Diversity and equality

-

House Democrats described the disparate impact standard as "the most important tool" for enforcing the Fair Housing Act.

November 22 -

Eric Blankenstein, who resigned from the Consumer Financial Protection Bureau in May after the discovery of his racially charged writings, was named acting executive vice president of Ginnie Mae.

November 8 -

Gentrification and rapid home price growth have intensified the loss of wealth the African-American community experienced post-crisis, widening the chasm between what white and black borrowers can afford, Redfin found.

October 17 -

Institutions that offer fewer than 500 open-end lines of credit will get another two-year exemption from reporting requirements under the Home Mortgage Disclosure Act.

October 10 -

Simone Grimes had alleged former FHFA Director Mel Watt made inappropriate advances toward her and she was paid less than the man who had previously held her position.

September 27 -

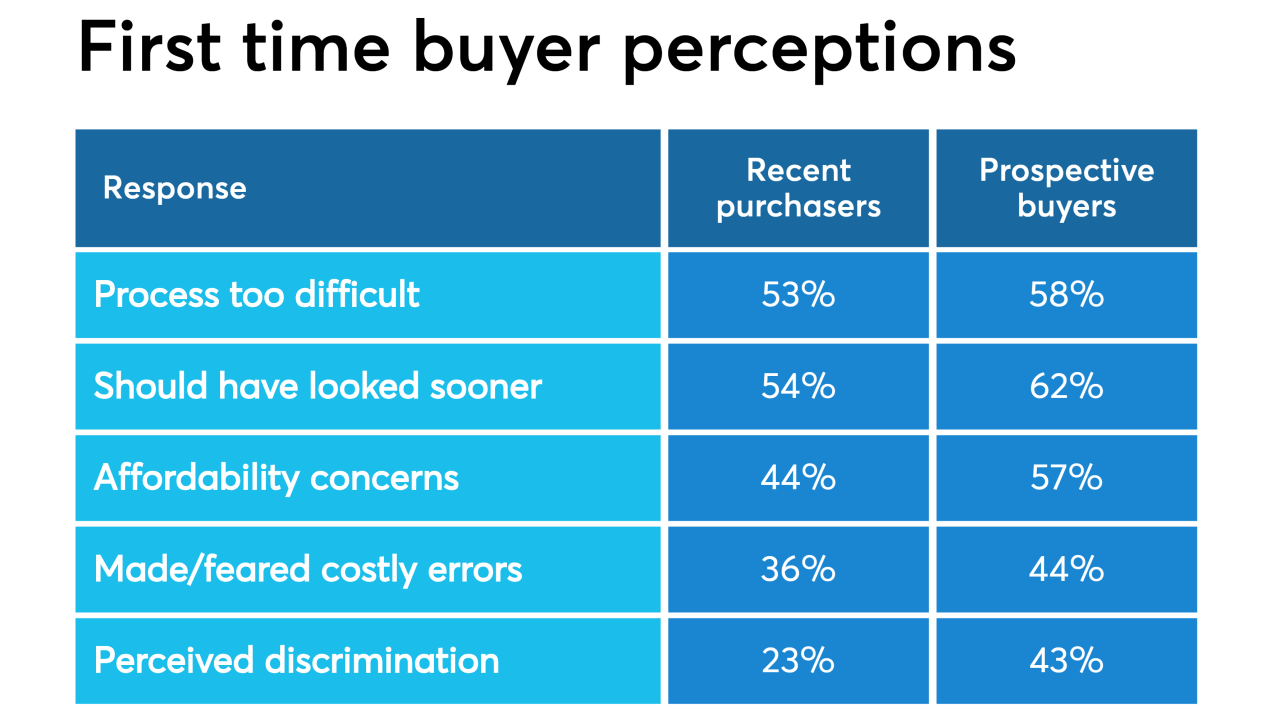

More than half of recent, as well as prospective, first-time homebuyers said purchasing a house was more difficult than it should be, according to a survey for Framework.

September 25 -

California Attorney General Xavier Becerra filed a brief Thursday in support of Oakland's lawsuit against Wells Fargo, alleging that the bank illegally discriminated against minority borrowers.

September 13 -

The legislation takes aim at third-party bank service vendors, the backlog of FHA appraisals, rural housing assistance and other issues where there is broad agreement.

September 11 -

With its proposal to restrict disparate-impact claims, the Trump administration seems determined to solve a problem that does not exist.

September 6 -

The agency says the "disparate impact" standard needs to be amended to align with a recent Supreme Court ruling. But consumer advocates say the change would make it more difficult for borrowers to allege discrimination under the Fair Housing Act.

August 16 -

Under a proposal yet to be officially unveiled, plaintiffs relying on the so-called “disparate impact” doctrine would have to show a more direct link between a lender’s policy and discriminatory effect.

July 31 -

Eric Blankenstein, now at HUD, is under fire for asking a subordinate to defend him after it was revealed he wrote racially charged blogs 14 years earlier.

July 29 -

The bill, similar to legislation that passed the chamber last year, would permit the inclusion of items such as rent and telecom payments to help consumers build their credit profiles.

July 25 -

The CFPB did not file any fair-lending enforcement actions in the 2018 fiscal year and did not refer any Equal Credit Opportunity Act violations to the Department of Justice.

July 2 -

After years of largely standing on the sidelines, lawmakers are taking a closer look at whether algorithms used by banks and fintechs to make lending decisions could make discrimination worse instead of better.

June 26 -

The real estate service Zillow has tried to quantify what has long been real estate conventional wisdom: That gay neighborhoods carry a premium over other neighborhoods.

June 21 -

The mortgage agency has hired Eric Blankenstein, who sparked controversy while at the consumer bureau over past revelations of racially charged writings.

June 19 -

Despite the Fair Housing Act going into effect 51 years ago, LGBTQ+ still face discrimination when buying a home or applying for a mortgage.

June 13 -

The company intentionally submitted inaccurate borrower information overstating the number of white applicants, the consumer bureau alleges in a consent order.

June 5 -

The agency's spring rulemaking agenda includes the process for collecting small-business data as well as underwriting rules for GSE-backed loans. But what's missing from the list may be just as important.

May 28