-

Owensboro's continued place on a list of U.S. cities attracting millennial home buyers is once again attracting media attention.

December 1 -

Just to keep up with rising home prices in the Seattle area, would-be buyers needed an $11,000 pay raise in the past year to afford the typical mortgage.

November 29 -

New Penn Financial has entered into a pilot program to provide mortgage financing to participants in Home Partners of America's Lease Purchase program.

November 29 -

Sometimes reaching underserved borrowers takes experimenting with changes to the mortgage finance system. That's why Fannie Mae and Freddie Mac are working with lenders to test innovative loan products that meet borrowers' evolving needs.

November 24 -

Potential first-time home buyers can save money for a down payment if they are able to use a special account just for that purpose.

November 17 Bilt Rewards

Bilt Rewards -

Over half of mortgage industry executives anticipate first-time home buyer growth in 2018, estimating that market will grow at a faster pace than the overall housing market, according to Genworth Financial.

November 17 -

A real estate agent allegedly duped two home buyers into thinking they had purchased a Boynton Beach, Fla., residence but instead pocketed their down payment and monthly payments, according to an arrest report.

November 13 -

With home values projected to rise in every major U.S. metro in 2018, a 20% down payment will cost thousands of dollars more, according to Zillow.

November 9 -

An emerging group of local entrepreneurs is taking up arms against the sky-high cost of living in the Bay Area, hoping to end once and for all the housing crisis crippling the region.

November 7 -

Homes on Staten Island are reaching "unaffordable levels," at a time when there are less homes on the market than buyers who want to purchase them.

October 31 -

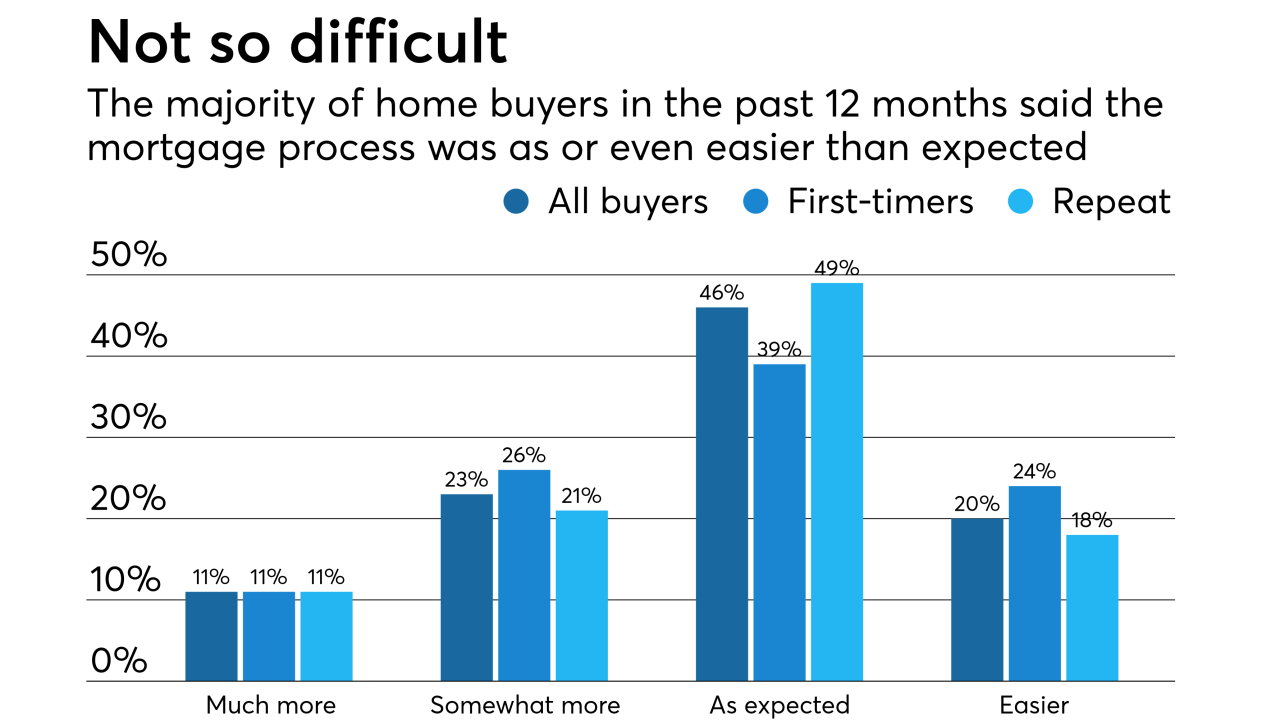

Recent home buyers found it easier getting a mortgage compared with last year's purchasers, but first-timers are being held back by a lack of inventory and student debt, according to a National Association of Realtors survey.

October 31 -

Nearly half of all Memphis renters are "cost burdened,'' meaning they spend more than 35% of their household income on housing.

October 19 -

With the housing crisis and the Great Recession well in the rear-view mirror, more and more credit unions are offering mortgage options with low or no down payment requirements.

October 17 -

Rising home prices, wages that haven't kept pace with those increases and high levels of student debt are forcing first-time home buyers on Long Island, N.Y., to find creative ways to afford the biggest purchase of their lives.

October 16 -

Building off the success of policy changes in 2016, there are now even more ways for mortgage lenders to help student loan borrowers become homeowners.

October 4 Bilt Rewards

Bilt Rewards -

CMG Financial is trying out a platform that gives borrowers the ability to raise funds for down payments in conjunction with Fannie Mae loans.

October 3 -

While millennials were the largest group of home buyers in the past 12 months, many had problems with affordability and the down payment.

September 27 -

The plight of Orlando-area renters sheds light on a new set of post-Irma realities — rent payments on uninhabitable homes and apartments, challenges getting rent deposits refunded and few housing options in a tight rental market.

September 25 -

Fed economists are suggesting a new mortgage product that would allow home buyers to build equity faster and give banks incentive to profitably hold the loans in portfolio.

September 13 -

A decade after the financial crisis and housing collapse, more consumers seem in the mood to buy a new home before they sell their existing home.

September 13