-

Wire fraud is considered a consumer and title agent issue, but the millions of dollars it's diverting from home purchase transactions make it an issue mortgage lenders need to address, too.

December 5 CertifID

CertifID -

Fintech adoption among real estate and title agents is accelerating, though their optimism on the housing market has tanked, according to First American Financial Corp.

November 27 -

Private mortgage insurers are moving away from traditional rate cards in favor of more granular risk-based pricing to make their products more competitive and efficient for lenders.

November 26 -

Ellie Mae plans to more quickly adapt to an evolving digital mortgage landscape with Amazon's help rebuilding from the inside-out.

November 26 -

Lenders are constantly looking for ways they can streamline their operations and produce savings for themselves and their borrowers in order to compete in a leaner market this year.

November 12 -

Black Knight added to its mortgage loan data product offerings by acquiring Ernst Publishing, an Albany, N.Y.-based provider of recording fee, transfer tax and title premium fee information.

November 7 -

The Money Source is the latest mortgage company partnering with Ellie Mae to streamline workflows between lenders and correspondent investors through Encompass Investor Connect.

October 25 -

Ellie Mae is tackling home equity lines of credit loans with its latest Encompass Digital Mortgage Solution update as signs point to a surge in home equity borrowing.

October 22 -

Some lenders are tapping artificial intelligence and machine learning to improve operational efficiency and enhance the borrower experience, but complexities do exist in implementing the technology.

October 4 -

The bureau's findings and request for information came after acting Director Mick Mulvaney had cited data security as a flaw at the agency.

September 26 -

It's good advice in any relationship context. SunTrust's Bryce Elliott wants transparency from his technology partners. "It's OK to tell me no."

September 18 -

Blend, a provider of mortgage point of sale systems, is offering a new product that uses machine learning to streamline loan closings and analyze loan data quality.

September 18 -

Ellie Mae EVP Joe Tyrrell talks customer acquisition strategy. Crafting a personalized consumer experience, he says, starts with data.

September 18 -

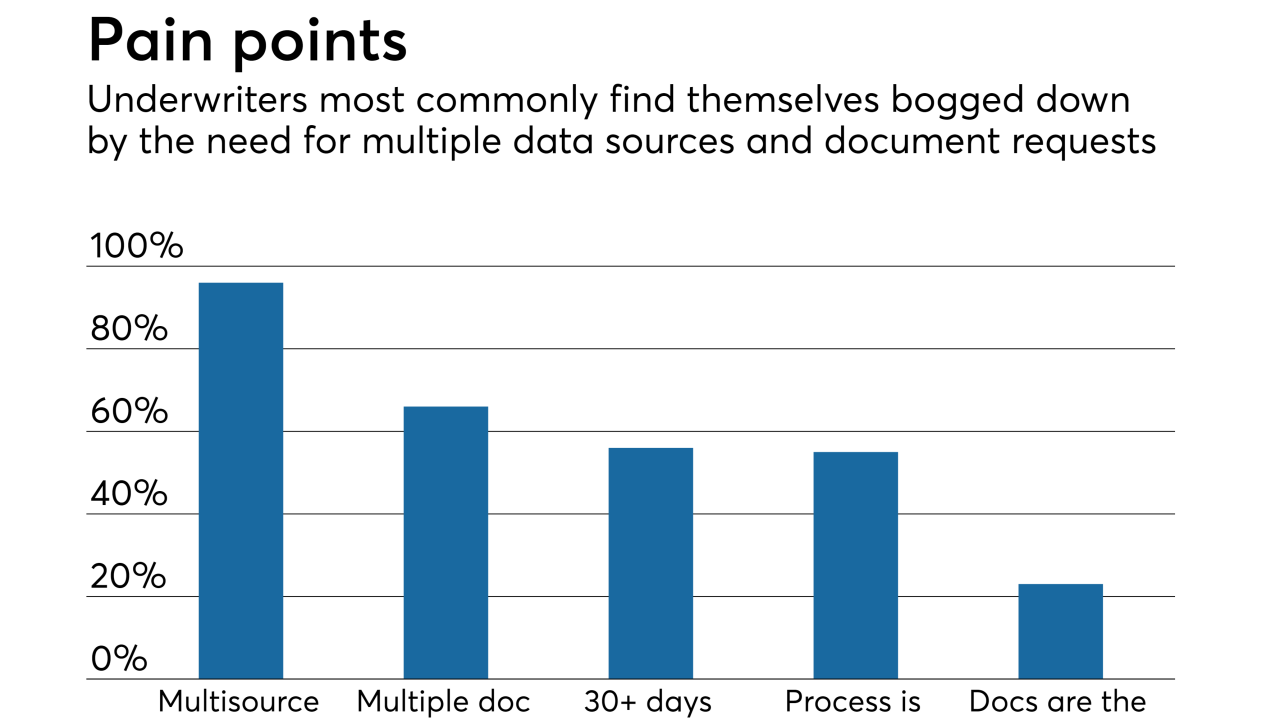

Accessing a mortgage applicants' data from a direct source goes a long ways toward shortening the origination process, according to 96% of mortgage underwriters responding to a recent CoreLogic survey.

September 17 -

A man from Hialeah, Fla., will face sentencing in November after pleading guilty to conspiracy in an $8 million mortgage and tax-refund scheme.

September 12 -

Due diligence firm American Mortgage Consultants has launched a new subsidiary in response to growing lender and servicer interest in digital transactions.

September 10 -

Wire fraud committed through business email compromise schemes has emerged as a serious threat to mortgage and real estate transactions. Defending against these scams requires a comprehensive strategy that includes technology, training and nonstop vigilance.

August 27 -

Fraudsters can track a home sale from the moment it goes on the market until the deal closes, make these transactions a ripe target for business email compromise scams that seek to intercept wire transfers and steal from legitimate participants in a deal.

August 27 -

Post-crisis measures made it harder for rogue borrowers and employees to commit fraud. Now, a new threat has emerged from scammers posing as title agents, real estate professionals and more.

August 24 -

The CFPB made changes to a rule that allows financial firms to be exempt from sending annual privacy notices to customers if they meet certain conditions.

August 10