-

The popular program could go idle next month for the second time in less than a year if lawmakers are unable to approve a $99 million credit subsidy.

September 17 -

It’s hard to time the next economic slowdown. But lenders, many with lingering memories of the financial crisis, are taking steps now to limit exposure in commercial real estate, construction and other loan segments.

August 4 -

The decision gives the vast majority of banks and credit unions another year to implement the controversial accounting method for loan losses.

July 17 -

Banks fear that more competition from nonbanks in commercial real estate will drive down pricing and lead to a relaxation of terms.

June 14 -

The Michigan company said the loan — made to a borrower that plans to shut down its reverse mortgage business — has collateral.

May 13 -

Recent data from the Federal Reserve suggests lenders are growing pessimistic about the credit environment. But is that a sign of trouble ahead, or just sound risk management?

February 18 -

Loans grew 6% at JPMorgan Chase, but the bank is "not going to be stupid" and assume that will last forever, its CEO says. Here are some precautionary steps it's taking.

January 15 -

The number of consumers being pursued by debt-collection agencies fell dramatically in the past year, but it's as much technicality as achievement, and bankers need to keep that in mind when reviewing the credit scores of millions of Americans.

August 14 -

American Mortgage Consultants has acquired the right to hire 50 employees from The Barrent Group and will add 150 more in response to increased private-label securitization.

July 24 -

As mortgage lenders continue seeking ways get more trustworthy consumers into the housing market, a majority of them are utilizing alternative credit as a means of assessing borrower risk, according to Experian.

May 25 -

As the mortgage industry moves farther past the housing crisis, access to credit remains tight, especially for first-time homebuyers.

May 23 -

The company has also hit its goal of having half of total loans tied to customers around Atlanta.

May 21 -

The post-recession boom in auto loans and credit cards for borrowers with marred credit histories has been winding down in recent months.

May 17 -

Preferred Bank's experience with an apartment developer is a reminder of how important strict underwriting terms will be as loan demand increases, rates rise and lenders try to outdo each other.

May 4 -

Costs rose at the global bank, profit in North America fell 16% and questions are mounting for new CEO John Flint ahead of the release of his strategic plan.

May 4 -

Investors are growing worried about lackluster loan growth this year at community banks.

April 12 -

Freddie Mac is delaying the soft launch of its Phrase 3 updates to the Uniform Loan Delivery Dataset by a week.

February 26 -

The Arkansas company has spent two years trying to reassure nervous investors and analysts that it can rapidly book real estate loans using conservative practices.

January 18 -

Consumer default rates are up month-to-month, which may reflect a gap between spending and income that is stressing second mortgages and bank cards, Standard & Poor's and Experian find.

November 22 -

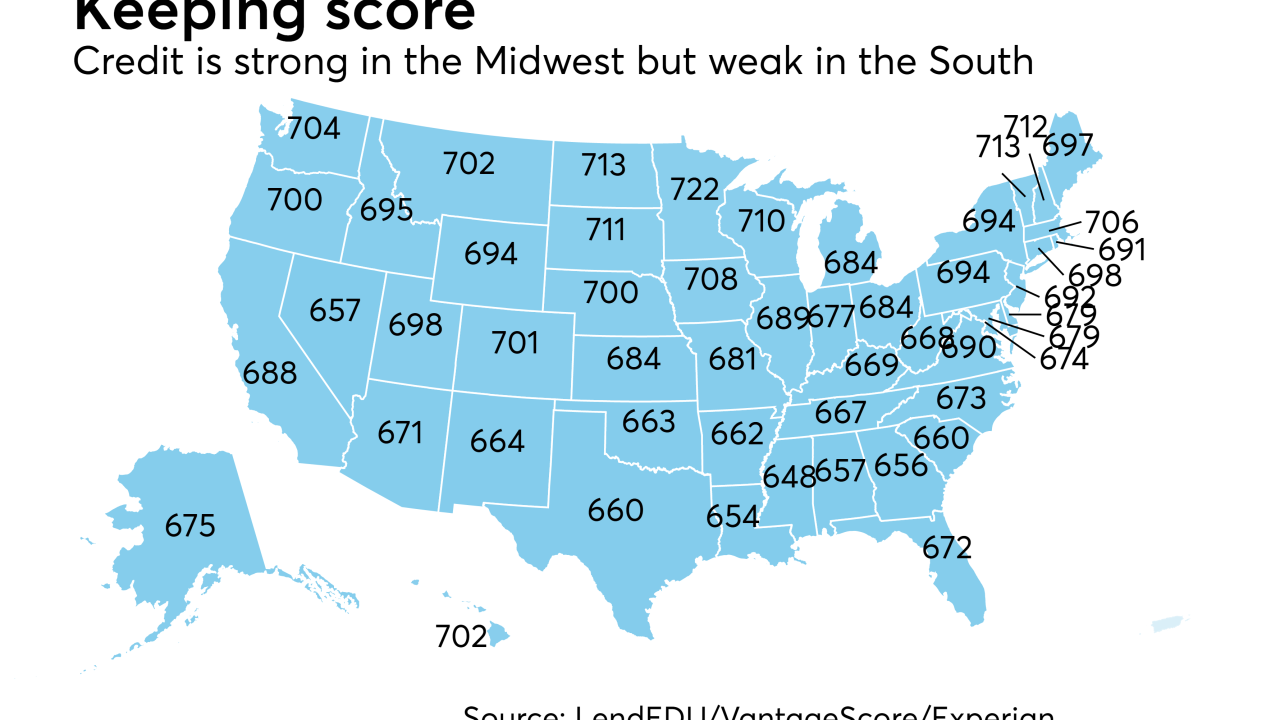

Consumer credit varies nationally due to regional variations in income and the cost of living. To get a sense of where it's strongest and weakest, here's a look at the five best and worst states for consumer credit scores.

October 23