30 -

Growing CRE mortgage volumes raised the bar for the coming year despite lingering concerns, according to the CRE Finance Council.

June 23 -

With residential supply severely lagging behind demand, redeveloping unused office space into multifamily properties seems like a perfect solution, but it’ll take governmental collaboration and tax breaks to make such projects financially compelling, developers say.

June 11 -

However, conditions for commercial mortgages overall worsened slightly due to persistent concerns in the hotel and office sectors, a Moody’s Investors Service report found.

April 26 -

The bond issuance out of Fortress' CF Hippolyta master trust will finance 19 newly constructed or planned Amazon distribution and logistics facilities in 15 states.

March 9 -

Already contending with stressed retail, hotel and restaurant loans, bankers are beginning to view office lending — historically a safe bet — as increasingly risky as companies of all types rethink their space needs.

February 28 -

The Federal Reserve warned of significant risks of business bankruptcies and steep drops in commercial real estate prices in a report published on Friday.

February 19 -

Volumes should rise this year but it could become more difficult to get loans for certain property types, the Mortgage Bankers Association said.

February 10 -

Commercial real estate portfolios have held up better than expected during the pandemic. But rising delinquencies and fears of a delayed economic recovery are renewing questions about credit quality.

January 12 -

The river of red ink will likely begin to flow in the new year, due not only to the pandemic itself, but also to longer-term secular trends that have been accelerated by COVID-induced changes in the economy, says DebtX President and CEO Kingsley Greenland.

December 30DebtX -

The economic fallout from COVID-19 has highlighted systemic concerns about commercial real estate exposure, business debt and short-term wholesale funding, the Financial Stability Oversight Council said in an annual report.

December 3 -

The ballot measure, which would allow local jurisdictions to expand rent control, had concerned mortgage companies who worried the law would result in a patchwork of different policies that could complicate underwriting and discourage lending.

November 4 -

The price for the commercial valuation and budgeting technology company was not disclosed.

November 4 -

The predominantly white universe of real estate investors may be used to working with people and companies with enough financial resources to have a track record in the business, but historic inequities have limited those opportunities for Black executives.

October 16 -

One could change how commercial property is taxed, the other could change rent control policies. Both might affect financing.

October 14 -

The Charlotte, N.C., company recently closed on a sale of its Cohen Financial platform to SitusAMC.

September 23 -

A new report on bank-held commercial real estate and C&I loans indicates troubled borrowers may be skipping payments on loans they won't be able to refinance or extend over the next year, leading to a potential wave of defaults over the next four to six quarters.

September 15 -

The city of Birmingham plans to set aside nearly $1 million in the 2021 budget to prop up the underperforming CrossPlex Village development in Five Points West, city officials said.

August 14 -

Borrowers will likely have to put more assets on the line to get forbearance extensions.

August 13