-

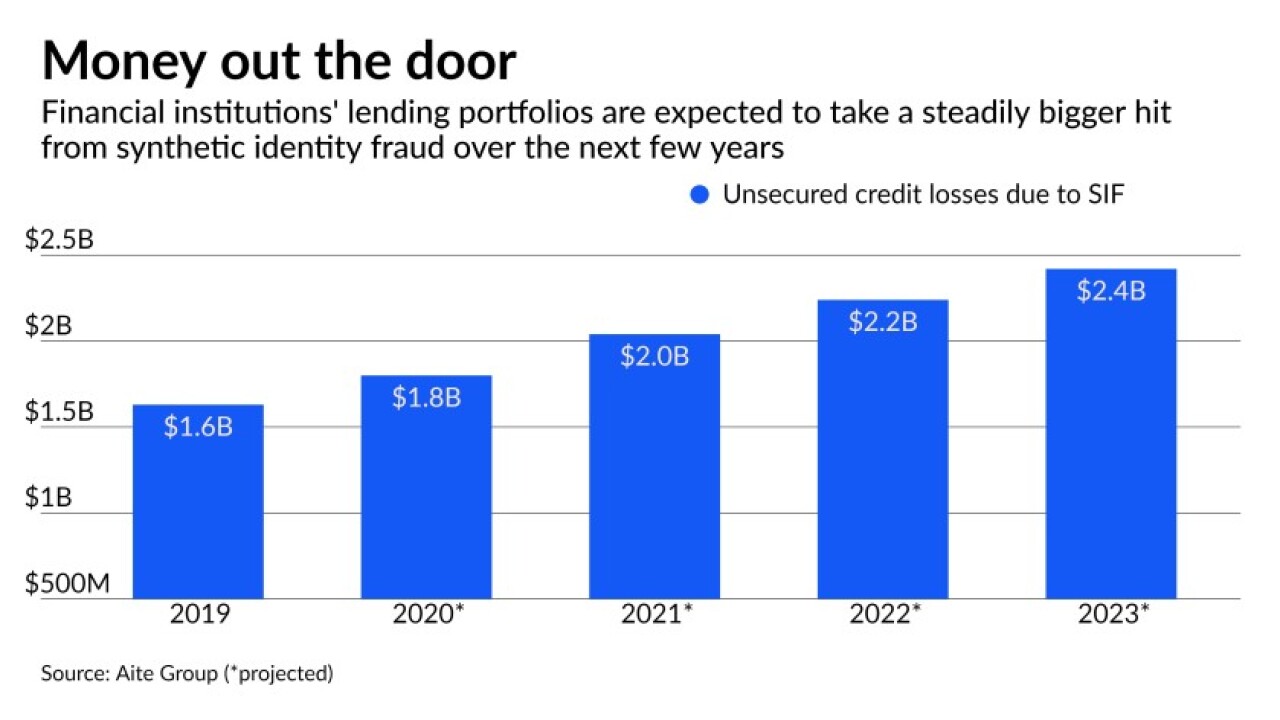

Scams in which a real person’s information is used to create fictitious businesses or individuals have led to $6 billion in credit losses. The Federal Reserve has developed a standard definition for synthetic identity fraud so lenders can distinguish it from traditional identity theft.

June 2 -

While COVID-19 pushed digitization to the forefront of lending, a majority of borrowers still want some degree of human interaction, according to a survey by ICE Mortgage Technology.

May 13 -

There is an emotional and human aspect in all relationships and that holds true for the bond between individuals and brands. The COVID-19 pandemic has brought both the strengths and weaknesses in customer experience under the spotlight. This episode will focus on how connecting with customers and ensuring they have a positive experience with a company is paramount, particularly in a pandemic-driven world. Join our host, Brooke Worden, President of The Rudin Group and guest speaker, Virgil Miller, Chief Operating Officer of Aflac U.S. and President of Aflac Group in a discussion that will highlight how and why Aflac is emphasizing three key aspects of the customer experience in 2020.

December 11 -

-

-

In too many places, identity verification and other vetting is still done manually, says Signicat's John Erik Setsaas.

October 19 Signicat

Signicat -

Customers' needs and expectations changed drastically in 2020, overturning conventional thinking about their experience in the process. How can we strike the right balance between embracing digital channels and recognizing the value of human touch?

October 15 -

The pandemic has exacerbated delays and inefficiencies in loan manufacturing, while adding to security risks.

October 14 Kofax

Kofax -

-

An internally built system called Advanced Listening analyzes phone calls, emails, text messages and more, identifying possible compliance violations, systemic issues and opportunities to improve processes, products and customer service.

August 20 -

The annual survey and ranking of mortgage servicers found that while trust is increasing, borrowers were frustrated with some digital interactions and long wait times with call centers.

July 30 -

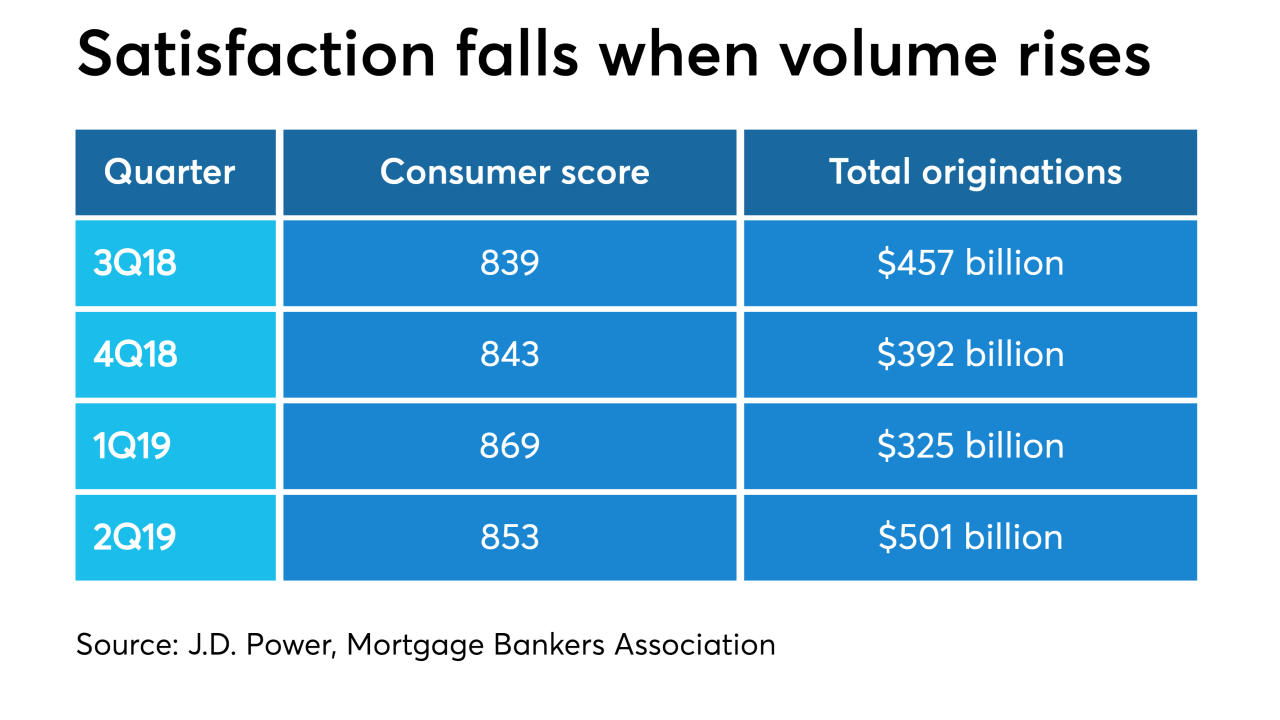

Consumer mortgage originator satisfaction scores fell in the second quarter as lenders had to work through the increase in application activity, a J.D. Power report said.

November 14 -

The average number of attempts to defraud mortgage companies each month increased by 42% this year and hit the smallest businesses hardest, according to LexisNexis Risk Solutions.

October 29 -

With the mortgage industry inching closer to full digitization, lenders need to strike the right balance of man-versus-machine as borrowers still look to leverage human interaction during the origination process.

September 20 -

Linda Lacewell, New York’s superintendent of financial services, said the CFPB's debt collection proposal does not go far enough to protect consumers.

September 18 -

Like many regional banking companies, Huntington Bancshares casts itself as a community bank, albeit one with more than $100 billion in assets.

September 9 -

The pursuit of a more digital mortgage business always involves a balancing act between the drive for automation and the preference or need many consumers may have for some kind of personal touch.

August 16 -

Discover Bank is approaching $1 billion in home equity-related receivables, a milestone for the six-year-old home-loan division that aims to rework the lending process for both its customers and loan officers.

August 5 -

Mortgage servicer customer satisfaction levels are among the lowest of any industry as more companies prioritize cost-cutting, regulation and default management over their borrowers, according to J.D. Power.

August 1 -

Amazon's reputation is built on customer fulfillment and technology innovation, but are those enough to guarantee success in the mortgage business?

July 3 AI Foundry

AI Foundry