-

The two credit unions have combined assets of more than $115 million and serve nearly 16,000 members.

April 24 -

Acting CFPB Director Mick Mulvaney dismissed concerns by Sen. Elizabeth Warren, D-Mass., about his leadership of the consumer agency while supporting a lighter regulatory touch for credit unions.

February 27 -

Credit union executives talked up a pending regulatory relief effort while endorsing a radical shift in direction by the Consumer Financial Protection Bureau during a meeting with President Trump and other top White House officials on Monday.

February 26 -

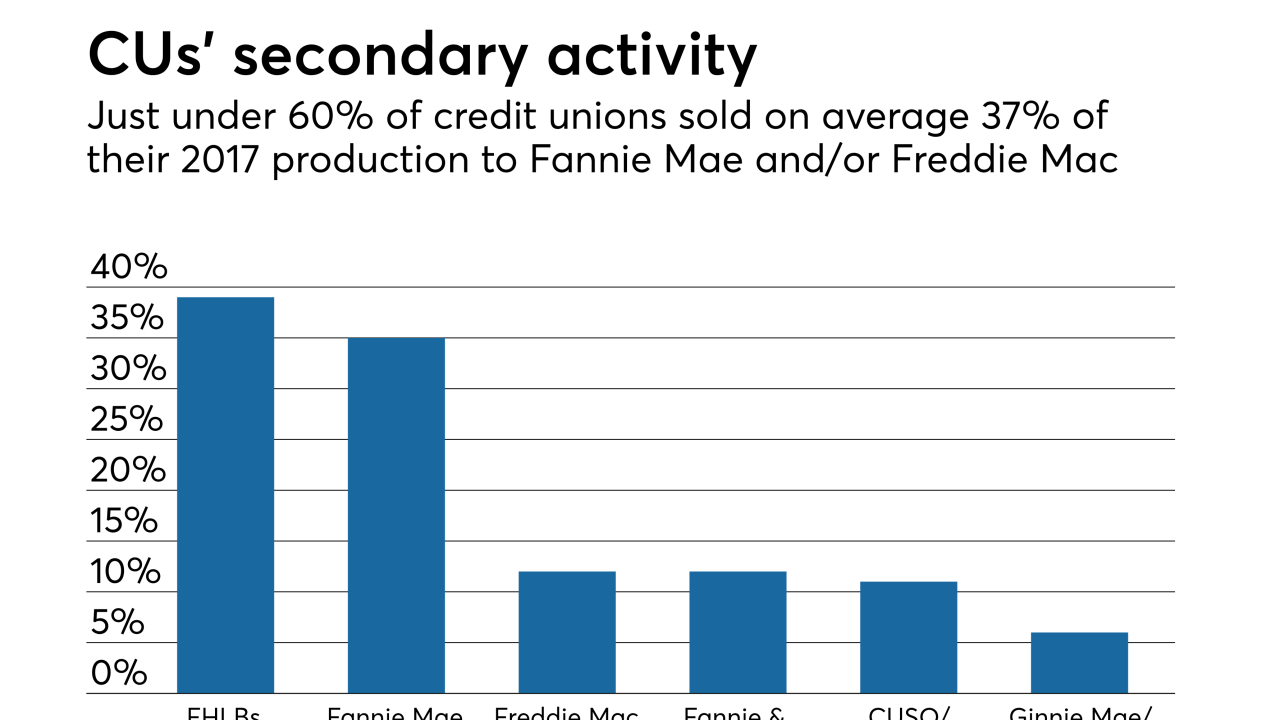

Credit unions favor housing finance reforms that would keep the government-sponsored enterprises or something similar in place, but add an explicit government guarantee to their mortgage-backed securities, according to a recent survey.

February 26 -

In his decision Thursday, U.S. District Judge Paul Gardephe said the lawsuit brought by the Lower East Side People's Federal Credit Union lacked standing.

February 2 -

The credit union service organization now serves almost 200 CUs across the continental United States.

January 23 -

National Credit Union Administration Chairman Mark McWatters has not even been announced as President Trump's pick to run the Consumer Financial Protection Bureau, but his potential nomination already is uniting diverse groups in opposition.

January 16 -

The Trump administration should not name J. Mark McWatters as head of the consumer agency, given his lack of experience overseeing commercial banks and his leadership of the National Credit Union Administration, a cheerleader for the industry it supervises.

January 5 Calvert Advisors LLC

Calvert Advisors LLC -

The long-running slide in mortgage payments 60 or more days past due will continue next year, and perhaps even longer as borrowers benefit from favorable economic conditions.

December 13 -

Colonial Savings founder James S. DuBose died after a yearlong battle with cancer. He was 93.

December 4 -

Top banking executives called the Republican tax plan an important first step toward tax reform and economic stimulus, but questions immediately arose about whether trade-offs and complexities in the bill would undercut it.

November 2 -

Quicken Loans Mortgage Services and Calyx Software developed a version of the Point loan origination system that's preconfigured with tools for small mortgage firms to work with the Detroit lender's TPO division.

October 11 -

Lawmakers signaled Monday that Congress will likely have a swift and powerful response to revelations that the credit reporting company Equifax was hacked, exposing 143 million people to identity theft.

September 11 -

Lenders will not have to report data on open-ended home equity lines of credit in 2018 or 2019 if they originated fewer than 500 HELOCs the preceding year, the bureau said.

August 24 -

Despite rising home prices and a market where many older homeowners are loath to sell, home equity line of credit lending remains muted in all but one corner of the industry: credit unions.

August 14 -

A Muskogee, Okla., woman charged with embezzling more than $10,000 from a local church also is a federal mortgage loan originator licensed to represent a local bank, according to national registry records.

July 31 -

The addition of these four credit unions brings the number of CUs served by the CUSO to nearly 200.

July 11 -

The Consumer Financial Protection Bureau's final rule to formalize guidance on a number of TILA-RESPA Integrated Disclosures compliance points omits an originally proposed fix for the so-called black hole that's created when a mortgage closing is delayed.

July 7 -

From the largest banks to the smallest independents, policymakers want to hear the mortgage industry speak with one voice in the critical efforts to reform the government-sponsored enterprises.

June 29 Cunningham & Co.

Cunningham & Co. -

The NCUA is letting federal credit unions securitize and sell assets. Such transactions would free up capital at credit unions, allowing them to make more loans.

June 26