-

Recent reports by Standard & Poor’s, Experian and an industry trade group show changes in loan performance and credit over the course of the past month.

February 16 -

An uptick in pandemic-related payment suspensions reflecting new or restarted plan activity previously occurred as the omicron variant spread, but activity has since subsided.

February 7 -

While the significant drop in suspended payments overall from the pandemic’s peak suggests many have recovered from related hardships, the uptick points to some new distress.

January 28 -

The number of loans with payments 90-plus days late but not in foreclosure has fallen below 1 million, but the total is still double pre-pandemic levels, according to Black Knight’s measure.

January 21 -

The residential market is generally healthy, but distress is growing in areas where foreclosures are more common, homes are less affordable, and more properties are underwater, Attom finds.

January 20 -

The remaining 705,000 borrowers with pandemic-related payment suspensions may have complex or recent hardships to sort out, but the majority who had plans have exited them.

January 19 -

The coming change will further test the effectiveness of Biden administration policies aimed at putting more affordable properties in the hands of consumers or charitable organizations.

January 14 -

COVID loan forbearance championed by progressives has created a new, permanent class of distressed borrower, Whalen writes.

January 5 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

But the number remaining was still more than twice as high as pre-pandemic, according to Black Knight.

December 23 -

Further declines occurred in November, albeit at a slower pace than in October, according to a new loan performance report from the Mortgage Bankers Association.

December 21 -

More than half of respondents to a recent Arizent survey think one-stop shops will be the biggest disruptor in the next three years, followed by all-cash purchase programs and iBuyers.

December 13 -

However, the seven institutions in the Office of the Comptroller of the Currency study service 13% fewer loans compared with the third quarter of last year.

December 10 -

While over 112,000 loans exited plans in the past week, there is only a modest opportunity for continued improvement in the near term, Black Knight said.

December 10 -

Rising home values also brought 70,000 properties out of underwater status during the three-month period, CoreLogic said.

December 9 -

Axylyum, which recently released information about its first named client, offers an alternative to other forms of risk sharing for private companies originating income-producing mortgages.

December 2 -

Like the stock market rout around news of the Omicron variant, the recent increase in payment suspensions suggests financial troubles associated with the pandemic may not be over.

November 29 -

Due in part to pandemic-related forbearance, GSE portfolio loans with year-plus delinquencies hit the highest point seen since the Federal Housing Finance Agency started tracking them in 2015.

November 23 -

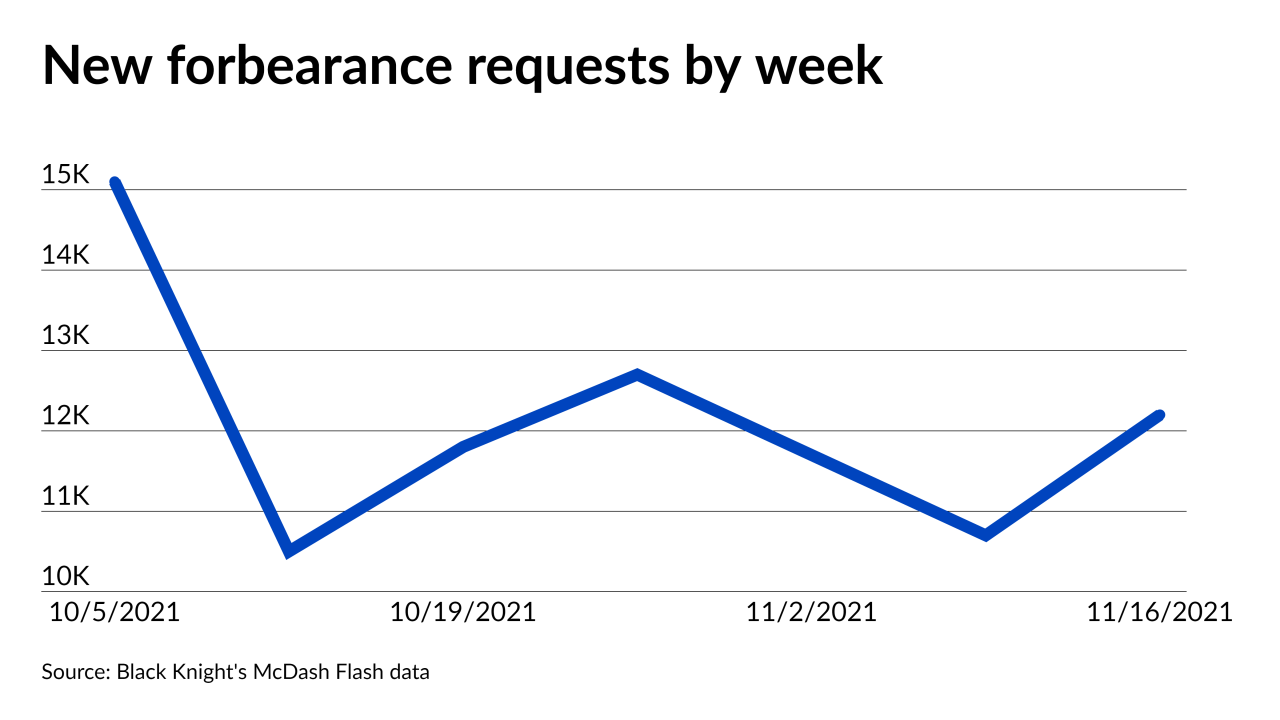

Activity in loans insured by the Federal Housing Administration and guaranteed by the Department of Veterans Affairs drove the increase in new requests, according to Black Knight.

November 19 -

The decline in late payments recorded in a trade group survey raise hope that many servicers will bear up under a wave of tighter enforcement coming from regulators.

November 10 -

Mortgage defaults, bank repossessions and auctions rose for the third month in a row, according to Attom Data Solutions.

November 10