-

It's good advice in any relationship context. SunTrust's Bryce Elliott wants transparency from his technology partners. "It's OK to tell me no."

September 18 -

Blend, a provider of mortgage point of sale systems, is offering a new product that uses machine learning to streamline loan closings and analyze loan data quality.

September 18 -

Ellie Mae EVP Joe Tyrrell talks customer acquisition strategy. Crafting a personalized consumer experience, he says, starts with data.

September 18 -

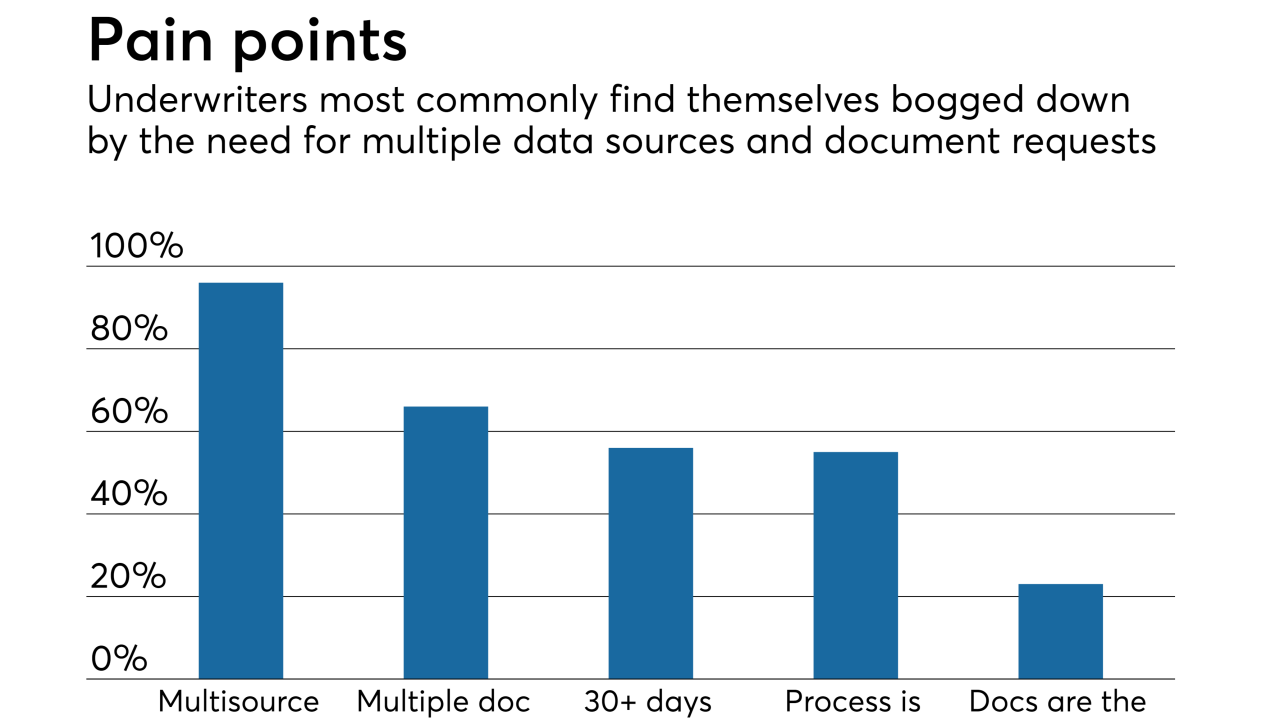

Accessing a mortgage applicants' data from a direct source goes a long ways toward shortening the origination process, according to 96% of mortgage underwriters responding to a recent CoreLogic survey.

September 17 -

A man from Hialeah, Fla., will face sentencing in November after pleading guilty to conspiracy in an $8 million mortgage and tax-refund scheme.

September 12 -

Due diligence firm American Mortgage Consultants has launched a new subsidiary in response to growing lender and servicer interest in digital transactions.

September 10 -

Wire fraud committed through business email compromise schemes has emerged as a serious threat to mortgage and real estate transactions. Defending against these scams requires a comprehensive strategy that includes technology, training and nonstop vigilance.

August 27 -

Fraudsters can track a home sale from the moment it goes on the market until the deal closes, make these transactions a ripe target for business email compromise scams that seek to intercept wire transfers and steal from legitimate participants in a deal.

August 27 -

Post-crisis measures made it harder for rogue borrowers and employees to commit fraud. Now, a new threat has emerged from scammers posing as title agents, real estate professionals and more.

August 24 -

The CFPB made changes to a rule that allows financial firms to be exempt from sending annual privacy notices to customers if they meet certain conditions.

August 10 -

Capital One's dispute with Plaid raised questions about the ability of banks and aggregators to work together. But the end of that fight, and Capital One's deal with Finicity, show common ground can be reached — eventually.

August 10 -

Social media is a main avenue for mortgage lenders to reach the next generation of homebuyers. New American is trying to make their own lenders experts in the space.

August 3 -

Wire and other payments fraud affected a record number of businesses last year, and the FBI is warning in particular about real estate scams.

August 1 -

The Pennsylvania Housing Finance Agency is switching to Black Knight's LoanSphere MSP to service the agency's $4.9 billion mortgage loan portfolio.

July 30 -

Investments in technology and emphasis on user experience contributed to an increase in the average satisfaction score for mortgage servicers, according to J.D. Power. Yet only a fifth of customers use mobile platforms.

July 30 -

Startup LoanSnap, a company funded in part by Virgin Group founder Richard Branson, has launched artificial intelligence that matches consumers with mortgages based on a complex analysis of their financial situation.

July 20 -

Other aggregators came to the bank's defense, while one CEO suggested Plaid's very public protest was unfounded.

July 17 -

The measure, which has been compared to the EU’s new consumer privacy rules, grants Californians new rights over how companies collect and use their personal data.

June 29 -

Fannie Mae and Freddie Mac are making condominium loans eligible for automated appraisal waivers that could reduce mortgage borrowers' fees and shorten closing times for lenders.

June 28 -

Credit reporting firms with significant operations in New York will face new cybersecurity and registration requirements to stave off concerns related to a breach of Equifax's systems last year.

June 25