-

While using the 30-day SOFR as its index, Freddie Mac structured the deal so it could shift to a one-month term if and when that rate is approved.

October 19 -

The GSEs began sharing their risk with the private market in new ways during conservatorship, and the Federal Housing Finance Agency’s proposed capital framework currently discourages the use of those strategies. Industry leaders voiced concerns in a FHFA listening session this week.

September 11 -

Following its deadline for written comments on the topic last month, the Federal Housing Finance Agency is scheduling events that will focus on two key themes emerging in responses.

September 1 -

Arch's second CRT transaction this year to obtain indemnity reinsurance for mortgage-insurance premiums comes at a time it is also experiencing rising 60-plus-day delinquencies on its outstanding securitized pools.

August 31 -

There were questions about the GSEs' use of structured credit risk transfers in the single-family market given an earlier pandemic-related market disruption.

August 21 -

The government-sponsored enterprise's earnings were up tenfold as it stabilized mortgage market liquidity amid the coronavirus.

July 30 -

A bond market once thought to be key to the futures of Fannie Mae and Freddie Mac — and the roughly $5 trillion of home loans they backstop — could instead find itself on the scrap heap due to their own regulator.

July 8 -

The FHFA looks to shed light on the amount of funds Fannie and Freddie will need to hold for their risk-sharing deals.

June 3 -

Not only is FHFA Director Mark Calabria preparing the GSEs to raise capital, but he must also help them decide just what they are selling to private investors in the way of equity returns and risk.

May 20 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Fannie Mae's profitability suffered but it managed to stabilize the mortgage market in the first quarter even with the coronavirus disrupting, among other things, certain credit-risk transfer vehicles it has used.

May 1 -

While Freddie Mac stabilized liquidity in mortgage markets, coronavirus-related credit losses drove the GSE's income down in the first quarter of 2020.

April 30 -

Freddie Mac saw a decline in net profit in 2019 due to decreased interest rate income, lower amortization revenue and risk-reducing investment costs, but its consecutive-quarter results improved.

February 13 -

Fannie Mae is sponsoring a $1.03B CRT transaction, while Caliber Homes Loans, New Residential and Onslow Bay fill the non-QM pipeline

January 14 -

A risk-based capital rule for Fannie Mae and Freddie Mac is expected to top the agenda in 2020 as the companies' regulator executes plans for their release into the private sector.

December 27 -

The Federal Housing Financial Agency's latest report on credit risk transfers shows Fannie Mae continues to slowly improve a multifamily mortgage risk-sharing metric that lags Freddie Mac's by a wide margin.

November 15 -

JPMorgan Chase may be leading the next trend for banks seeking to shift risk away from their mortgage portfolios — if regulators give Wall Street the green light.

November 13 -

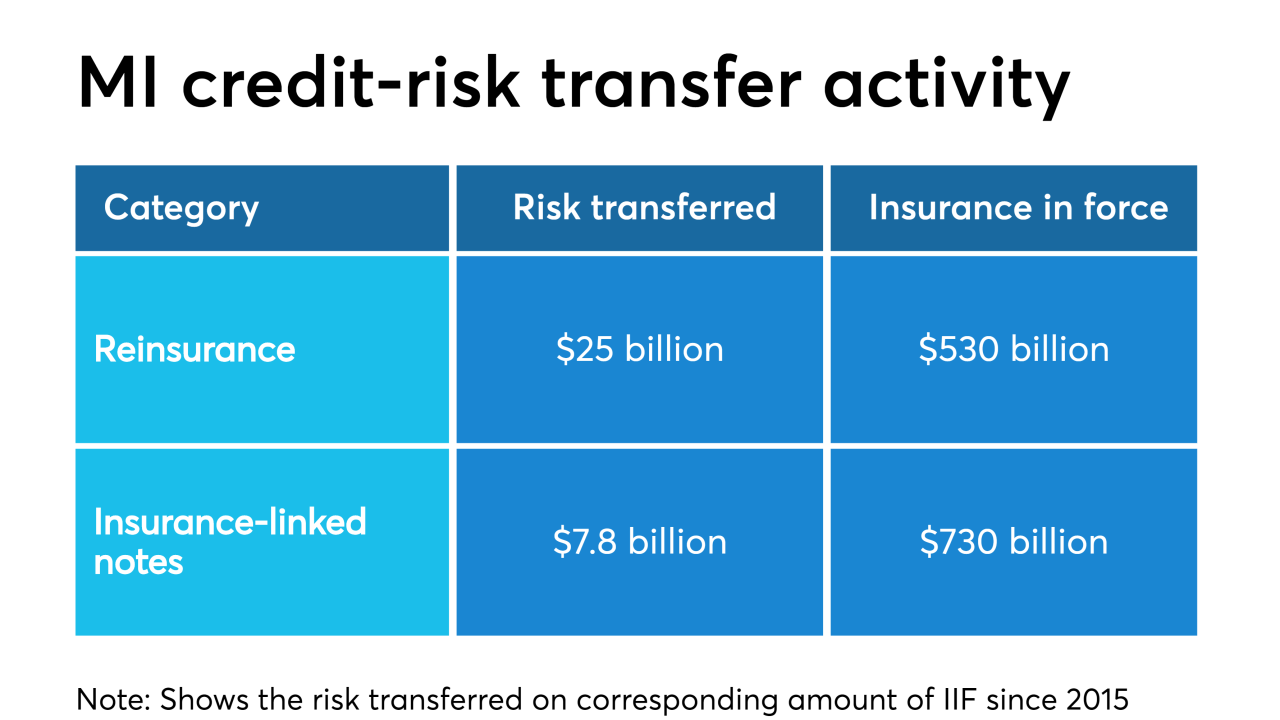

An increase in credit risk transfer activity since 2015 signifies a sea change for private mortgage insurers that may be about to intensify, according to an industry trade group.

November 5 -

Freddie Mac continues to churn out steady financial returns, with the growth in first-time home buyers and credit risk transfers providing the GSE stable footing when a recession comes, according to new CEO David Brickman.

July 31 -

The post-crisis operational improvements at both Fannie Mae and Freddie Mac have resulted in stronger mortgage loan performance, a Fitch Ratings report said.

July 3 -

Director Mark Calabria urged lawmakers to grant the agency chartering authority similar to that of bank regulators to boost competition in the mortgage market.

June 12