-

-

Several lenders have debuted artificial intelligence chatbots to help their customers through the homebuying process. What makes them stand out from the OpenAI phenom?

August 11 -

-

Financial services firms are focusing on essential risk-related priorities, but must not lose sight of the importance of innovative technologies that drive business forward.

February 27 -

As interest rates rise, pressure to deliver a better customer experience is becoming more intense

August 8 -

-

-

Origination fees vs. origination charges can be one of the most confusing parts of a loan offer. Diving into the difference between the terms and why there is no uniformity in the industry can help borrowers understand the lending process better, writes the CEO of Confer.

April 25 Confer, Inc.

Confer, Inc. -

-

This increases the opportunity for the company to keep in touch with its HomeSafe and EquityAvail customers between the loan closing and when it becomes due.

October 21 -

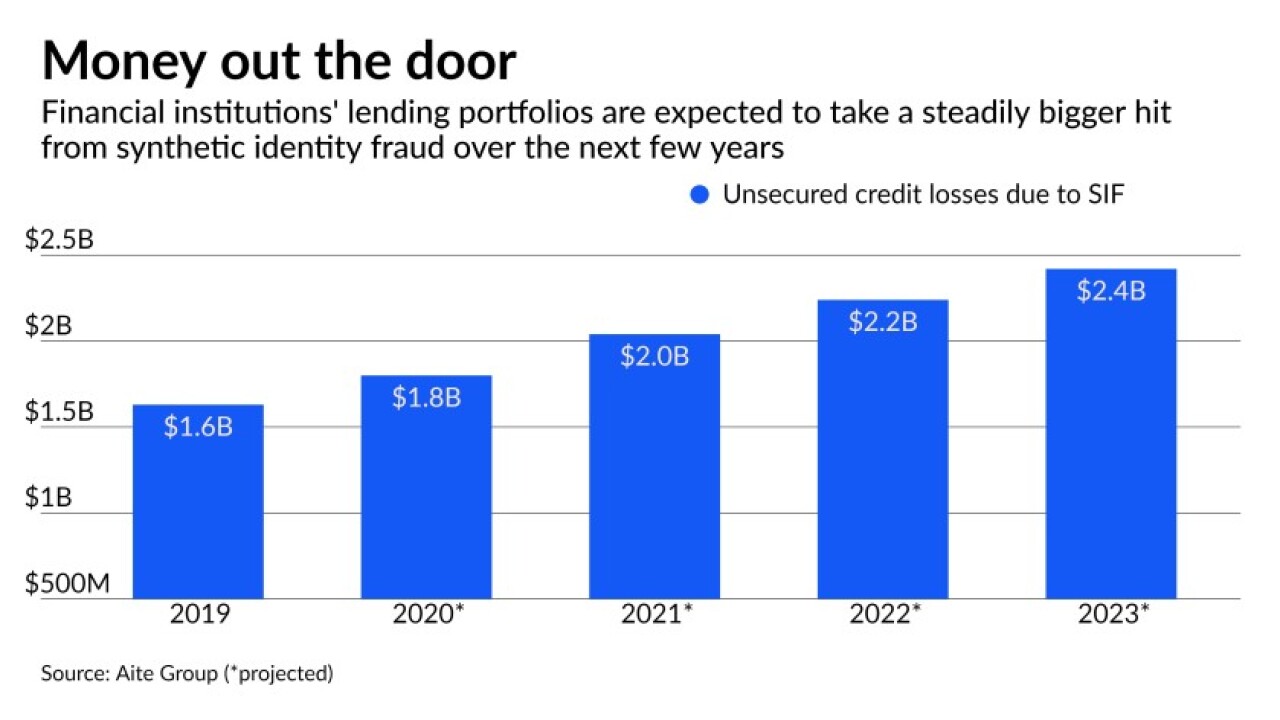

Scams in which a real person’s information is used to create fictitious businesses or individuals have led to $6 billion in credit losses. The Federal Reserve has developed a standard definition for synthetic identity fraud so lenders can distinguish it from traditional identity theft.

June 2 -

While COVID-19 pushed digitization to the forefront of lending, a majority of borrowers still want some degree of human interaction, according to a survey by ICE Mortgage Technology.

May 13 -

There is an emotional and human aspect in all relationships and that holds true for the bond between individuals and brands. The COVID-19 pandemic has brought both the strengths and weaknesses in customer experience under the spotlight. This episode will focus on how connecting with customers and ensuring they have a positive experience with a company is paramount, particularly in a pandemic-driven world. Join our host, Brooke Worden, President of The Rudin Group and guest speaker, Virgil Miller, Chief Operating Officer of Aflac U.S. and President of Aflac Group in a discussion that will highlight how and why Aflac is emphasizing three key aspects of the customer experience in 2020.

December 11 -

-

-

In too many places, identity verification and other vetting is still done manually, says Signicat's John Erik Setsaas.

October 19 Signicat

Signicat -

Customers' needs and expectations changed drastically in 2020, overturning conventional thinking about their experience in the process. How can we strike the right balance between embracing digital channels and recognizing the value of human touch?

October 15 -

The pandemic has exacerbated delays and inefficiencies in loan manufacturing, while adding to security risks.

October 14 Kofax

Kofax -

-

An internally built system called Advanced Listening analyzes phone calls, emails, text messages and more, identifying possible compliance violations, systemic issues and opportunities to improve processes, products and customer service.

August 20