-

More than half of respondents to a recent Arizent survey think one-stop shops will be the biggest disruptor in the next three years, followed by all-cash purchase programs and iBuyers.

December 13 -

However, the seven institutions in the Office of the Comptroller of the Currency study service 13% fewer loans compared with the third quarter of last year.

December 10 -

While over 112,000 loans exited plans in the past week, there is only a modest opportunity for continued improvement in the near term, Black Knight said.

December 10 -

Rising home values also brought 70,000 properties out of underwater status during the three-month period, CoreLogic said.

December 9 -

Axylyum, which recently released information about its first named client, offers an alternative to other forms of risk sharing for private companies originating income-producing mortgages.

December 2 -

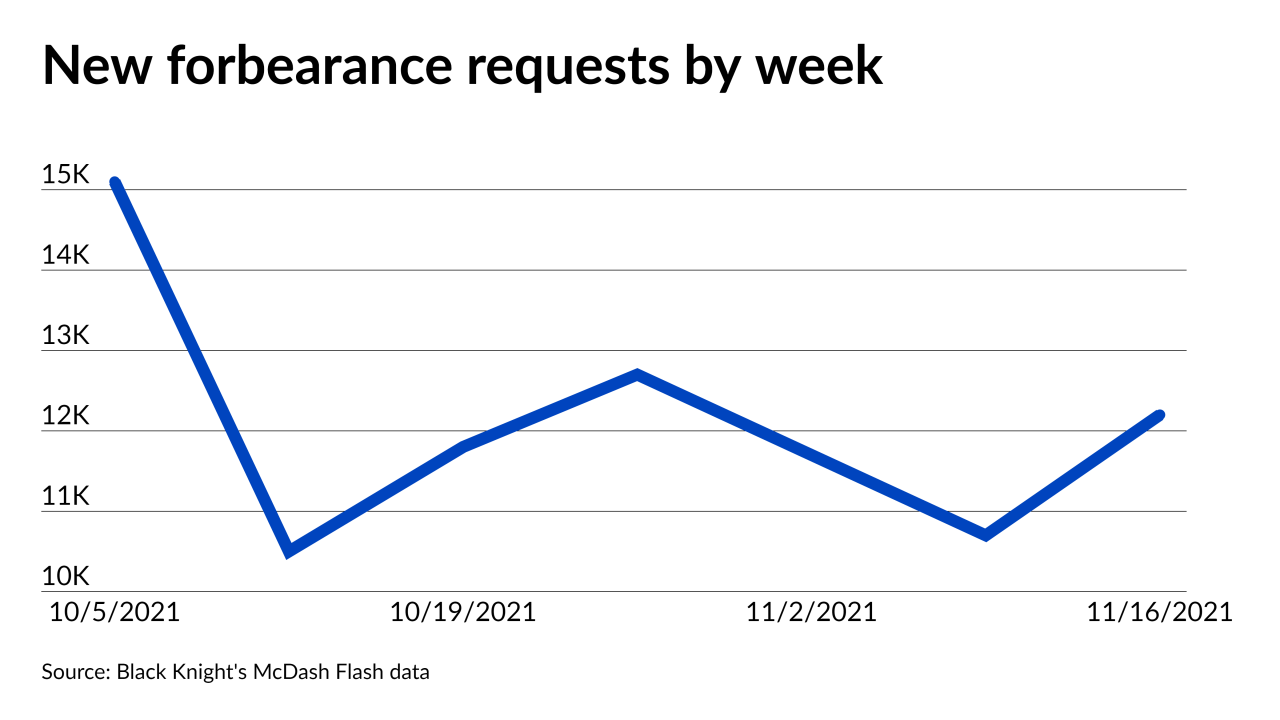

Like the stock market rout around news of the Omicron variant, the recent increase in payment suspensions suggests financial troubles associated with the pandemic may not be over.

November 29 -

Due in part to pandemic-related forbearance, GSE portfolio loans with year-plus delinquencies hit the highest point seen since the Federal Housing Finance Agency started tracking them in 2015.

November 23 -

Activity in loans insured by the Federal Housing Administration and guaranteed by the Department of Veterans Affairs drove the increase in new requests, according to Black Knight.

November 19 -

The decline in late payments recorded in a trade group survey raise hope that many servicers will bear up under a wave of tighter enforcement coming from regulators.

November 10 -

Mortgage defaults, bank repossessions and auctions rose for the third month in a row, according to Attom Data Solutions.

November 10 -

Numbers decreased across all loan types, with the largest decline among GSE-backed mortgages.

October 29 -

Numbers have fallen on a consecutive quarter and 12-month basis in half of all states but are likely to increase following the gradual end to the federal foreclosure ban, according to Attom Data Solutions.

October 28 -

The firm, dubbed Polpo Capital, is looking to produce a 15% net return to investors with modest leverage by capitalizing on the coming distress in commercial mortgage debt as forbearance agreements expire

October 22 -

Following the federal moratorium’s end, the number jumped, marking the highest quarterly growth on record, according to Attom Data Solutions.

October 14 -

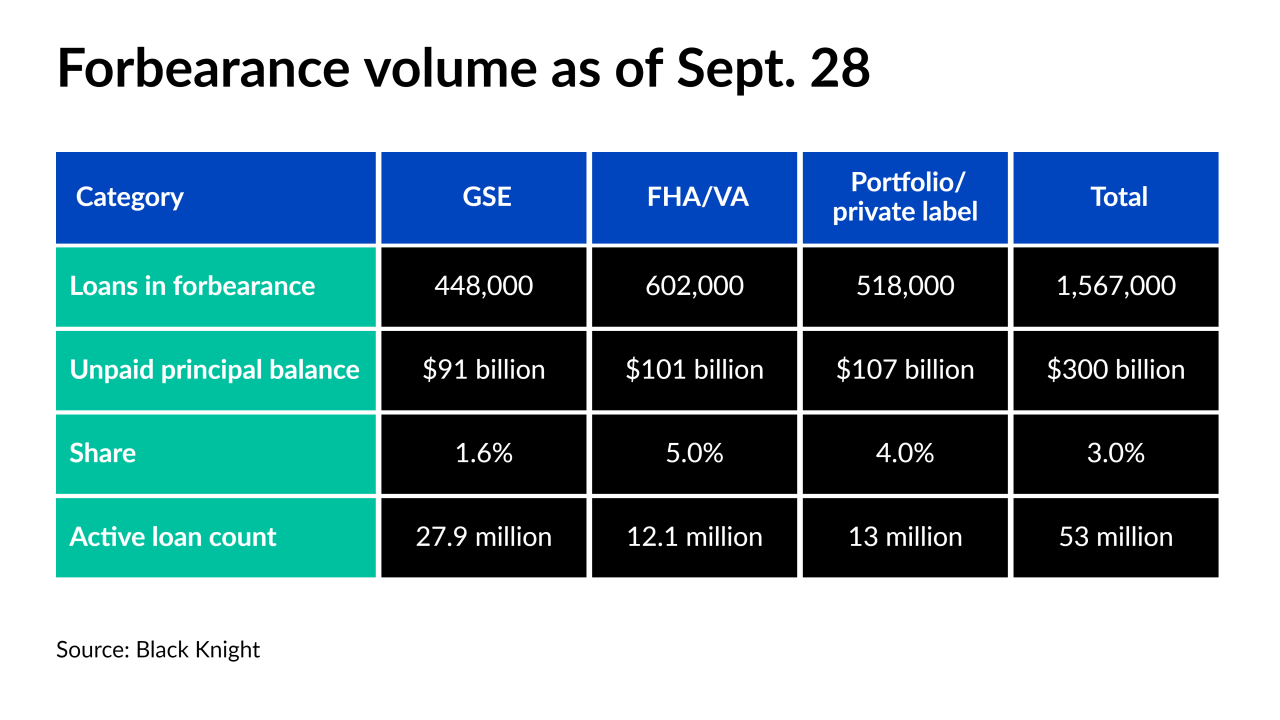

The current volume of distressed mortgages is now down by more than 70% from its peak pandemic level.

October 8 -

Although over 1.5 million forborne borrowers remain, a fifth could exit their plan in the next week, according to Black Knight.

October 1 -

While nearly 1.6 million forborne borrowers remain, about 460,000 are up for review at the end of September.

September 24 -

The end of many COVID relief plans in September have the industry holding its breath, with outcomes potentially foreshadowing the months to come.

August 27 -

The overall pace of both entries and exits slowed, even as the private-label securities and portfolio loan segment saw a spike in its numbers.

August 23 -

The most vulnerable areas all have the same things in common: relatively moderate price appreciation and affordability hurdles — either due to high home values or employment issues.

August 17