-

Rebounding employment brought total forborne mortgages under 2 million, according to the Mortgage Bankers Association.

July 6 -

The lack of a stabilizing force in the commercial real estate mortgage business is creating one of the most significant threats the lending industry faces, writes the CEO of Cirrus.

July 5 Cirrus

Cirrus -

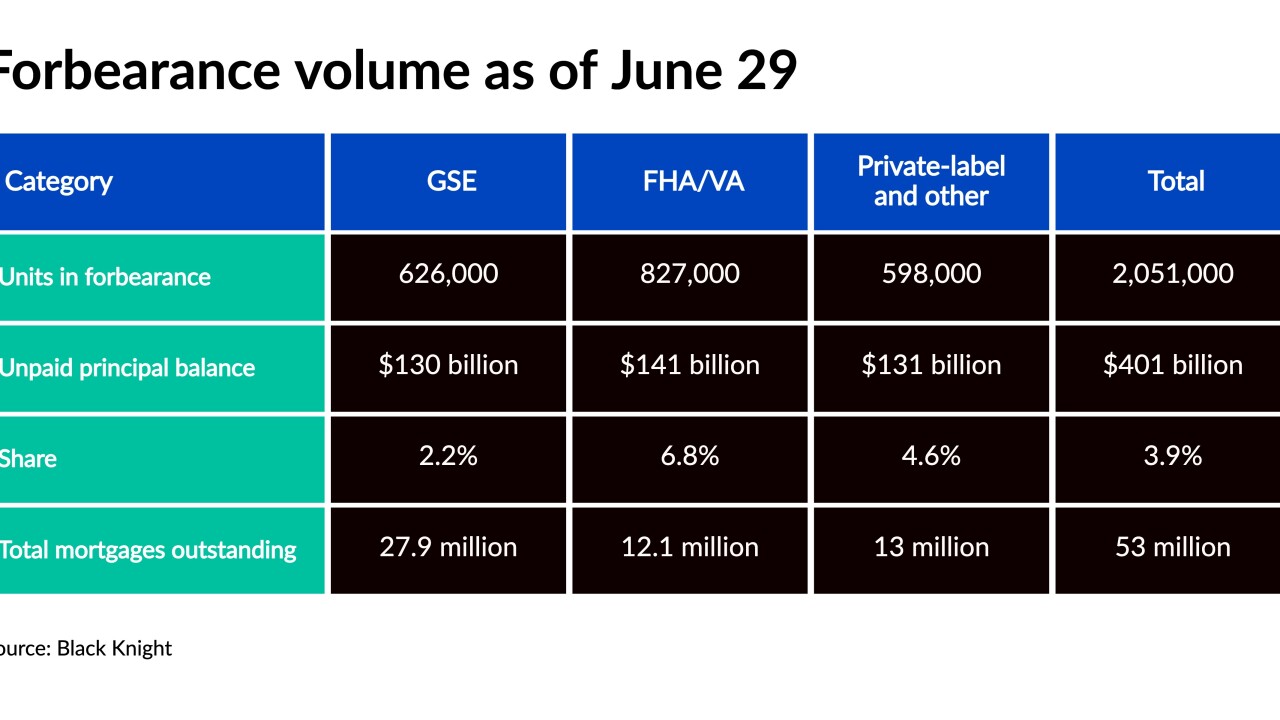

The number of GSE-backed and government sponsored loans in forbearance declined, while portfolio and private-label loans increased.

July 2 -

Private mortgage insurers can continue to hold less capital for forborne delinquent loans, which helps them potentially upstream payments to parent companies in the third and fourth quarters.

July 1 -

The change makes it easier for borrowers exiting forbearance to get access to home retention options that might otherwise be out of reach due to skyrocketing home prices.

June 30 -

The Federal Housing Finance Agency addressed the period between the end of the federal foreclosure moratorium and the beginning of new Consumer Financial Protection Bureau directives as home loan companies expressed relief that requested exemptions from some foreclosure waiting periods were included.

June 29 -

Fewer borrowers are suspending payments for pandemic hardships but some who got back on track are having trouble again, and deadlines could spur a final round of new requests.

June 28 -

The White House extended the foreclosure moratorium for federally-backed home loans a final month, and government agencies plan to roll out additional measures in July.

June 24 -

The numbers, which include payments suspended for pandemic-related hardships, could be a consideration in the possible further extension of moratoria federal regulators are close to making a call on.

June 23 -

Growing CRE mortgage volumes raised the bar for the coming year despite lingering concerns, according to the CRE Finance Council.

June 23 -

Evaluations for payment reduction still represent a relatively small share of home retention actions but their uptick could add incrementally to servicers’ workloads.

June 22 -

The strength of the housing market helped to increase forbearance exits while minimizing new requests, according to the Mortgage Bankers Association.

June 22 -

So far companies plan on using roughly the same number of employees as they shift from handling payment suspensions to assessing borrowers who have seen long-term declines in their incomes.

June 21 -

Experts expect only a small uptick in distressed mortgages, either through default or inability to refinance, which will create some opportunity for debt buyers

June 21 -

About 20% of the pandemic-related delinquent borrowers are up for review by the end of June, which could lead to vast improvement or deeper financial strife, according to Black Knight.

June 18 -

Consumer-permissioned access to bank or payroll information could be used to evaluate borrowers who still need relief after payment suspensions for pandemic-related hardships end.

June 16 -

Although activity crept down in May from April, it posted “dramatic” increases from the year before, according to Attom Data Solutions.

June 15 -

The guidance addresses confusion related to how lenders should handle situations in which borrowers have not paid for a year and need additional help due to a natural disaster.

June 11 -

Meanwhile, National MI has been increasing its new insurance written by slightly widening its credit standards.

June 11 -

But March's overall late payment rate was 1.3 percentage points higher than one year ago, while the 90-day-plus rate was 2.3 percentage points higher.

June 8