-

Top banking executives called the Republican tax plan an important first step toward tax reform and economic stimulus, but questions immediately arose about whether trade-offs and complexities in the bill would undercut it.

November 2 -

Quicken Loans Mortgage Services and Calyx Software developed a version of the Point loan origination system that's preconfigured with tools for small mortgage firms to work with the Detroit lender's TPO division.

October 11 -

Lawmakers signaled Monday that Congress will likely have a swift and powerful response to revelations that the credit reporting company Equifax was hacked, exposing 143 million people to identity theft.

September 11 -

Lenders will not have to report data on open-ended home equity lines of credit in 2018 or 2019 if they originated fewer than 500 HELOCs the preceding year, the bureau said.

August 24 -

Despite rising home prices and a market where many older homeowners are loath to sell, home equity line of credit lending remains muted in all but one corner of the industry: credit unions.

August 14 -

A Muskogee, Okla., woman charged with embezzling more than $10,000 from a local church also is a federal mortgage loan originator licensed to represent a local bank, according to national registry records.

July 31 -

The addition of these four credit unions brings the number of CUs served by the CUSO to nearly 200.

July 11 -

The Consumer Financial Protection Bureau's final rule to formalize guidance on a number of TILA-RESPA Integrated Disclosures compliance points omits an originally proposed fix for the so-called black hole that's created when a mortgage closing is delayed.

July 7 -

From the largest banks to the smallest independents, policymakers want to hear the mortgage industry speak with one voice in the critical efforts to reform the government-sponsored enterprises.

June 29 Cunningham & Co.

Cunningham & Co. -

The NCUA is letting federal credit unions securitize and sell assets. Such transactions would free up capital at credit unions, allowing them to make more loans.

June 26 -

The House passed a bill that assigns Qualified Mortgage status to loans that banks hold in portfolio.

June 9 -

Credit unions continue to press the Consumer Financial Protection Bureau for regulatory relief, arguing that existing exemptions have not gone far enough.

June 1 -

From a few employees at Hutchinson Credit Union who spent part of their day focusing on better servicing of local home mortgages, Member Mortgage Services has grown in just 13 years into a separate company with 37 employees.

April 26 -

Learn how some of the industry's most successful loan originators get it done with these tricks of the trade from the 2017 Top Producers rankings' top 20 loan officers of the South.

April 25 -

Learn how the some of the industry's most successful loan originators get it done with these tricks of the trade from the 2017 Top Producers rankings' top 20 loan officers of the Midwest.

April 19 -

Changes in the housing market are creating new opportunities and challenges for credit unions, including how they market themselves to potential borrowers.

February 14 -

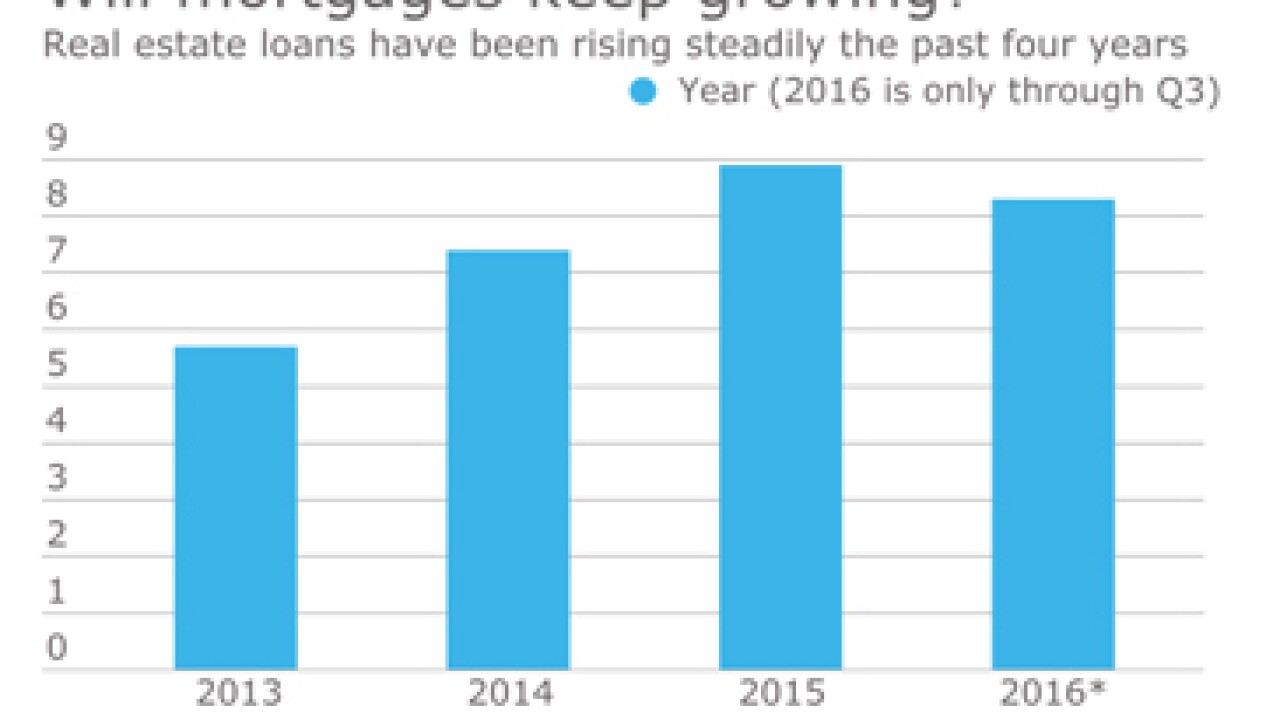

Real estate loans have been growing over the last few years despite a number of headwinds, but can credit unions build on that trend as interest rates rise?

February 13 -

Stringent regulations put in place after the recession have been unevenly enforced across the industry, to the detriment of small financial institutions. Here's hoping that changes with the new administration.

February 9 Members Mortgage Co.

Members Mortgage Co. -

The newly installed chairman of the Federal Communications Commission voted against 2015 rules that largely rejected the banking industry's entreaties.

January 31 -

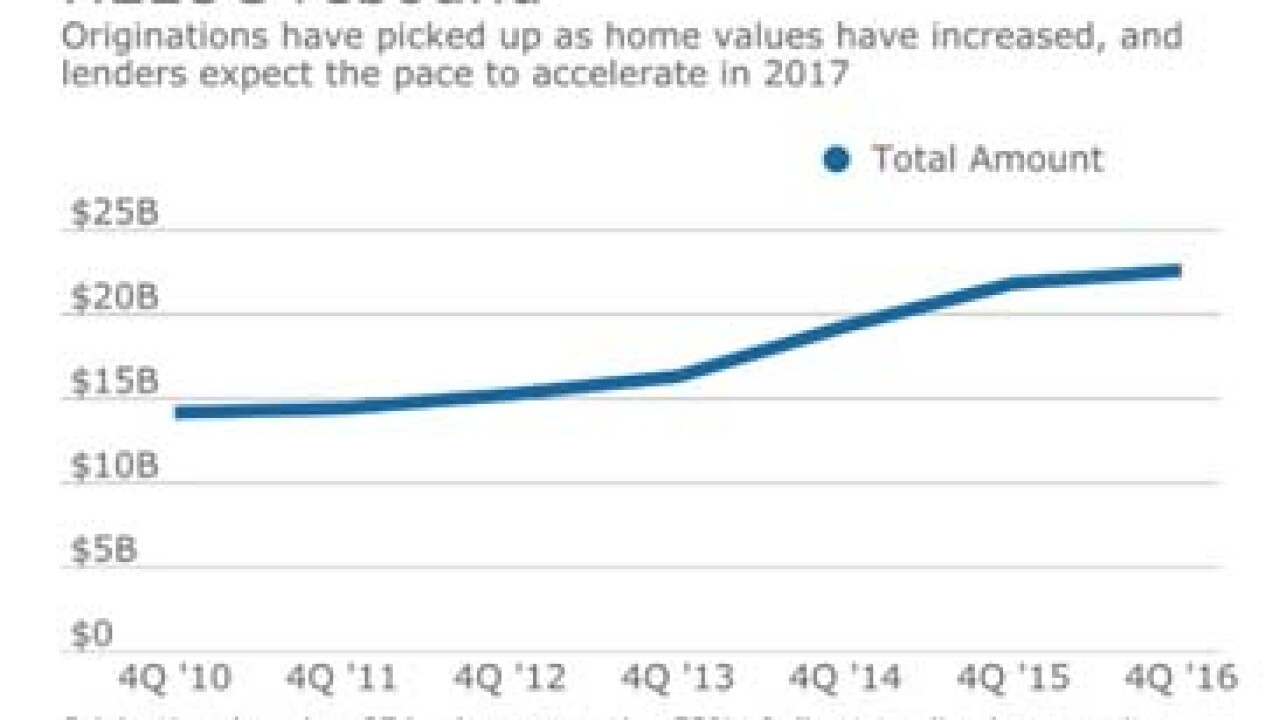

With home values and interest rates rising, homeowners finally seem ready to tap into their homes' equity to fund long-delayed home-improvement projects.

January 30