-

Foreclosure activity during 2019 fell 21% from the previous year, but a few indicators show a change in direction could be possible, according to Attom Data Solutions.

January 16 -

A former Fannie Mae employee is facing more than six years in federal prison for participating in a scam involving discount sales of properties owned by the government-sponsored enterprise.

January 15 -

Jon Leiberman rarely plays the lottery but he felt like he won it this past June.

January 15 -

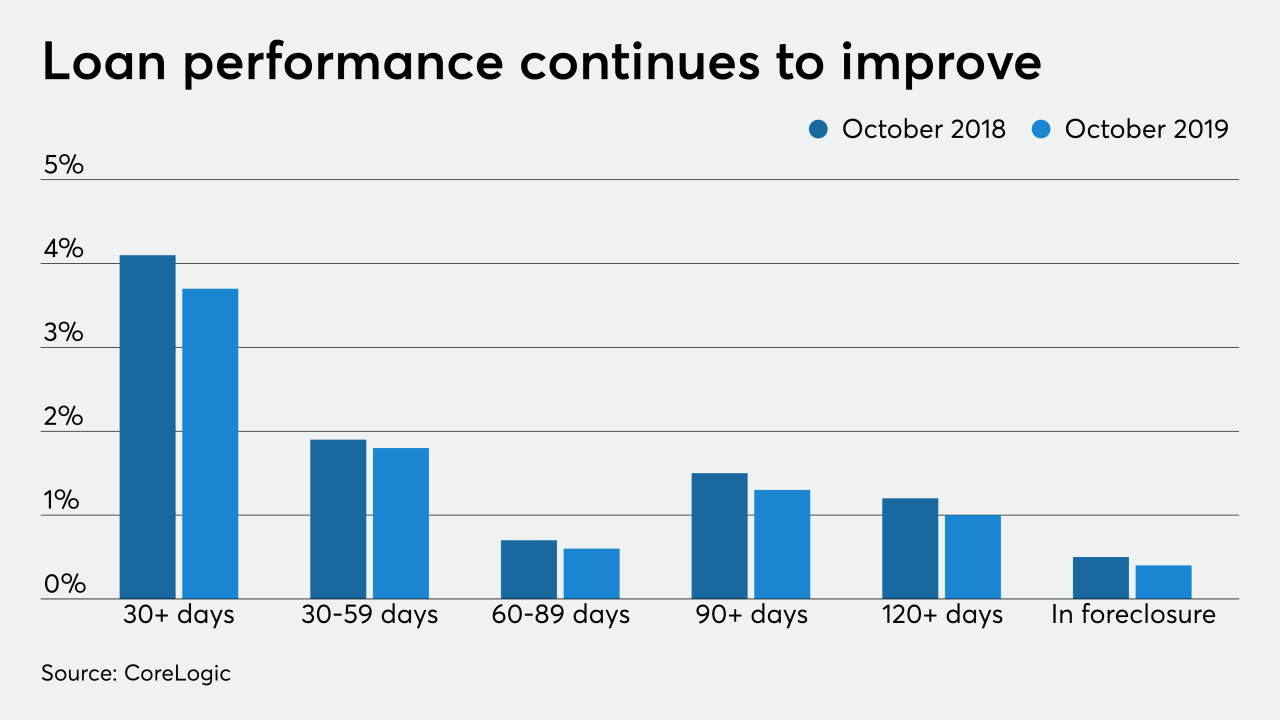

The nationwide mortgage delinquency rate had its best October in at least two decades, while the foreclosure rate remained at a 20-year for the twelfth straight month, according to CoreLogic.

January 14 -

Vision Property Management has settled accusations made by New York regulators of predatory lending practices for a total of $3.75 million in cash and forgiven mortgage loan balances.

January 10 -

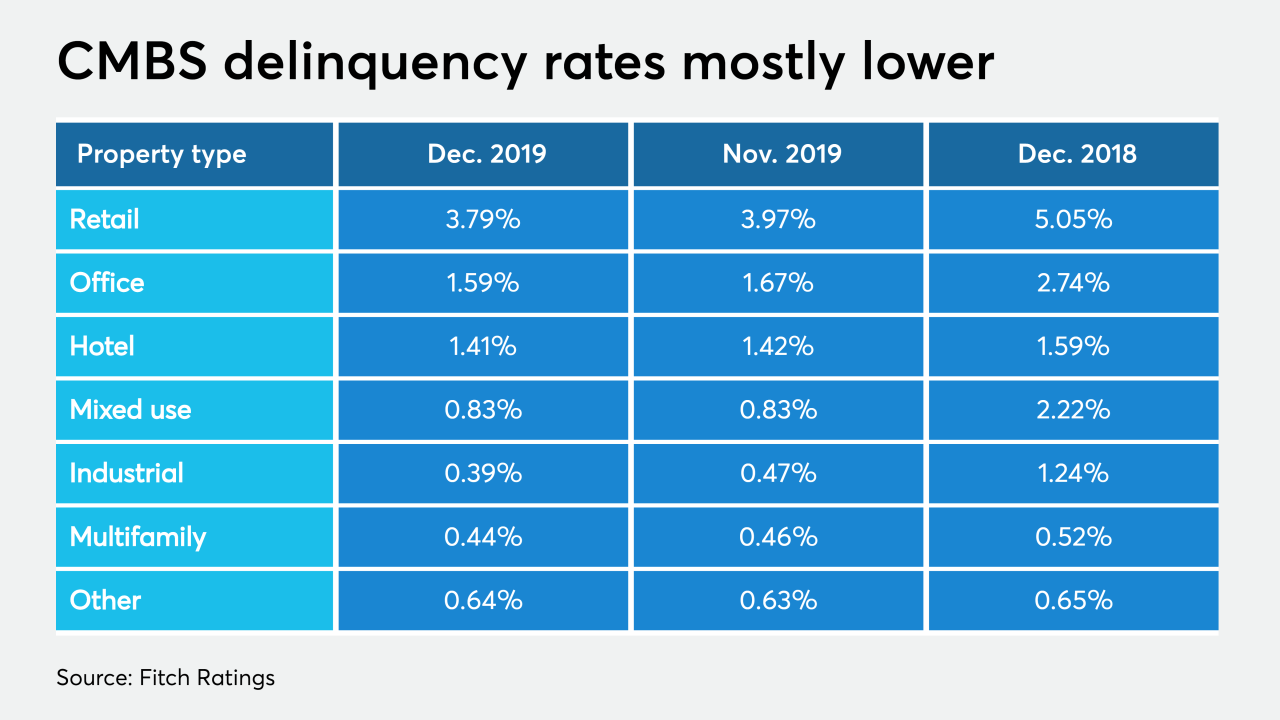

The delinquency rate for commercial mortgage-backed securities ended 2019 at its lowest point in nearly 11 years, aided by increased issuance and the resolution of legacy transactions, Fitch Ratings said.

January 10 -

The developer of three adjacent lots said one of the reasons for the sale was her time was up with her mortgage holders.

January 10 -

The city of Detroit is expanding property tax exemptions for homeowners to help more residents avoid foreclosure, officials announced Wednesday.

January 8 -

The owners of the former 3M corporate campus filed under Chapter 11 of the Bankruptcy Code, which cancelled a scheduled foreclosure auction of the Austin property.

January 8 -

Elizabeth Warren rolled out a plan to restore bankruptcy protections repealed in a 2005 law championed by Joe Biden, including those that involve mortgage lending.

January 7 -

Ramsey County, Minn. officials agreed to sell Wesely Pettiford's house back to his family, but obtaining financing to make badly needed repairs has been difficult.

January 6 -

There are an estimated 46,000 vacant homes in the San Francisco Bay Area, a surprising number in a region beset by a crippling housing shortage.

January 6 -

Whatcom County in northwestern Washington state went from falling prices and plenty of inventory in 2009 to high prices and low inventory in 2019

January 2 -

November's foreclosure starts hit their lowest level since Black Knight started tracking this data in 2000, while the foreclosure rate reached a 14-year low.

January 2 -

Scores of homes destroyed or badly damaged by Memorial Day tornadoes still sit vacant and abandoned, creating new blight and safety concerns in neighborhoods.

December 30 -

The owner of the MacArthur Center Mall in Norfolk, Va., has defaulted on a $750 million loan which includes the property as collateral.

December 20 -

New York Gov. Andrew Cuomo has signed legislation aimed at getting mortgage companies to take quicker action on vacant properties.

December 19 -

Most commercial and multifamily loan delinquency rates remained near record lows in the third quarter extending a long run of declines in the securitized market, according to the Mortgage Bankers Association.

December 6 -

In another sign of the hot real estate market in the Colorado Springs area, the number of mortgage foreclosures filed in El Paso County last month fell to a near-20-year low.

November 29 -

It's been two years since Taunton, Mass., City Solicitor Jason Buffington announced that a real turnaround was on the horizon for the forlorn and nearly vacant Whittenton Mills complex.

November 27