-

EF Hutton admitted in a court filing that it has defaulted under the terms of its contract with a real estate company and that the company has rightfully accelerated the debt.

June 27 -

The number of property foreclosures in Monroe County, Michigan, continues to decline, continuing a trend for the past decade, county Treasurer Kay Sisung said.

June 25 -

Trash and broken furniture cover the stained carpet at the boarded, long-vacant house in Trotwood, Ohio, where paint strips hang like confetti from the ceiling and an awful smell fills the air as soon as Chad Downing unlocks the door.

June 24 -

Although the performance of the government-sponsored enterprises' single-family loans continues to improve, the deeply delinquent totals remain significant in states with court-processed foreclosures.

June 21 -

The number of properties in some stage of mortgage default has fallen to its lowest level in 14 years as most types of delinquencies have declined, according to Black Knight.

June 20 -

Economic strength bolstered the performance of loans included in commercial mortgage-backed securities with delinquencies improving for the seventh consecutive quarter, according to the Mortgage Bankers Association.

June 10 -

The use of financing to buy fix and flip properties increased 35% annually by dollar volume to its highest level in nearly 12 years, according to Attom Data Solutions.

June 7 -

The large number of overleveraged commercial mortgage-backed securities loans coming due in 2019 is likely to cause the payoff rate to drop an additional 9 percentage points by December, a Morningstar report said.

May 29 -

Colorado was a leader when it came to missed mortgage payments and foreclosures in the years before the 2008 financial crisis. Now, no state can compare when it comes to borrowers who are timely on their mortgage payments and hanging onto their homes.

May 23 -

The distressed mortgage market continues to dry up, with delinquencies shriveling to a record low rate and foreclosure filings dropping annually for 10 consecutive months.

May 21 -

Even though mortgage delinquencies increased on a quarter-to-quarter basis, strong overall metrics mitigate any concerns regarding future loan performance, according to the Mortgage Bankers Association.

May 14 -

As home price appreciation levels off, the amount of underwater loans rose in the first quarter while equity-rich properties continued adding value, according to Attom Data Solutions.

May 9 -

Private-label mortgage securitizations with variable servicing fee arrangements could become more common going forward as issuers look to increase investor cash flow while reducing the loan servicer's economic exposure, Fitch said.

May 6 -

With nearly $90 million added in the past two months, Goldman Sachs marched closer to its $1.8 billion consumer-relief mortgage settlement with the U.S. Department of Justice.

May 2 -

Mortgage prepayments came gushing in at the start of the spring home buying season as delinquencies also improved, according to Black Knight.

April 23 -

As the dangers of global warming lead to heightened natural disasters, those disasters result, at least temporarily, in a higher amount of mortgage defaults. From Texas to the nation's capital, these are the 12 most hazard-prone housing markets, according to Redfin.

April 15 -

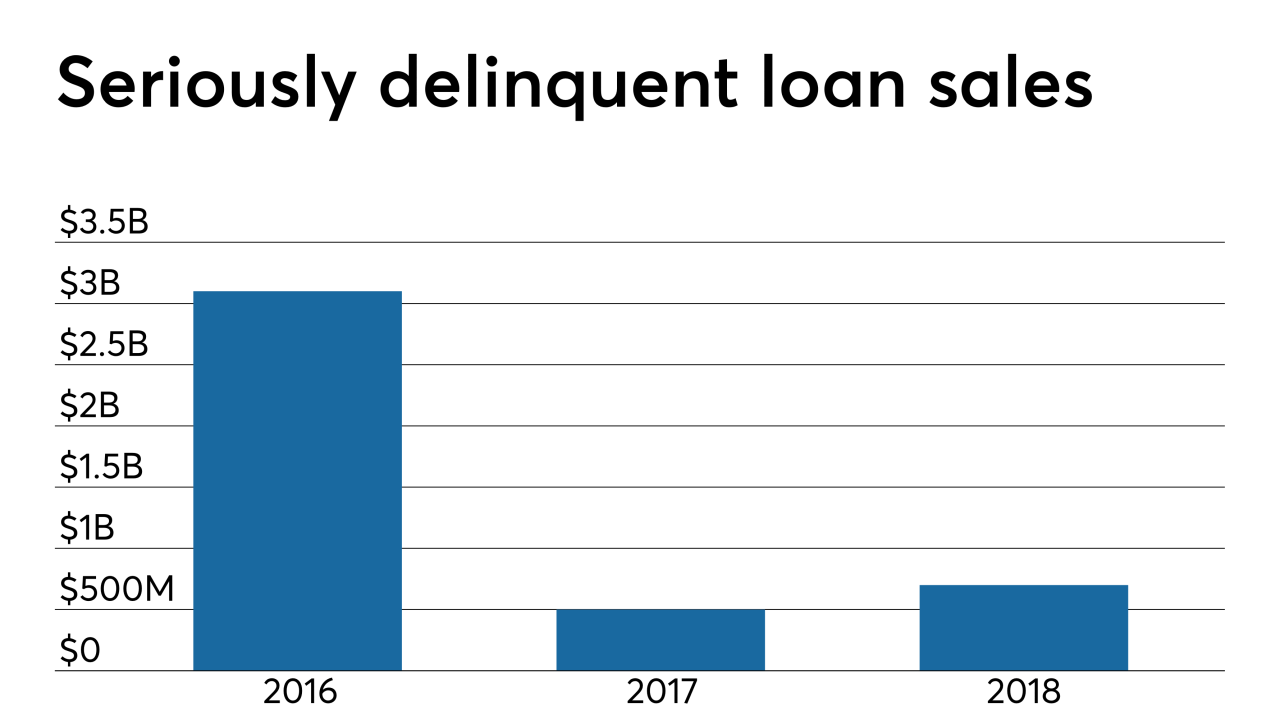

Freddie Mac's latest nonperforming mortgage auction will include one pool targeted to smaller investors like nonprofit organizations.

April 12 -

Caliber Home Loans settled a grievance with the Massachusetts attorney general over allegations of providing distressed borrowers with unaffordable loan modifications.

April 11 -

The number of properties with foreclosure filings dropped to the lowest quarterly amount since the Great Recession, according to Attom Data Solutions.

April 11 -

With a strong job market and low interest rates, the mortgage delinquency rate fell to its lowest January level in at least 20 years.

April 9