-

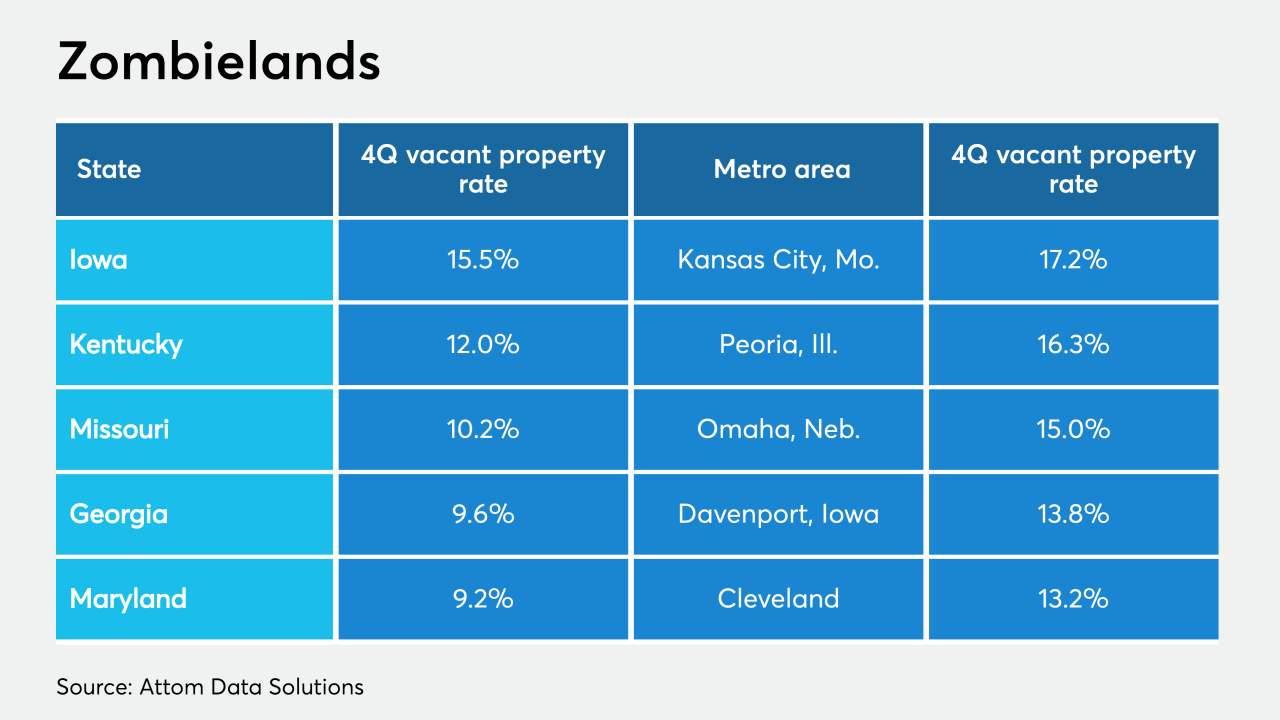

While the total foreclosures continued to fall with coronavirus moratoria in place, the share of zombie properties rose in the fourth quarter, according to Attom Data Solutions.

October 30 -

The government-sponsored enterprise also saw a 22% increase in net worth from the second quarter.

October 29 -

Researchers are increasingly focused on the risks related to owner-occupied loans with low balances and low-income properties with a limited number of renters.

October 29 -

The scheme targeted distressed homeowners in the Filipino community, most of whom were nonnative English speakers, forcing some of them into bankruptcy and homelessness, according to law enforcement officials.

October 29 -

A booming housing market contrasts with a slow-to-improve job market, making for lopsided improvement in the number of troubled mortgages, according to numbers from the Mortgage Bankers Association.

October 26 -

To continue providing liquidity for lenders, Fannie Mae lengthened the period in which it would continue the purchase of forborne mortgages and pools of mortgage-backed securities into 2021.

October 22 -

As of the end of July, there were more than 1 million past-due mortgages not in forbearance plans, and the majority likely would have qualified for forbearance under the CARES Act.

October 22 -

HUD Deputy Secretary Brian Montgomery questioned "whether we could ever totally accept desktop-only appraisals" at the Mortgage Bankers Association conference this week.

October 21 -

The pandemic has turned stress-testing around liquidity from theory into an actual case study. And while lenders shore up their cash reserves, they explain why many have been hesitant to take advantage of Ginnie Mae's Pass-Through Assistance Program.

October 21 -

Minus various expenses including corporate, legal and servicing rights valuation, Ocwen had adjusted pretax income of $13.5 million.

October 20 -

The overall forbearance rate was under 6% for the first time since April as another large swath of loans fell out of CARES Act coverage, according to the Mortgage Bankers Association.

October 19 -

As financial distress mounted, 12.4% of mortgagors missed payments across the second and third quarters of 2020 — and it could get worse, according to a study from the Mortgage Bankers Association.

October 16 -

While overall mortgage delinquency rates slowly descend, serious delinquencies — especially loans past 120 days due — jumped in July, according to CoreLogic.

October 13 -

Forbearance rates dropped below 7% for the first time in six months, but the decrease is largely due to the ending of the initial six-month term of forbearance granted by the legislation, according to the Mortgage Bankers Association.

October 13 -

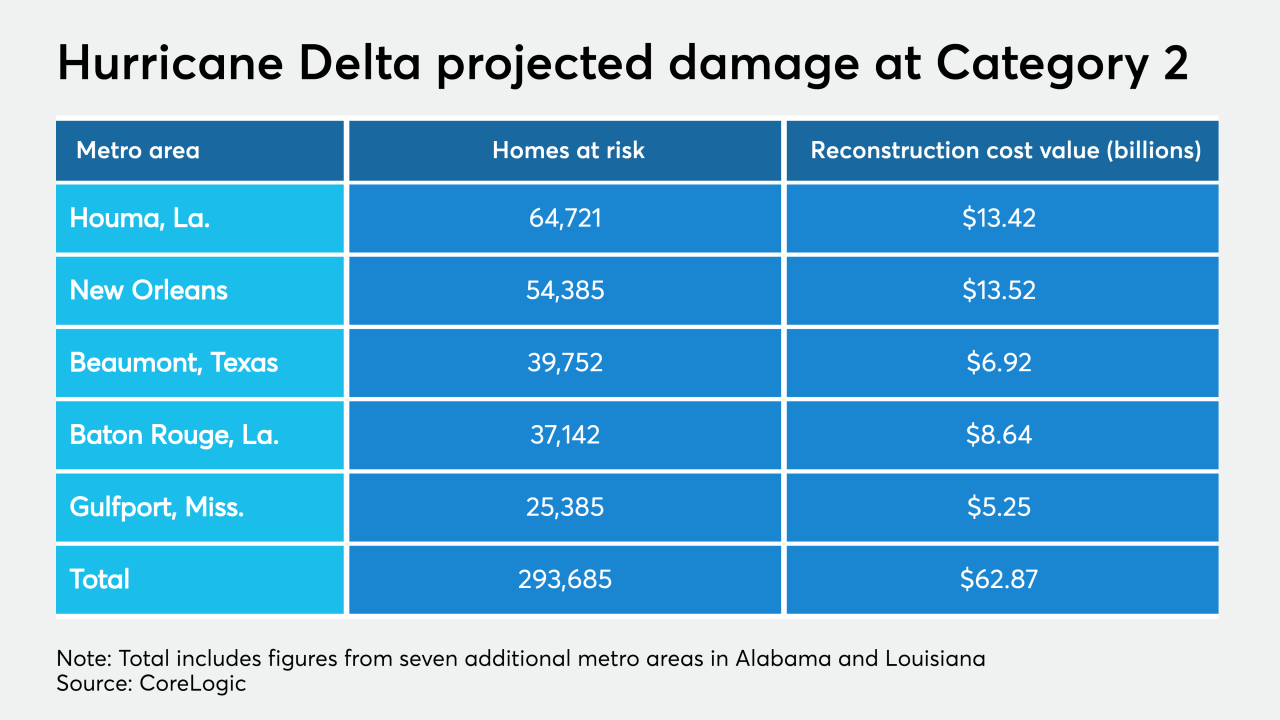

Expected to make landfall as a Category 2 storm, Hurricane Delta's surge is estimated to cause damage to 293,685 residential properties across Alabama, Louisiana, Mississippi and Texas, according to CoreLogic.

October 9 -

The metro areas surrounding New York, Washington, Philadelphia and Baltimore face the highest risk of impact from the pandemic based on home affordability, equity and foreclosures.

October 8 -

MCS isn’t the only distressed mortgage services entity gaining interest from investors as poor economic conditions threaten more hardships for homeowners.

October 6 -

Three nonprofits look to create or preserve 10,000 units, vowing to fight off firms like Blackstone and Colony Capital, which bought up foreclosed homes after Great Recession.

October 6 -

GSE mortgages in forbearance fell for the 17th straight week, spearheading the overall downtrend, according to the Mortgage Bankers Association.

October 5 -

But most borrowers who have exited forbearance plans are back on track when it comes to paying, and the incidence of loss mitigation plans is high among those who aren't.

October 5