-

If the tally included loans with some form of payment relief, the rate would be close to 8%.

October 5 -

Over 3.6 million borrowers sit in coronavirus-related forbearance with portfolio and private-label securitized loans driving the week's increase, according to Black Knight.

October 2 -

The class-action lawsuit claims the company used deceptive contracts, locking low-income Black homebuyers into disadvantageous long-term mortgages without proper lending disclosures.

October 1 -

Delinquencies will rise due to the severe effects of the pandemic on the commercial property sector, Fitch said.

September 30 -

Gov. Andrew M. Cuomo on Monday announced he will extend the eviction moratorium — set to expire Oct. 1 — to next year, continuing protections for tenants as well as homeowners who have been unable to pay rent and mortgage during the public health crisis.

September 29 -

Shannon King, a single mother, left the Bay Area a decade ago as housing costs soared, hoping to find an affordable place to live in southern Oregon.

September 21 -

More defaults will lead to an increase in distressed sales, and that will drive down prices, CoreLogic said.

September 21 -

Nowhere is the widening gap between real estate and the real economy more apparent than in Las Vegas, where tourism is in ruins, wages are plunging and home prices just keep rocketing higher.

September 17 -

Any roadmaps for client service that existed before the pandemic have changed, according speakers at DigMo2020.

September 15 -

After flattening over the three prior weeks, the number of loans going into coronavirus-related forbearance dove at a rate not seen since early August, according to the Mortgage Bankers Association.

September 15 -

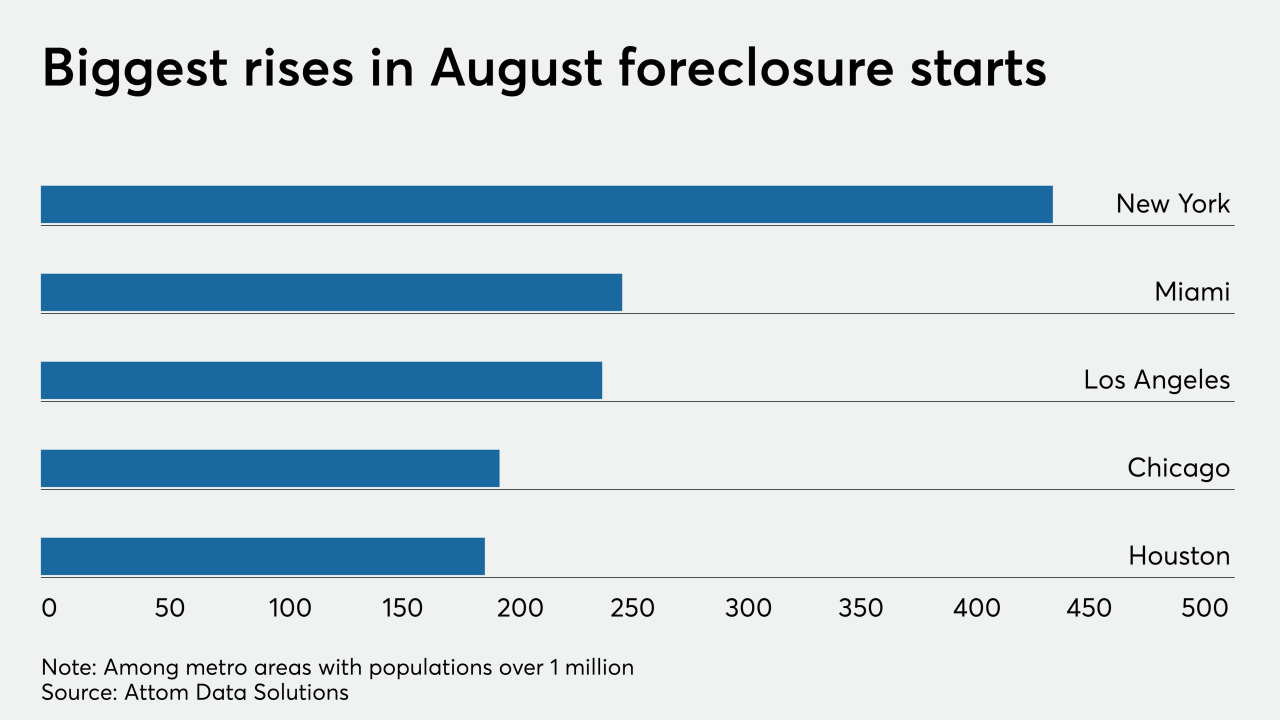

While still greatly trailing year-ago numbers, mortgage foreclosure activity jumped in August from July as moratorium restrictions started lifting and courthouses reopened, according to Attom Data Solutions.

September 11 -

Some of the cures were the result of short-term remedies and could reverse as relief measures end.

September 10 -

"The current economic crisis continues to disproportionately impact borrowers with FHA and VA loans," said Mike Fratantoni, the MBA's senior vice president and chief economist.

September 8 -

Without further government help, that rate could double again by 2022, CoreLogic said.

September 8 -

Today there are 1 million fewer Americans in forbearance than there were at the peak in May, according to Black Knight.

September 4 -

The lightning-ignited Hennessey Fire destroyed 254 single-family homes in Napa County, Calif., making it one of the most destructive in county history, Cal Fire reported.

September 2 -

Gov. Gavin Newsom late Monday signed a stopgap measure to rein in evictions, offering limited protections for tenants and aid to landlords hit financially by the coronavirus pandemic.

September 1 -

For the first time since June 7, the number of loans going into coronavirus-related forbearance didn't decrease from the week before, according to the Mortgage Bankers Association.

August 31 -

Blackstone Group, which led Wall Street's initial foray into the single-family rental business, is making a new investment in suburban houses at a time when the COVID-19 pandemic is pressuring traditional commercial real estate.

August 28 -

The new reality for investors and originators accounts for forbearances and ability-to-repay.

August 28