Freddie Mac set a record for single-family mortgage loan purchases in the third quarter, helping the company to achieve higher net income both quarter-to-quarter and year-over-year.

The government-sponsored enterprise had third-quarter net income of $2.5 billion, an increase of 39% over

These results exceeded both B. Riley Securities' $1.3 billion forecast for the GSE and the last 12-month quarterly run rate of $1.5 billion.

The growth came from higher net revenue generated by the "growing guarantee portfolios," which also included "above-average multifamily activity," said CEO David Brickman during a media call.

"The housing market continues to be a source of strength in an otherwise troubling economy … and we have benefited from it. And we have also contributed to that strength by enabling the mortgage market to function seamlessly," he added.

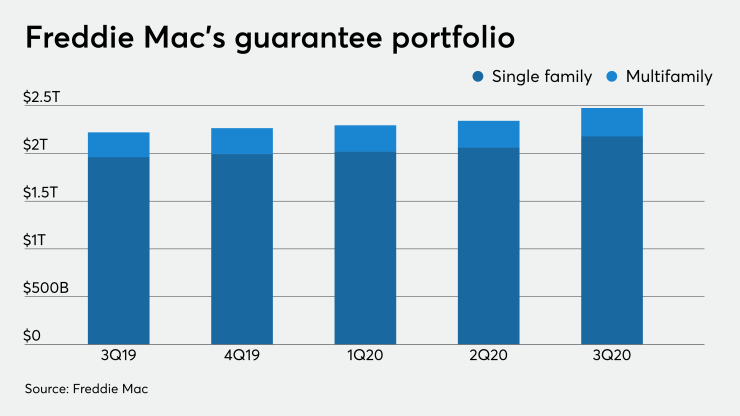

Freddie Mac did $337 billion in new single-family business during the quarter, up 45% from the second quarter. As a result, its single-family guarantee portfolio is now $2.18 trillion, up from $2.06 trillion in the second quarter and $1.96 trillion as of Sept. 30, 2019. Fundings during the quarter included 137,000 for first-time homebuyers, which is the highest number since 2010, Brickman pointed out.

At the same time, the multifamily portfolio grew to $297 billion as of Sept. 30, from $281 billion three months prior and $260 billion one year ago.

"We expect the multifamily market to continue to do well in the medium to long-term but that ultimately will depend on resumption of economic growth," Brickman said. "Since other debt providers have stepped back from the multifamily market, Freddie Mac has stepped forward. This is precisely the countercyclical support borrowers need from us and for which we are almost uniquely suited."

The single-family seriously delinquent rate, while still historically low, rose 56 basis points to 3.04% due to the amount of loans in forbearance.

"Our data shows that the vast majority of Freddie Mac borrowers who have fallen more than 60 days behind on their mortgage payments during the pandemic, 96.1% to be exact, have

"Since the outbreak began, approximately 639,000 single-family borrowers have used our forbearance options and 300,000 of those have already exited forbearance,” he added. “In the third quarter nearly 100,000 borrowers moved directly from forbearance to a payment deferral, bringing them current on their mortgage."

Brickman also addressed Freddie Mac's

Earlier this month, Freddie Mac did its first-ever

Freddie Mac tracked "continued improvement in that market over the last several months and we're very comfortable with where we see CRT spreads now and where we think we can execute our credit risk transactions," Brickman said.

The GSE is planning to introduce an adjustable rate mortgage product indexed to SOFR during the current quarter, Brickman said on the call.

Freddie Mac continued to build its net worth position, Brickman said, with a 22% increase in total equity to $13.9 billion from $11.4 billion at end of the second quarter. It was one year ago that the Federal Housing Finance Agency allowed

"This level of capital puts Freddie Mac in a very solid financial position," Brickman noted. "We would not have needed a draw [from its line of credit with the U.S. Treasury] in any of the nine hypothetical quarters contemplated by the last published Dodd-Frank stress test [which are] most plausible to a severely adverse scenario."

When it comes to the net worth position of both GSEs, "the most important driver going forward will be the outcome of the expected

The case could "potentially upend the legality of FHFA's authority and the cash flow sweep itself. Government actions around the GSEs have always been questionable, in our view, and a re-examination of these issues could be decisively positive for GSE shareholders," Binner wrote.