-

While the overall foreclosure rate fell, the share of zombie properties grew in the first quarter of 2020, according to Attom Data Solutions.

February 28 -

Distressed mortgage servicing costs are falling and that's primarily due to the market's stability, but it also reflects improved efficiencies that may help in a weaker economy.

February 26 -

Alabama is fourth in the country for raw vacancy rate with more than 18% of all housing units in the state empty.

February 25 -

Corporations that own California properties could soon be fined for keeping homes vacant for more than three months under a proposed law to give tenants, nonprofits and cities more say over what happens to empty buildings.

February 21 -

For the first time in 15 years, fewer than 2 million mortgaged properties lie in default or foreclosure status as of the end of January, according to Black Knight.

February 20 -

Despite a healthy economy and booming real estate market, 2.2% of Orange County, Calif., mortgages were "seriously underwater" at year's end, Attom Data Solutions says.

February 14 -

The city's Residential Mortgage Foreclosure Diversion program, born out of the recession in 2008, has prevented nearly 14,000 foreclosures by working with lenders and homeowners to lower mortgage payments.

February 13 -

Mortgage delinquencies dropped to a 40-year low in the fourth quarter as strong employment bolstered borrowers' ability to make timely payments, the Mortgage Bankers Association said.

February 11 -

The city's decision to drop a lawsuit alleging predatory ending by Wells Fargo, JPMorgan Chase, Bank of America and Citigroup highlights the challenges municipalities face in taking on deep-pocketed financial institutions.

February 4 -

Default rates for prime jumbo mortgages will increase, but a strong economy and rising home prices will bail most borrowers and lenders out, Moody's said.

February 3 -

Foreclosure activity during 2019 fell 21% from the previous year, but a few indicators show a change in direction could be possible, according to Attom Data Solutions.

January 16 -

A former Fannie Mae employee is facing more than six years in federal prison for participating in a scam involving discount sales of properties owned by the government-sponsored enterprise.

January 15 -

Jon Leiberman rarely plays the lottery but he felt like he won it this past June.

January 15 -

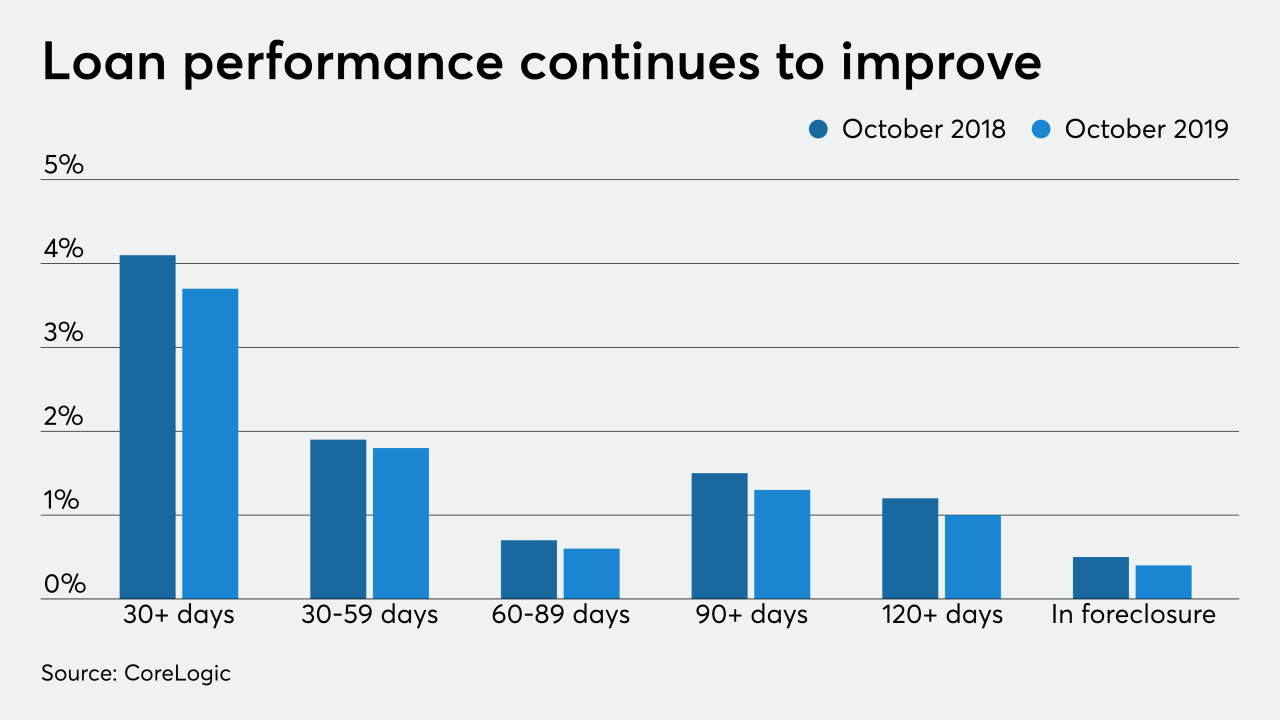

The nationwide mortgage delinquency rate had its best October in at least two decades, while the foreclosure rate remained at a 20-year for the twelfth straight month, according to CoreLogic.

January 14 -

Vision Property Management has settled accusations made by New York regulators of predatory lending practices for a total of $3.75 million in cash and forgiven mortgage loan balances.

January 10 -

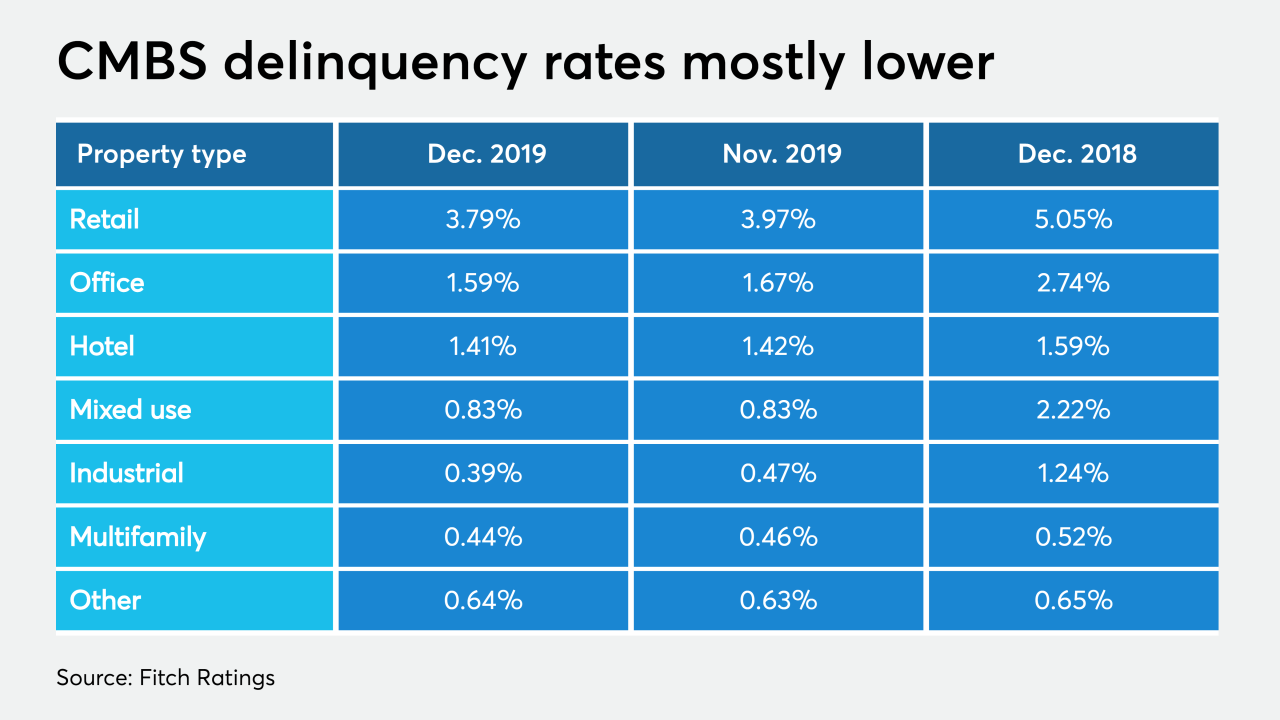

The delinquency rate for commercial mortgage-backed securities ended 2019 at its lowest point in nearly 11 years, aided by increased issuance and the resolution of legacy transactions, Fitch Ratings said.

January 10 -

The developer of three adjacent lots said one of the reasons for the sale was her time was up with her mortgage holders.

January 10 -

The city of Detroit is expanding property tax exemptions for homeowners to help more residents avoid foreclosure, officials announced Wednesday.

January 8 -

The owners of the former 3M corporate campus filed under Chapter 11 of the Bankruptcy Code, which cancelled a scheduled foreclosure auction of the Austin property.

January 8 -

Elizabeth Warren rolled out a plan to restore bankruptcy protections repealed in a 2005 law championed by Joe Biden, including those that involve mortgage lending.

January 7